California Water Service Group CWT announced that its subsidiary California Water Service (Cal Water) has acquired Kings Mountain Park Mutual Water Company’s (Kings Mountain) water system assets. The agreement was originally approved by the California Public Utilities Commission in late 2022.

Customers of Kings Mountain will now receive water utility services directly from Cal Water’s Bear Gulch District, which had previously supplied water to the community through a system interconnection.

California Water Service’s Bear Gulch District already serves about 61,000 people through approximately 19,000 service connections in Portola Valley, Woodside, Atherton, and portions of Menlo Park, Redwood City and San Mateo County. The Kings Mountain system is adjacent to two other portions of the Bear Gulch District. Joining the systems might result in enhanced water supply reliability and firefighting capabilities.

Cal Water intends to make investments in Kings Mountain’s water infrastructure to ensure that it continues to provide reliable and safe water for both regular customer demands and emergency firefighting requirements.

Needs for Investments & Consolidation

Aging water and wastewater infrastructure and delays in essential upgrades are concerns for the industry. Per the American Society of Civil Engineers, nearly 50,000 community water systems and 16,000 wastewater treatment systems in the United States are presently providing water solutions to customers. Some of the service providers are too small and have limited financial strength to carry out essential and costly repairs on time, leading to pipeline breakage and disruption of services and increased possibility of contamination.

In order to ensure the extension of high-quality services to customers and investments needed to upgrade the existing and acquired assets, large water utility companies are acquiring small players. Per the U.S. Environmental Protection Agency estimates, drinking water and wastewater systems will require at least $896 billion in additional investment over the next 20 years.

In the first quarter of 2024, CWT made capital investments of $109.8 million, up 34% year over year, to enhance its infrastructure. The estimated capital expenditure for 2024 is $380 million. The company continues to acquire water and wastewater systems to expand its operations.

In January 2024, CWT’s subsidiaries, Hawaii Water Service and New Mexico Water Service, acquired the assets of HOH Utilities, LLC and Monterey Water Company, respectively. This twin acquisition added nearly 2,200 new customers.

Peer Moves

Apart from CWT, other companies like American Water Works Company, Inc. AWK and Essential Utilities WTRG are also expanding operations through acquisitions and investments.

During the first quarter of 2024, AWK completed the acquisition of a wastewater treatment plant and related assets from Granite City that added nearly 26,000 wastewater customers. Its pending 26 acquisitions (as of Mar 31, 2024), when completed, should add another 66,800 customers to its customer base. Acquisitions allow the company to get fresh demand for its services and expand its revenue stream.

American Water aims to invest $3.1 billion in 2024. A major portion of this amount would be utilized for infrastructure improvements in regulated businesses. It aims to invest $16-$17 billion during 2024-2028 and $34-$38 billion in the 2024-2033 period.

Essential Utilities is actively exploring opportunities to expand utility operations through the acquisition of municipal assets. Since 2015, Essential Utilities has been expanding utility operations by completing many water and wastewater acquisitions, adding 129,000 customers.

Essential Utilities plans to invest $1.3-$1.4 billion in 2024 for more than 5,000 planned projects and $7.2 billion during 2024-2028 to improve water and natural gas systems to better serve customers.

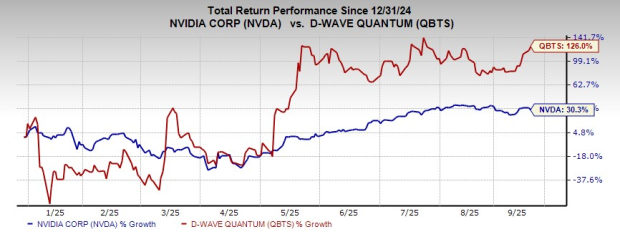

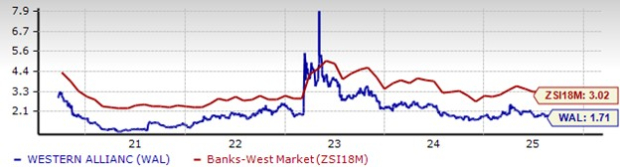

Price Performance

In the past three months, shares of CWT have risen 7.6% compared with the industry’s 4.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Another Stock to Consider

CWT currently has a Zacks Rank #1 (Strong Buy).

Another top-ranked stock from the same industry is Primo Water PRMW. The company presently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

PRMW’s long-term earnings growth rate is 15.47%. The Zacks Consensus Estimate for 2024 EPS implies a year-over-year improvement of 53.2%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

California Water Service Group (CWT) : Free Stock Analysis Report

Primo Water Corporation (PRMW) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.