Piper Sandler Downgrades Rating on PBF Energy (LSE:0KE0)

On September 20, 2024, Piper Sandler made a significant move by downgrading their outlook for PBF Energy from Neutral to Underweight, as reported by Fintel. This shift in perspective undoubtedly caught the attention of investors, provoking contemplation and speculation in the market.

Analyst Price Forecast Indicates Potential Upside

With an average one-year price target of 46.36 GBX/share as of August 26, 2024, the future of PBF Energy seems poised for a potential uptrend. Ranging from a low of 35.31 GBX to a high of 54.54 GBX, the forecasted increase of 38.48% from the latest closing price of 33.47 GBX/share is a beacon of hope for investors seeking growth.

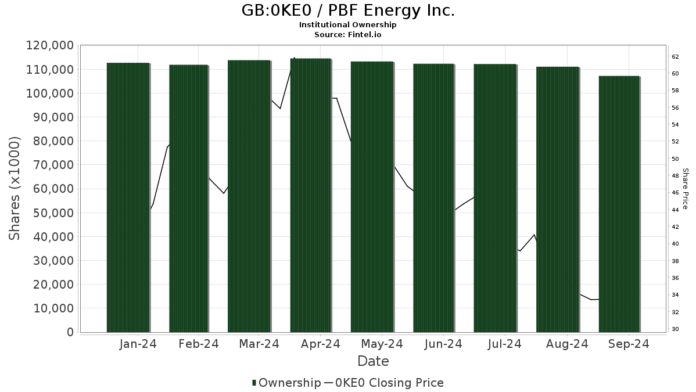

It is crucial to consider the fund sentiment surrounding PBF Energy. As reported, there are 846 funds or institutions with positions in the company, a figure that has decreased by 10 owners or 1.17% in the last quarter. Interestingly, the average portfolio weight dedicated to 0KE0 has seen an increase of 11.56%, with total shares owned by institutions decreasing by 3.74% to 107,235K shares in the past three months.

Delving further into shareholder activities, notable ETFs and institutions such as iShares Core S&P Mid-Cap ETF, Vanguard Total Stock Market Index Fund Investor Shares, iShares Russell 2000 ETF, and Bank of New York Mellon have demonstrated fluctuations in their holdings of PBF Energy. These changes, including both increases and decreases, paint a dynamic picture of investor sentiment towards the company.

Exploring the Data with Fintel

For investors seeking comprehensive and detailed research platforms, Fintel emerges as a go-to source. Covering a wide array of data including fundamentals, analyst reports, ownership data, fund sentiment, and insider trading, Fintel provides a robust toolkit for informed decision-making in the financial markets. Additionally, their exclusive stock picks, driven by advanced quantitative models, offer a potential avenue for enhancing profitability.

Click to Learn More about Fintel’s offerings and delve deeper into the world of investing.

This article was first published on Fintel, providing valuable insights into the financial landscape.

The insights presented in this article are solely those of the author and may not necessarily align with the views of Nasdaq, Inc.