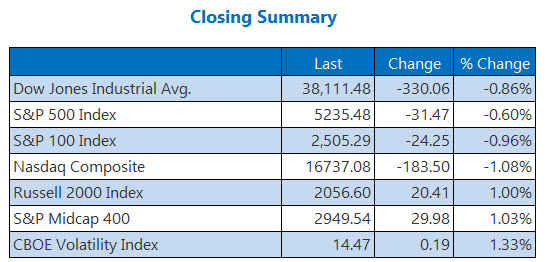

Wall Street’s losses stretched into another day, with investor sentiment dinged by Salesforce’s (CRM) revenue whiff and rising Treasury yields. The Dow slid 330 points for a third-straight loss, its worth losing streak since mid-April, while the Nasdaq also shed triple digits. Investors are also bracing for the release of the Federal Reserve’s favorite inflation gauge, the personal consumption expenditures (PCE) price index, due out tomorrow and expected to show slow progress.

Continue reading for more on today’s market, including:

5 Things to Know Today

- Fed President John Williams says inflation is still too high. (CNBC)

- Dollar General’s price cuts aren’t enticing customers. (MarketWatch)

- Unpacking Salesforce’s earnings report.

- Behind this retail stock’s dismal day.

- PayPal’s Fastlane option excited analyst.

Commodities Prices Scatter Ahead of Inflation Reading

Oil futures fell Thursday, pressured after a surprise rise in fuel inventories lead to a selloff of “risky” assets and equities. For the session, July-dated West Texas Intermediate (WTI) crude lost $1.32, or 1.7%, at $77.91 a barrel for the session.

Gold prices, meanwhile, managed to eke out a win. For the session, June-dated gold added 0.1% at $2,366.50 per ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.