The Supply Shock

The recent suspension of a key lithium mine by CATL, a major electric vehicle battery producer, has sent shockwaves throughout the industry. Initially reported by UBS and later confirmed by CATL, the move is in response to market conditions of the lithium carbonate sector in Yichun.

Market Reaction and Squeeze

This decision is set to slash China’s monthly lithium carbonate output by approximately 8%, translating to a reduction of 5,000 to 6,000 tons. The immediate fallout was a surge in lithium prices, with futures on the Guangzhou Futures Exchange spiking 5.5% to 76,700 yuan per ton ($10,700).

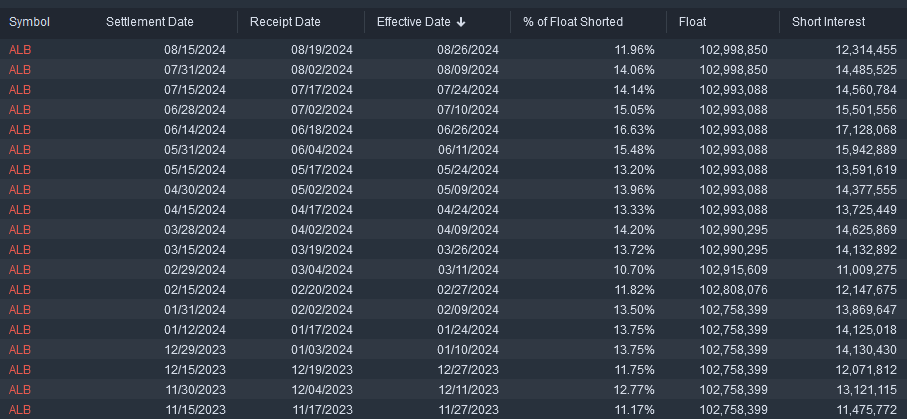

Short Sellers on Their Toes

The unexpected shift in market sentiment has resulted in a supply short squeeze as short-sellers scrambled to cover their positions. Companies like Pilbara Minerals and Albemarle experienced significant stock price jumps in response.

Analyst Insights

Analysts in the field, including Citi’s Jack Shang and CLSA’s James McIntosh, offer differing views on the future trajectory of lithium prices. While some foresee a rebound, others are more cautious, pointing to a possible stabilization in the market.

Hope Amid Volatility

Despite the recent tumultuous price movements, industry experts are optimistic about the future. UBS projects a potential increase in lithium prices for the remainder of the year, signaling a possible recovery in the market.

Market Dynamics

The fluctuations in lithium prices, which have plummeted nearly 90% since their peak in 2022, are attributed to oversupply issues and a slowdown in electric vehicle adoption. The temporary suspension by CATL offers a glimmer of hope for stability in the market.

Industry Resilience

Amidst the volatility, the electric vehicle and battery sector continues to navigate challenges and opportunities in the evolving landscape of sustainable energy. The halt in lithium production serves as a reminder of the intricate balance between supply and demand in this burgeoning market.