The Market Whirlwind

In an unexpected dance of financial tides, the Federal Reserve slashed the benchmark interest rate by a dramatic 50 basis points on September 18, stirring the Wall Street waters. While some feared the cut foreshadowed economic storm clouds, a swift market resurgence on September 19 hinted at a different forecast, propelled by robust labor data.

Amidst this whirlwind, investing in rate-sensitive sectors like financial technology (fintech), utilities, and home building emerges as a strategic move for investors seeking the long-term horizon. Five standout stocks beckon – PayPal Holdings Inc., Fidelity National Information Services Inc., American Water Works Co. Inc., OGE Energy Corp., and M/I Homes Inc..

The Fintech Fable

Fintech’s fortunes ebb and flow with interest rates – higher rates impeding progress and innovation. Lower borrowing costs spell opportunity for tech evolution and product enhancement, a vital cog in fintech’s success story over the past few years.

Utilities: Powering Up

Capital-intense operations dominate utilities, relying heavily on credit markets to sustain infrastructure upgrades. The Fed’s rate cuts inject vigor into this sector, bolstering prospects and future stability.

Home Builders on Solid Ground

The housing industry stands to gain from lower interest rates. A notable 50-basis point drop in the Fed rate promises reduced mortgage rates, enticing buyers to take the plunge into new homeownership.

Unveiling the Champions

PayPal Holdings Inc.

Embracing a Zacks Rank #1, PayPal harnesses the wind of sustained growth in payment volumes. The upswing echoes through a vibrant customer base, with Venmo’s expansion and robust merchant services fortifying its market position.

Fidelity National Information Services Inc.

Basking in a Zacks Rank #2 glow, Fidelity National Information Services rides the waves of organic growth in banking solutions. A roadmap marked by digital transformation and strategic expansions focalize global opportunities ahead.

American Water Works Co. Inc.

A Zacks Rank #2 gem, American Water Works steers through success on the navigational compass of acquired assets and strategic initiatives. Financial currents are in favor, supported by recent rate hikes and expansive operations.

OGE Energy Corp.

Anchored by a Zacks Rank #2, OGE Energy unfurls a canvas of investment boldness. Propelled by a $6 billion infrastructure plan, OGE’s vision includes grid reliability enhancements and renewable energy incorporation to reduce carbon footprints.

OGE Energy Corporation Positioned for Impressive Growth According to Zacks

Striking Growth Projection for OGE Energy

OGE Energy, with a forecasted EPS and revenue growth rate of 5.6% and 11.3% in the fiscal year ending December 2025, is primed for significant expansion. This trajectory showcases promise and potential for investors as the company navigates through the competitive energy landscape.

Image Source: Zacks Investment Research

The Rise of Zacks Rank #1 M/I Homes Inc.

With a Zacks Rank of #1, M/I Homes is making waves in the real estate sector. Renowned for its commitment to exceptional customer service, innovative design, and quality construction, M/I Homes has cemented its position as a top player in the market. Targeting a diverse customer base, ranging from first-time homeowners to luxury buyers, the company’s offerings cater to a wide spectrum of demands in the housing industry.

Robust Growth Prospects on the Horizon for M/I Homes

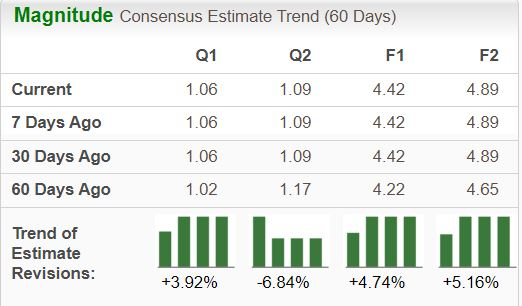

Looking towards December 2025, M/I Homes anticipates a growth rate of 5.1% in revenue and 5.6% in EPS, reflecting a promising future. The recent uptick in Zacks Consensus Estimate for various earnings periods is a testament to the positive momentum propelling M/I Homes forward.

Image Source: Zacks Investment Research

The Quest for Lucrative Investments

Zacks Investment Research has identified five stocks poised for substantial growth, presenting an opportunity for investors to potentially double their investments. With recommendations backed by solid analysis, these stocks offer a chance to capitalize on market trends often overlooked by mainstream investors.

Don’t miss out on these hidden gems that could be the next big successes on Wall Street. Seize the opportunity to explore new avenues for financial growth and diversification.

Discover these 5 potential home runs today! >>

Stay ahead of the curve and gain access to the latest insights from Zacks Investment Research. Download the report on “5 Stocks Set to Double” for valuable recommendations and strategic investment options.

Find out more about enticing stock opportunities with in-depth analysis on leading companies such as PayPal Holdings, Inc., Fidelity National Information Services, Inc., and American Water Works Company, Inc. Uncover the potential for growth and stability in these dynamic markets.

To delve deeper into the world of investment and financial strategies, explore the full article on Zacks.com for comprehensive coverage and expert insights.

Note: The opinions expressed in this article are those of the author and do not necessarily align with Nasdaq, Inc.