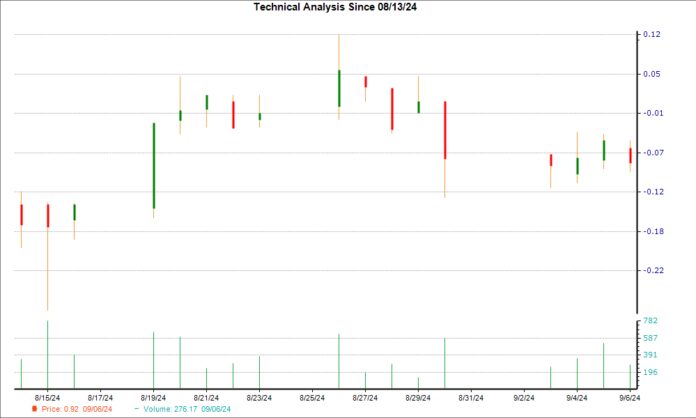

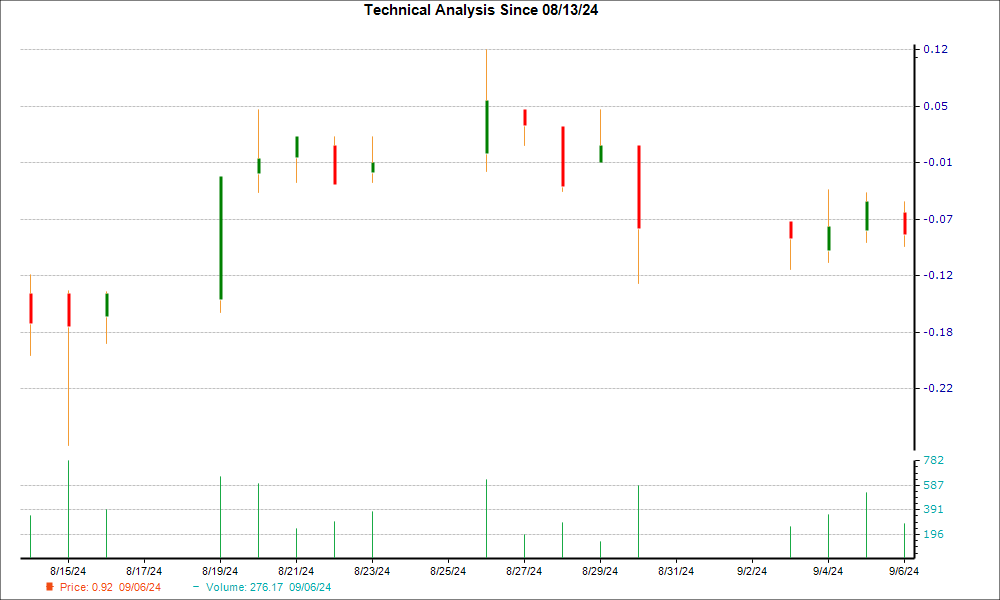

The recent trajectory of Canaan CAN has been akin to a rollercoaster ride, with the stock witnessing an 8.1% decline over the past fortnight. However, amidst this downturn, a glimmer of hope emerges as a hammer chart pattern materialized in the stock’s recent trading session, hinting at a potential trend reversal on the horizon. This candlestick formation not only suggests a bottom might be in sight but also implies that bullish sentiment could be gaining ground to provide crucial support.

While technical patterns like the hammer signify a possible reversal, the fundamental landscape for this cryptocurrency-mining device manufacturer is also painting a promising picture. Wall Street analysts are growing increasingly optimistic about Canaan’s future earnings potential, further bolstering the likelihood of a turnaround for the stock.

Demystifying the Hammer Chart and its Trading Implications

The hammer pattern, a stalwart in candlestick charting, manifests a scenario where a stock displays a minimal difference between its opening and closing prices, sandwiched between a substantial gap from the day’s low to its open or close, forming an elongated lower wick. When this lower wick stretches at least twice the real body length, the resultant candle resembles a mighty ‘hammer.’

Essentially, in a downtrend conundrum dominated by bears, the stock typically kicks off the day on a lower note compared to the preceding close, only to end even lower. Yet, on the fortuitous day the hammer emerges, amidst the ongoing downtrend, the stock hits a new low. Albeit after a nudge of support at this daily low, a trickle of buying enthusiasm transpires, propelling the stock to conclude the session near or slightly above its debut price.

When sighted at the trough of a downtrend, the hammer is akin to a distress flare from the bulls, suggesting a potential shift in momentum as the bears relinquish their grip on the price. This modest victory by the bulls in halting the free fall could foreshadow an imminent trend reversal.

Hammer candles, regardless of the timeframe – be it daily, weekly, or even by the minute – cater to both short-term traders and long-haul investors alike, serving as a beacon of hope in turbulent market waters.

Nevertheless, like any market gauge, the hammer pattern comes with inherent caveats. Since its potency hinges on strategic placement within the chart mosaic, coupling it with other bullish indicators is always advisable for a more comprehensive outlook.

The Fundamentals Propelling a Canaan Rebound

Recent trends in earnings estimate revisions for CAN have been on an upward trajectory, underpinning a bullish undercurrent on the fundamental front. Heightened earnings projections typically serve as a green flag for impending price upticks over the short haul.

Over the past month, the consensus EPS estimate for the ongoing year has surged by a whopping 33.3%. This surge signifies a consensus among sell-side analysts tracking CAN that the company is poised to deliver stronger earnings than previously anticipated.

Adding to the optimism, CAN presently boasts a Zacks Rank #2 (Buy), placing it in the upper echelons of over 4,000 stocks assessed based on earnings estimate adjustments and EPS surprises. Historically, stocks holding a Zacks Rank #1 or 2 tend to outshine the broader market benchmarks.

Moreover, the Zacks Rank has established itself as a reliable barometer for identifying auspicious inflection points when a company’s fortunes begin to take a positive turn. Hence, for Canaan’s shares, a Zacks Rank of 2 serves as a compelling fundamental indicator of an impending revival.

Ready for a rebound with Canaan? The stars might just be aligning.

Market News and Data brought to you by Benzinga APIs