An eternal debate among the investment community is whether it is preferable to bet on the horse or the jockey of a particular company. In this case, the horse is a metaphor for the industry and business model of the company in question. The jockey refers to the senior management team, and in particular the CEO, who steers and directs the company.

Can a business model or industry be so compelling or strong that any jockey could essentially lead it to victory? While there is no doubt that some combination of the two play a role in success, some investment strategies place more emphasis on one or the other elements.

The debate has recently resurfaced in high profile fashion given the recent handing off of the reins to a new CEO at Starbucks (SBUX). Other examples abound, especially on the retail side, of new leadership being brought in to rejuvenate a brand.

Here we highlight two small caps under coverage by Zacks which illustrate this debate and offer potential investors an option to choose their personal preference.

Kingsway Financial Services (KFS) operates through two key segments: Extended Warranty and Kingsway Search Xcelerator (KSX). The Extended Warranty segment offers vehicle service agreements (VSAs) and warranty products across the United States for automobiles, HVAC systems, and commercial refrigeration. In 2023, the segment contributed $68.2 million in service fee and commission revenues (down 7.8% from 2022).

The KSX segment, which focuses on business services, generated $35 million in revenue in 2023 (up 81.9% from 2022). The company expects this segment to become an increasingly larger part of total revenue. The segment is based on the “search fund” model and is supported by empirical evidence from a 2022 Stanford Business School study which concluded that search funds generated superior returns from 1984-2021.

In fairness, the KSX segment is also betting on the horse, selecting certain industries which meet certain growth criteria. But the outsized emphasis on the jockey is the noteworthy. The company typically hires the CEOs for the acquired companies from top MBA programs. The company also seeks proven leadership skills and has a propensity to hire candidates with military experience.

Kingsway Financial Services (KFS) appears near an inflection point for operational performance. Our Neutral rating is based on the need for additional evidence that the acquired companies are being effectively digested and meeting performance goals.

The stock is currently trading at 2.1X trailing 12-month EV/Sales TTM, which compares to 2.3X for the Zacks sub-industry, 1.2X for the Zacks sector and 5.3X for the S&P 500 Index. Over the past five years, the stock has traded as high as 2.9X and as low as 0.9X, with a five-year median of 2.

Image Source: Zacks Investment Research

TSS Inc. (TSSI) exemplifies the horse analogy as it participates in the growing industry of data centers and its connection with the exponential growth of AI. The company delivers complex IT solutions, including rack and systems integration, configuration services, data center management, and strategic procurement. TSS Inc. serves a broad spectrum of customers, from data center operators to modular data center (MDC) facilities, addressing rapidly evolving demands, especially around AI and accelerated computing infrastructure.

The surge in demand for AI-enabled infrastructure has been a significant catalyst for TSS. The company invested heavily in expanding its production capacity in second-quarter 2024, which has already started to contribute to its revenue growth. TSS Inc. (TSSI) began delivering AI-enabled rack integration solutions in June 2024, and the company expects this trend to continue accelerating throughout 2024 and beyond, positioning TSS as a key player in AI-driven data center infrastructure.

Net income saw a significant jump, growing 345% year-over-year to $1.4 million, mainly driven by higher profitability in its core businesses. Adjusted EBITDA also saw a notable rise of 62%, reaching $2 million. The company’s focus on high-margin segments seems to have mitigated the impact of revenue decline in its procurement segment, improving overall profitability.

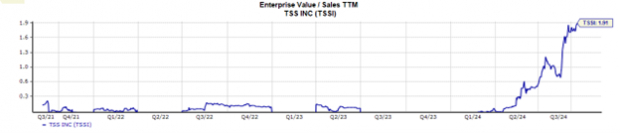

The stock is currently trading at 1.80X trailing 12-month EV Sales/TTM, which compares to 2.10X for the Zacks sub-industry, 3.37X for the Zacks sector and 5.13X for the S&P 500 index.

Image Source: Zacks Investment Research

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

TSS Inc. (TSSI): Free Stock Analysis Report

Kingsway Financial Services, Inc. (KFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.