The U.S. housing market is trying to bounce back after a difficult 2023 and the first half of this year. Homebuilder confidence rebounded in September after hitting a low in the past four months. Also, housing starts and building permits rebounded, bringing a glimmer of hope to the housing sector.

The Federal Reserve’s rate cut is going to help the sector in the near term as mortgage rates are likely to decline further. It would thus be prudent to invest in homebuilding stocks. We have narrowed our search to four homebuilding stocks, such as PulteGroup PHM, Meritage Homes Corporation MTH, M/I Homes, Inc. MHO and Century Communities, Inc. CCS, with upside potential for 2024.

Each of these stocks has a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Homebuilder Confidence Rebounds

According to the National Association of Home Builders (NAHB)/Wells Fargo’s Housing Market Index (HMI), confidence among U.S. homebuilders for newly built single-family homes jumped to 41 in September from 39 in the previous month.

Mortgage rates have fallen to their lowest level since February, giving a boost to homebuilders’ sentiment. The 30-year fixed rate mortgage for the week ended Sept. 12 was 6.2% compared with 7.18% a year ago.

Mortgage rates hit their highest level of 7.76% in October last year. However, mortgage rates have declined substantially since then.

Housing Starts, Building Permits Jump

The Commerce Department reported on Wednesday that housing starts for privately owned homes increased 9.6% to an annualized rate of 1.356 million in August, beating the consensus estimate of a rise of 2.9%. The jump in August housing starts follows a 3.9% decline in July to a revised rate of 1.237 million units.

Year over year, housing starts jumped 3.9% in August. Single-family housing starts, representing the majority of the housing market, rose 15.8% in August compared to July, reaching 992,000 units.

Besides, residential building permits for August — an indicator of construction activity — rose 4.9% from the prior month to an annualized rate of 1.475 million units. The August figures also came in higher than the consensus estimate of a rise of 4.6% to 1.410 million units. Also, permits for single-family homes were up 2.8% last month from July but down 0.5% year over year.

The figures were released on the day the Federal Reserve announced its first rate cut since March 2020.

Rate Cuts to Boost Homebuilder Stocks

The Federal Reserve announced a 50-basis point rate cut, its largest since 2008, much to the relief of millions of Americans. The financial community was confident about a 25-basis point rate cut, with some hopeful about a bigger reduction.

A 50-basis point rate cut is being seen as an aggressive step by the Federal Reserve to help the economy and make a softer landing. The big rate cut is expected to boost the housing market, which accounts for 3.1% of the GDP.

Higher building costs have been a headwind for the construction sector, which is posing a major challenge to housing affordability. Higher mortgage rates saw buyers shying away from purchasing homes over the past two years.

However, with the Fed’s big rate cut, mortgage rates are likely to decline further and help the homebuilding market.

Homebuilder Stocks With Growth Potential

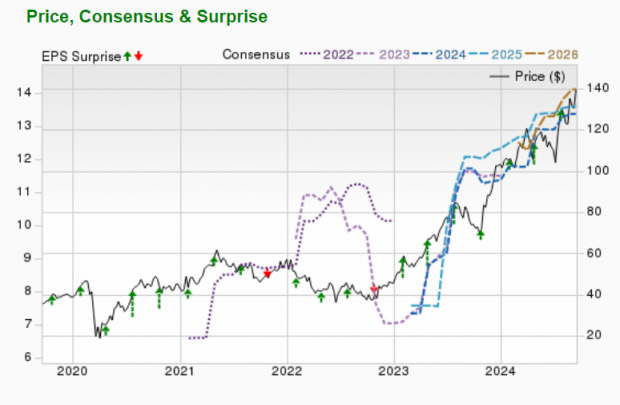

PulteGroup

PulteGroup engages in homebuilding and financial services businesses, primarily in the United States. PHM conducts operations through two primary business segments — Homebuilding (which accounted for 97.2% of 2021 total revenues) and Financial Services (2.8%). PulteGroup’s Homebuilding segment offers a wide variety of home designs, including single-family detached, townhouses, condominiums and duplexes at different prices, with a variety of options and amenities to all major customer segments: first-time, move-up and active adult.

PulteGroup’s expected earnings growth rate for the current year is 14%. The Zacks Consensus Estimate for current-year earnings has improved 5.2% over the past 60 days. PHM has a Zacks Rank #2.

Image Source: Zacks Investment Research

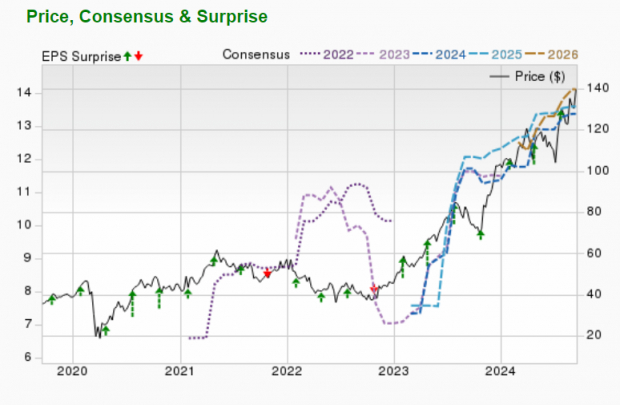

Meritage Homes

Meritage Homes is one of the leading designers and builders of single-family homes. The company primarily engages in building and selling single-family homes for entry-level, first-time, move-up, luxury and active adult buyers in historically high-growth regions of the United States.

Meritage Homes’ expected earnings growth rate for the current year is 6.1%. The Zacks Consensus Estimate for current-year earnings has improved 4% over the past 60 days. MTH presently has a Zacks Rank #2.

Image Source: Zacks Investment Research

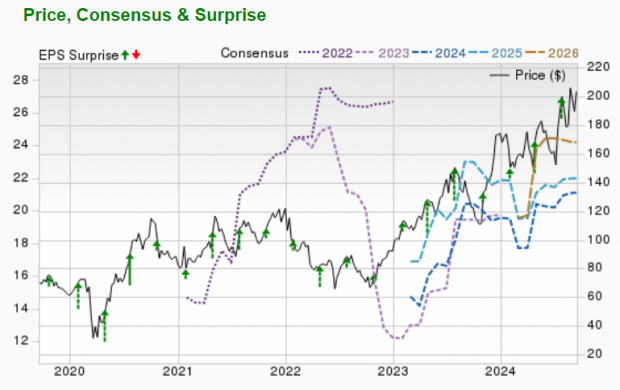

M/I Homes, Inc.

M/I Homes, Inc. is one of the nation’s leading builders of single-family homes. MHO has established an exemplary reputation based on a strong commitment to superior customer service, innovative design, quality construction and premium locations. M/I Homes serves a broad segment of the housing market, including first-time, move-up, luxury and empty-nester buyers. MHO designs, markets, constructs and sells single-family homes and attached townhomes to first-time, move-up, empty-nester and luxury buyers.

M/I Homes’ expected earnings growth rate for the current year is 21.9%. The Zacks Consensus Estimate for current-year earnings has improved 8.7% over the past 60 days. MHO carries a Zacks Rank #2.

Image Source: Zacks Investment Research

Century Communities

Century Communities is a home building and construction company. CCS’ activities comprise land acquisition, development and entitlements, and the acquisition, development, construction, marketing, and sale of various single-family detached and attached residential home projects.

Century Communities’expected earnings growth rate for the current year is 32.5%. The Zacks Consensus Estimate for current-year earnings has improved 5.9% over the past 60 days. CCS presently sports a Zacks Rank #1.

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

M/I Homes, Inc. (MHO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.