Vishay Intertechnology VSH recently introduced the Vishay Draloric AC05 WSZ and AC05-AT WSZ lead form for its AC and AC-AT series of 5 W resistors to expand its passive components offerings.

The WSZ lead form resistors, which can be used as surface-mount components, serve as snubber and inrush current limiting resistors that can be assembled on PCBs, improving pick and place, reducing assembly times and lowering costs.

These resistors feature a non-flammable silicone cement coating designed for harsh operating conditions, operating over a wide temperature range of -55 °C to +250 °C.

Vishay is expected to gain solid traction across automotive and industrial electronics, energy meters, and white goods power supplies on the back of its latest move.

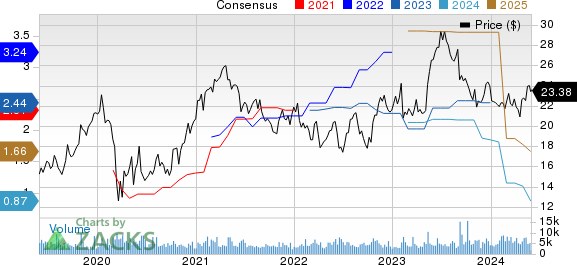

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Growth Prospects

Per a Mordor Intelligence report, the resistor market is likely to hit $10.5 billion in 2024 and reach $12.28 billion by 2029, witnessing a CAGR of 3.2% between 2024 and 2029. Vishay is well-poised to capitalize on this growth opportunity on the back of its expanding resistors offerings.

The company recently expanded its PTCEL series with the launch of new inrush current limiting positive temperature coefficient (PTC) thermistors.

Vishay also introduced MCB ISOA, a compact, thick film power resistor designed for mounting on a heatsink, offering a good pulse handling capability and a power dissipation capacity of up to 120W.

Vishay’s expansion of its thick-film resistor offerings with the launch of the Draloric RCS0805 e3 resistor remains noteworthy.

Expanding Portfolio

Strengthening resistors offerings bode well for the company’s increasing efforts to expand its overall product portfolio.

Vishay recently launched eight new 850 nm and 940 nm high-power infrared (IR) emitters in a bid to boost its optoelectronics offerings.

These AEC-Q102 qualified emitters, featuring a double-stack chip, offer high radiant intensity of up to 6000 mW/sr at 5 A pulse current and 2000 mW/sr at 1.5 A DC current, low thermal resistance, and reduce costs and space by occupying a 20% smaller footprint.

The company expanded its discrete offerings with the introduction of four series of surface-mount transient voltage suppressors (TVS), namely 6DFNxxA, 6DFNxxxCA, T6NxxA and T6NxxxCA.

Strength in the company’s overall portfolio offerings will likely aid its top-line performance in the upcoming period.

However, growing inventory adjustments, contracting lead times and a softening demand environment across industrial end markets remain major concerns for the company. Vishay’s shares have lost 2% in the year-to-date period, underperforming the Zacks Computer & Technology sector’s growth of 18.7%.

The Zacks Consensus Estimate for 2024 revenues is pegged at $3.1 billion, indicating a decline of 10% year over year.

The consensus mark for 2024 earnings is pegged at 87 cents per share, indicating a 64.3% decline from the year-ago figure. The figure has decreased by 21.9% in the past 30 days.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dropbox DBX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 30.6% in the year-to-date period. The long-term earnings growth rate for ANET is 15.68%.

Badger Meter’s shares have gained 27% in the year-to-date period. The long-term earnings growth rate for BMI is currently projected at 15.57%.

Shares of Dropbox have declined 22.6% in the year-to-date period. The long-term earnings growth rate for DBX is 11.44%

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.