These retail concepts are almost the same. And I’ll admit that stock returns over the last 10 years are virtually identical. But I believe shares of Dollar General (NYSE: DG) will outperform shares of Dollar Tree (NASDAQ: DLTR) over the next five or more years.

Skeptics might believe that there’s no reliable way to predict stock market moves. And that’s partly true, considering no one knows the future with certainty. But there is one reliable indicator for stocks. And simply making reasonable assumptions in this area can greatly improve investing decisions.

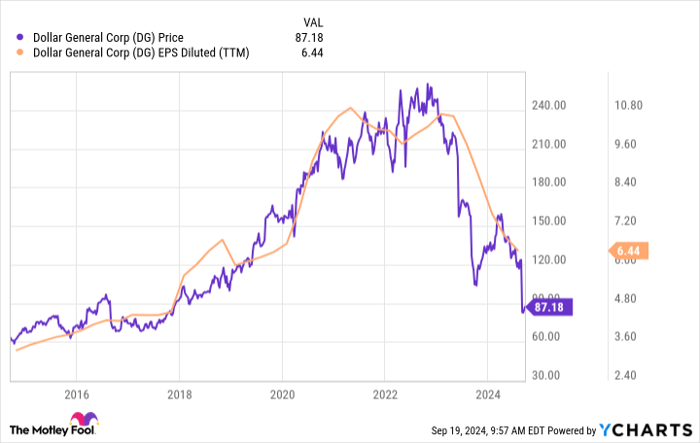

Here’s the reliable indicator: When earnings go up, stock prices tend to follow. Just look at the 10-year chart for Dollar General, showing its stock price alongside its earnings per share (EPS) — the two are clearly correlated.

DG data by YCharts

Dollar Tree stock and Dollar General stock are down 57% and 67% from their respective all-time highs. But Dollar Tree presently has a trailing-12-month net loss, and Dollar General’s EPS are down more than 40%. With profits down, a drop in stock price was the probable outcome.

Therefore, I believe predicting earnings is imperative for these two stocks. And I believe Dollar General is the better buy because its earnings will dramatically improve, and it will give plenty back to shareholders.

But first, let’s dispel a myth

It’s amazing how quickly a narrative can gain widespread acceptance, regardless of reality. The narrative for both Dollar General and Dollar Tree is that e-commerce is finally eating their lunch. Folks will cite Amazon‘s strong financial results for evidence.

But this is nowhere near accurate. In its financial report for the second quarter of 2024, Dollar Tree’s management gave an interesting statistic, sharing that it’s gained nearly 3 million net new shoppers in the past year. Dollar General hasn’t shared a similar statistic. But its same-store sales are up this year, which doesn’t indicate losing out to e-commerce.

For its part, Amazon’s business has many parts unrelated to e-commerce. When looking at its retail business, CEO Andy Jassy recently noted that consumers are trading down from higher-priced items to lower-priced items, impacting spending overall.

This is very similar to the trend at Dollar Tree and Dollar General. Management for both companies have noted that customers are strapped for cash and consequently buying fewer discretionary items. They’re only buying the essentials. Therefore, Dollar Tree and Dollar General aren’t losing customers, but rather, customer trends have shifted.

What are reasonable profit expectations?

Dollar General expects full-year EPS of at least $5.50, which is down sharply from previous forecasts and well off of its EPS just a couple of years ago. However, there’s reason to believe the company’s earnings are nearing a bottom.

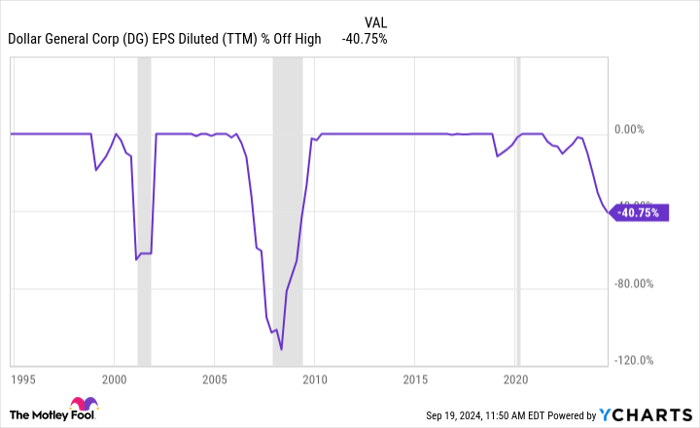

According to J.P. Morgan Research, the chances of a recession before the end of the year are going up. Granted, the odds are still low at 35%. But a number of indicators suggest a recession is coming. Even Dollar General’s numbers support this view. As the chart shows, the company’s earnings have historically plunged just before a recession.

DG EPS Diluted (TTM) data by YCharts

The trouble with broad economic data is that it normally lags reality. Therefore, it’s customary to see the shift in consumer behavior before the official numbers confirm the trend. And this means Dollar General’s financials usually improve long before a recession is officially over.

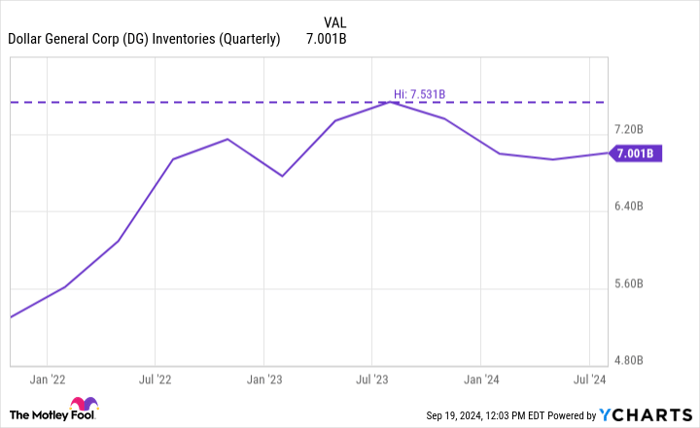

Moreover, in Dollar General’s case, it’s addressing some self-inflicted mistakes that have also hurt profits. Bloated inventory led to increased markdowns, theft, and damaged merchandise. But the company brought back former CEO Todd Vasos to help right the ship. And inventory levels are getting back to where they should be.

DG Inventories (Quarterly) data by YCharts

I expect consumer spending to eventually improve, leading to better profits for both Dollar Tree and Dollar General. But I believe Dollar General can get an extra boost from fixing its inventory issues. And I believe there’s another reason to expect better returns from Dollar General over the next five years.

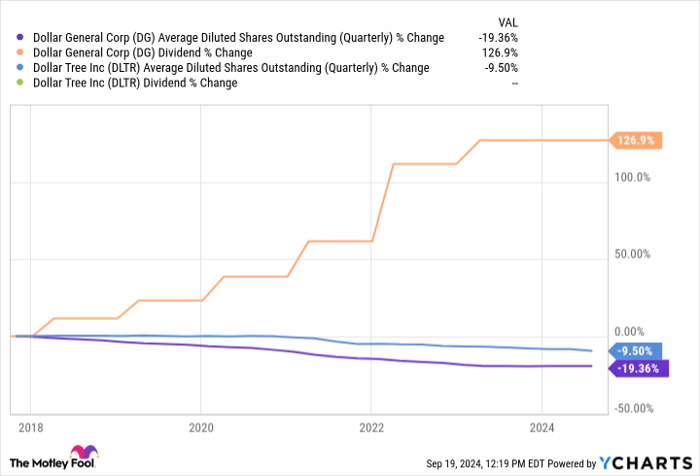

Historically speaking, Dollar General has returned more capital to shareholders than Dollar Tree. Both companies repurchase shares. But Dollar General pays a fast-growing dividend, which provides a little extra juice.

DG Average Diluted Shares Outstanding (Quarterly) data by YCharts

Putting it all together, the dollar store concept isn’t dead — consumers are just behaving differently right now because of the economy. This could prove to be short-lived, which would eventually turn a headwind for Dollar General into a tailwind. Dollar General could have an additional tailwind from fixing inventory issues.

Dollar Tree will likely enjoy similar tailwinds. But Dollar General has returned more money to shareholders in recent years. I expect that trend to continue, which makes Dollar General stock the better buy today.

Should you invest $1,000 in Dollar General right now?

Before you buy stock in Dollar General, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dollar General wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Jon Quast has positions in Dollar General. The Motley Fool has positions in and recommends Amazon and JPMorgan Chase. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.