FMC Corporation FMC recently received Brazilian registration for its Azugro and Ezanya herbicides, which are geared for use in cotton, tobacco and wheat crops. The Azugro and Ezanya herbicides are powered by Isoflex active, FMC’s brand name for bixlozone.

Isoflex active is a novel herbicide when used in cereal. It is classified by the Herbicide Resistance Action Committee as a Group 13 herbicide. The two new formulations will provide farmers with new tools to efficiently manage herbicide resistance across a vast spectrum of agronomic practices.

FMC believes that Azugro and Ezanya will help growers control weeds that are resistant to other herbicides, resulting in a healthier harvest. Azugro and Ezanya herbicides are efficient against major annual grass weeds such as goosegrass, Italian ryegrass and other critical broadleaf weeds. Azugro will be available for use in cotton during the 2024 crop season and wheat in 2025, while Ezanya will be available in tobacco during the 2024 crop season. In Brazil, research is ongoing into the application of Isoflex active in more crops and segments.

The registrations in Brazil represent another key regulatory approval for FMC and Isoflex active, which are already registered in Argentina, Australia and China. Products containing Isoflex active have demonstrated pre-plant, pre-emergence and early post-emergence selectivity in important crops around the world, including canola, cereals, oilseed rape and legumes.

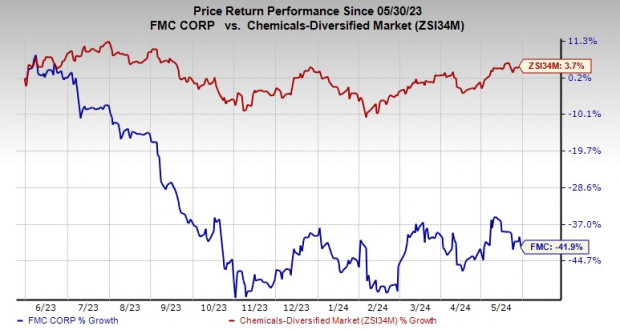

Shares of FMC have lost 41.9% over the past year against a 3.7% rise of its industry.

Image Source: Zacks Investment Research

FMC, on its first-quarter call, said that it sees full-year 2024 revenues between $4.50 billion and $4.70 billion, indicating a 2.5% increase at the midpoint from 2023. Adjusted EBITDA is expected in the range of $900 million to $1.05 billion, flat at the midpoint. Adjusted earnings are forecast between $3.23 and $4.41 per share, up 1% year over year at the midpoint. Full-year free cash flow is anticipated to be $400-$600 million.

FMC forecasts second-quarter revenues to be within $1 billion to $1.15 billion, implying a 6% increase at the midpoint from the second quarter of 2023. Adjusted EBITDA is forecast in the band of $170-$210 million, essentially flat year over year. Adjusted earnings are expected in the range of 43-72 cents for the second quarter, suggesting a 15% rise at the midpoint.

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Zacks Rank & Key Picks

FMC currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI sports a Zacks Rank #1 (Strong Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 74.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company’s shares have soared 148.5% in the past year.

The Zacks Consensus Estimate for Ecolab’s current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 36.4% in the past year.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.