Albemarle’s Market Uptrend fueled by Lithium Production Disruption

Albemarle Corporation, a key player within the Chemical – Diversified industry, has witnessed a remarkable 13.7% surge in its shares over the past week, surpassing the industry standard of 3.2% growth. Contributing to this impressive rally is the recent speculation surrounding a Chinese lithium producer’s intention to reduce production output. The lithium market, after its zenith in 2022, faced a downward trend due to escalating supply, making this positive development a beacon of hope for a market rebound.

Albemarle’s Strategic Growth Initiatives amid Volatile Lithium Pricing

Albemarle stands primed to leverage the expanding battery-grade lithium domain, particularly within the electric vehicle realm, which shows promising growth prospects. Forecasts predict a significant surge in lithium demand due to global electric vehicle integration, and Albemarle predicts a robust compound annual growth rate of 15-20% in lithium demand from 2024 to 2030.

The company’s operational agility is evident through its global lithium capacity enhancement projects, such as the La Negra and Qinzhou expansions. Cost-saving measures and a focus on productivity have fortified Albemarle against the backdrop of plummeting lithium prices, ensuring sustained competitiveness.

Robust Financial Health Propels Albemarle’s Strategic Endeavors

Albemarle’s steadfast commitment to enhancing shareholder value through robust liquidity and cash flows underscores its financial prudence. With a liquidity reserve of $3.5 billion and escalating operational cash flows, the company remains well-positioned to drive sustainable growth initiatives.

The company’s consistent dividend growth, maintained for 30 consecutive years, exemplifies its dedication to rewarding shareholders. Albemarle’s dividend yield of 1.8%, coupled with a healthy payout ratio of 33%, signifies a stable and secure dividend outlook.

Challenges Amidst Opportunities: The Story of Albemarle’s Market Position

However, Albemarle faces challenges amidst its growth narrative, with declining lithium market prices translating to a 40% revenue dip in the second quarter. The unease in the lithium domain, characterized by an overabundance of supply from China and weakening EV demand, continues to impede revenue growth prospects for the company.

Moreover, Albemarle’s Specialties unit grapples with demand constraints, particularly within the consumer electronics sector. As the company revises its EBITDA outlook due to a sluggish market recuperation and escalating logistics costs, it navigates through a terrain fraught with economic uncertainties and geopolitical tensions.

Albemarle’s Stock Evaluation: Balancing Optimism and Realism

Despite the recent stock surge, Albemarle’s forward 12-month earnings multiple of 36.11X reflects a substantial premium of 129.8% over the peer group average. This valuation, coupled with the company’s declining earnings estimates, underscores a cautious approach towards investment decisions. The market’s optimism, manifested in the elevated share price, juxtaposes the underlying challenges faced by Albemarle’s earnings trajectory.

Conclusion: The Rollercoaster Ride of Albemarle’s Stock Performance

While Albemarle’s recent stock rally showcases resilience amidst market turmoil, inherent challenges in the lithium domain and its Specialties unit paint a nuanced picture of the company’s trajectory. As investors navigate through fluctuating lithium dynamics and Albemarle’s financial landscape, a judicious approach is imperative to capitalize on the market volatility engendered by evolving lithium market dynamics.

The Rise and Fall: Albemarle Corporation Stock Performance Analysis

ALB Stock vs Competitors

Albemarle Corporation, in the game with its peers Sociedad Quimica y Minera de Chile S.A., Arcadium Lithium plc, and Rio Tinto Group, has had a rollercoaster ride in the stock market. While ALB has shown resilience with a 14% rise recently, SQM, ALTM, and RIO have not been as fortunate, suffering significant drops of 36.5%, 86.4%, and 16%, respectively, over a similar timeframe.

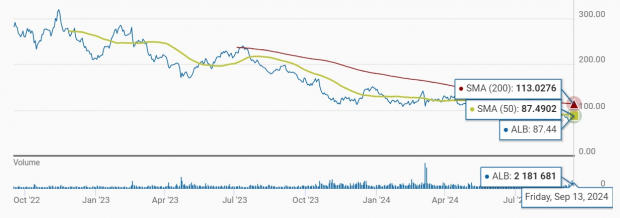

An Insight into ALB’s Year-to-Date Stock Performance

Investors eyeing Albemarle may find solace in its current trajectory. The company is reaping the rewards of heightened lithium volumes due to project ramp-ups and strategic moves to enhance its global lithium conversion capacity and overall productivity. ALB’s strategic positioning to seize the growing prospects in the battery-grade lithium market, driven by the global pivot towards electric vehicles, indicates a promising outlook. However, challenges such as a notable dip in lithium prices, weakness in the Specialties division, and a drop in earnings forecasts may cast shadows over its future. Furthermore, its lofty valuation could deter potential investors from diving in at the current juncture. Given these nuances, retaining Albemarle, tagged as a Zacks Rank #3 (Hold) stock, could bode well for existing stakeholders.

For the complete list of today’s Zacks #1 Rank (Strong Buy) stocks, check here.

Discover Potential Investment Opportunities

Unearth hidden gems with Zacks experts predicting five stocks poised for a potential double in 2024. While not all selections may hit the bullseye, past recommendations have realized exceptional growth of +143.0%, +175.9%, +498.3%, and +673.0%. Many picks in this report remain under Wall Street’s radar, offering a golden chance to get in on the ground floor.

Don’t Miss Out on These 5 Potential Home Runs >>

Get a Free Stock Analysis Report on Rio Tinto PLC (RIO)

Access a Free Stock Analysis Report on Albemarle Corporation (ALB)

Read Free Stock Analysis Report on Sociedad Quimica y Minera S.A. (SQM)

Grab a Free Stock Analysis Report on Arcadium Lithium PLC (ALTM)

For further details, read the full article on Zacks.com here.

Visit Zacks Investment Research for more insights.

Disclaimer:

The thoughts and viewpoints expressed in this article belong solely to the author and do not necessarily mirror those of Nasdaq, Inc.