The recent plummet of 4% in Wells Fargo & Company’s stock price is akin to a storm brewing in the financial markets. The root cause? An official agreement inked with the Office of the Comptroller of the Currency (OCC) that delves deep into the bank’s anti-money laundering (AML) tactics and sanctions risk management practices.

Highlighted within the agreement are deficiencies in the bank’s internal controls for money laundering and procedures for managing risk across multiple sectors. These areas include suspicious activity and currency transactions reporting, customer due diligence, and the bank’s initiatives for customer identification and beneficial ownership.

Back in the second quarter of its fiscal year, Wells Fargo disclosed this ongoing scrutiny in its filing with the Securities and Exchange Commission (SEC). The bank hinted at being in ‘resolution discussions’ with the U.S. SEC regarding an investigation linked to the cash sweep options it presents to new investment advisory clients.

Wells Fargo’s move to solidify its AML and sanctions risk management apparatus through the formal OCC agreement mirrors its relentless pursuit of enhancing risk management systems and meeting regulatory standards.

The management at WFC asserted, “We have been toiling diligently to tackle a substantial part of the formal agreement’s requirements, and our commitment to completing the work aligns with the same urgency as our other regulatory obligations.”

Exploring the Specifics of WFC’s Pact with OCC

The pact mandates the formation of a Compliance Committee to monitor Wells Fargo’s adherence to its provisions. The focus of the action plan must be on enhancing front-line risk management, independent risk management, independent testing, customer identification, and detecting suspicious activities.

Among other requirements, the agreement necessitates the bank to refine its AML and sanctions risk management protocols, secure OCC’s approval for assessing the AML and sanctions risks of new offerings, and inform OCC before expanding any of these products.

Prevailing Regulatory Troubles at WFC

The narrative of Wells Fargo’s struggles dates back to September 2016, marked by a slew of penalties and sanctions, including Federal Reserve’s imposition of a cap on asset positions.

A further blow came in July 2024 when a class action lawsuit surfaced, accusing the bank of mismanaging its employee health insurance scheme, thereby compelling numerous U.S.-based employees to overpay for prescription drugs. Former employees alleged that Wells Fargo’s health plan shells out inflated prices to pharmacy benefit managers, exacerbating the financial burden on employees.

In June 2024, another class action lawsuit cast a shadow over WFC, implicating it in a $300-million Ponzi scheme that impacted over a thousand investors, mostly senior citizens. The lawsuit alleged that Wells Fargo was complicit in the fraudulent activities spanning from 2011 to 2021, providing substantial assistance to the fraudsters while reaping benefits from the deception.

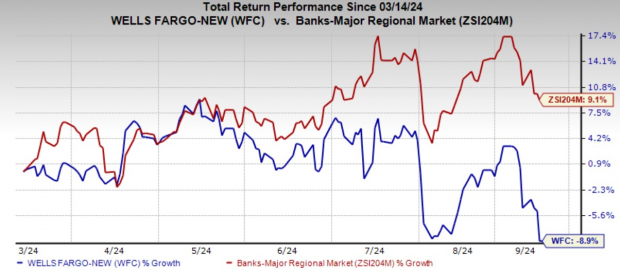

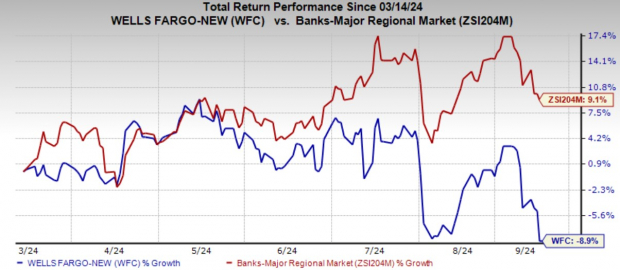

Over the last six months, while major players in the industry burgeoned by 9.1%, WFC witnessed an 8.9% downturn.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Presently holding a Zacks Rank #3 (Hold), Wells Fargo is at a crossroads grappling with regulatory obligations while aiming to steer its ship through turbulent waters.

Legal Probes Enveloping Other Financial Institutions

Fast forward to September 11, 2024, The Toronto-Dominion Bank TD found itself at the receiving end, agreeing to cough up a hefty $28 million penalty in response to the Consumer Financial Protection Bureau’s (CFPB) enforcement regarding credit report malpractices. Accusations ranged from mishandling customers’ credit information to failing in amending its flawed practices.

Earlier in the same month, Robinhood Markets, Inc.‘s HOOD cryptocurrency platform signed a settlement with the California Department of Justice to settle contentious crypto withdrawal issues by paying a sum of $3.9 million. Allegations suggested that HOOD barred customers from withdrawing their cryptocurrency from accounts between 2018 and 2022.

Zacks Labels Top Semiconductor Stock as #1

Comparing this potential investment gem to the behemoth NVIDIA, which surged over +800% since Zacks’ endorsement, offers an intriguing insight. While NVIDIA’s prowess endures, this newfound semiconductor star holds promise for exponential growth.

Equipped with robust earnings growth and an expanding clientele, it stands poised to cater to the escalating demand for Artificial Intelligence, Machine Learning, and Internet of Things. A staggering leap in global semiconductor manufacturing from $452 billion in 2021 to a projected $803 billion by 2028 only adds to the allure.

Explore This Stock Now for Free >>

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

For more on this article, visit Zacks.com

The perspectives shared in this article represent the views and opinions of the author and not necessarily those of Nasdaq, Inc.