Hewlett Packard Enterprise (HPE) spun off from HP in November 2015. Its product portfolio includes servers and storage products, as well as networking solutions for enterprise clients.

Since the spinoff, the tech stock has returned 91% to shareholders. After adjusting for dividend reinvestments, cumulative returns are closer to 144% – much lower than the S&P 500 Index ($SPX), which has surged over 200% in this time frame.

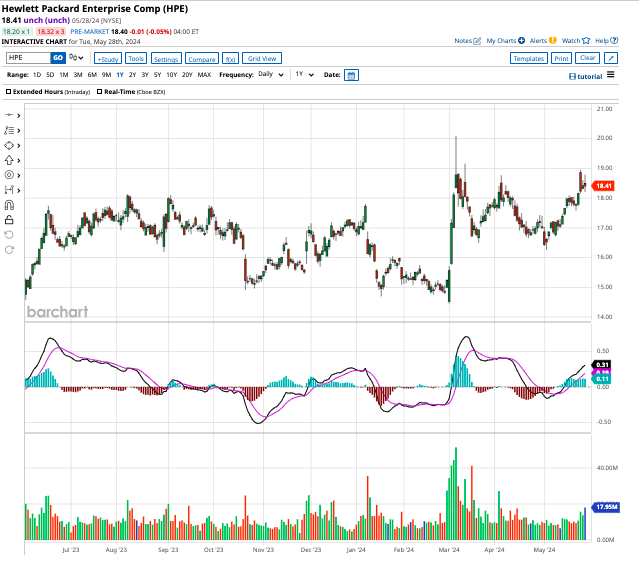

Valued at $24 billion by market cap, HPE stock is down 9% from all-time highs, and offers shareholders a tasty dividend yield of 2.8%. Let’s see if this underperforming tech stock is a buy ahead of its upcoming earnings.

What Does Wall Street Expect From HPE in Fiscal Q2 of 2024?

HPE is forecast to report its fiscal Q2 of 2024 (ended in April) earnings results on June 4. Analysts tracking the tech stock expect it to report revenue of $6.83 billion and adjusted earnings of $0.39 per share.

In fiscal Q1, HPE reported revenue of $6.8 billion, down 13% year over year, which missed consensus revenue forecasts. However, it ended the quarter with earnings of $0.48 per share, above estimates of $0.45 per share.

Its sales decline was attributed to reduced demand for networks and a delay in GPU (graphics processing units) orders as well as a lack of supply support for GPUs. Net sales from its servers business also fell 23% to $3.4 billion.

HPE entered into a partnership with semiconductor giant Nvidia (NVDA) last November, which was expected to drive sales in verticals such as networking and supercomputing due to robust demand for AI-powered technologies. However, these developments failed to materialize, as HPE continues to expect weakness in the networking market through fiscal 2024.

In fiscal 2024, HPE expects revenue growth to be flat, with adjusted earnings between $1.82 and $1.92 per share. Comparatively, Wall Street expects sales to rise marginally, up by 0.4% to $29.2 billion, with adjusted earnings of $1.88 per share. In the year-ago period, HPE reported earnings of $2.15 per share.

HPE stock might seem undervalued, given that the company forecasts to end fiscal 2024 with a free cash flow of at least $1.9 billion. Priced at 12.6x forward cash flows, HPE stock is quite cheap if it can continue to grow its earnings and cash flows going forward.

The AI server market is forecast to expand by 18% annually through 2032, providing HPE with the opportunity to gain traction in an expanding market.

Evercore Is Bullish on HPE Stock

Last week, HPE stock rose by 4% in a single trading session after Evercore added the company to its TAP (Tactical, Action, Positioning) list with an “Outperform” rating.

Evercore analyst Amit Daryanani expects AI-related backlog to drive sales in Q2, while simultaneously cautioning investors that the company might miss estimates due to weak networking demand.

Daryanani also expects HPE to lose market share in the Edge business, due to uncertainty around its product portfolio.

What Is the Target Price for HPE Stock?

Most experts on Wall Street are more reserved about HPE’s prospects. Out of the 13 analysts covering HPE stock, one recommends “strong buy,” one recommends “moderate buy,” and 11 recommend “hold.”

Plus, the mean target price for HPE stock is $17.33, which is a discount to the current price of $18.41.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.