Source: Barry Dawes 09/25/2024

Bearing the torch of market wisdom, Barry Dawes of Martin Place Securities provides a glimpse into the intriguing possibility of silver outshining gold in the current financial landscape.

Watching the gold price surge once more, we witness its ascent in a wave of anticipation that may lead to a significant propulsion. With US$2800 tantalizingly within reach, the horizon is ripe for the spectacle of US$3000 marking this bullish rally.

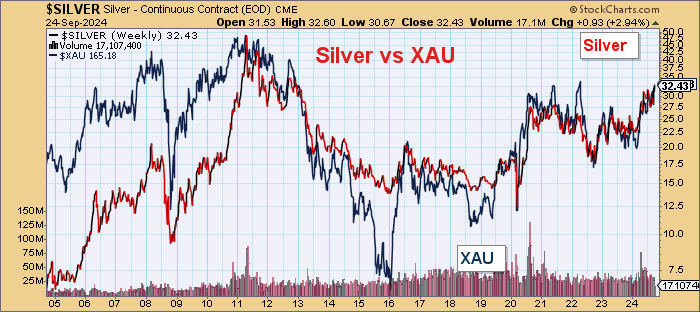

While silver has been trailing gold significantly, it stands at the cusp of a catch-up endeavor. The breakthrough at US$32 signals a pivotal moment, hinting at a swift retest of the previous peak at US$50.

The gold stocks are on the brink of a breakout with the XAU index poised to overcome the formidable resistance at 165.

Observing the North American gold indices XAU and HUI breaking free from their 13-year downtrends evokes a sense of exhilaration, as if they are ready to soar to new heights, soaring beyond limits previously fathomed.

Reflecting on the 20-year XAU versus silver chart, the two metals seem to be dancing in unison, their performance mirroring each other’s steps.

As previously noted, silver appears to be more in tune with the ebullient animal spirits that propel gold stocks skyward, painting a picture where gold takes the backseat as silver steers the wheel.

This alignment elucidates why small-cap gold stocks have lagged behind the surge in gold prices and the performance of major gold indices.

For the long-struggling shareholders in small and micro-cap companies, a glimmer of hope emerges as the stocks are poised for substantial gains.

In the grand tapestry of commodities, a stirring movement is afoot as oil, coal, copper, lithium, grains, and fertilizers show signs of awakening from dormancy.

The futures market is teetering on the brink of US$2,700, a milestone that may soon be effortlessly surpassed.

With the breeze of US$2,800 beckoning tantalizingly close, the journey seems paved with promise.

While gold is poised to outshine the stocks, the forecast remains clear of any impending crashes.

The Golden Surge

At the pinnacle of 165, the gold stocks are on the precipice of a potential breakthrough.

The impending week looms with the promise of significant gains.

Liberating themselves from the shackles of a 13-year downward trend, the gold stocks are heralding a new era of growth and prosperity.

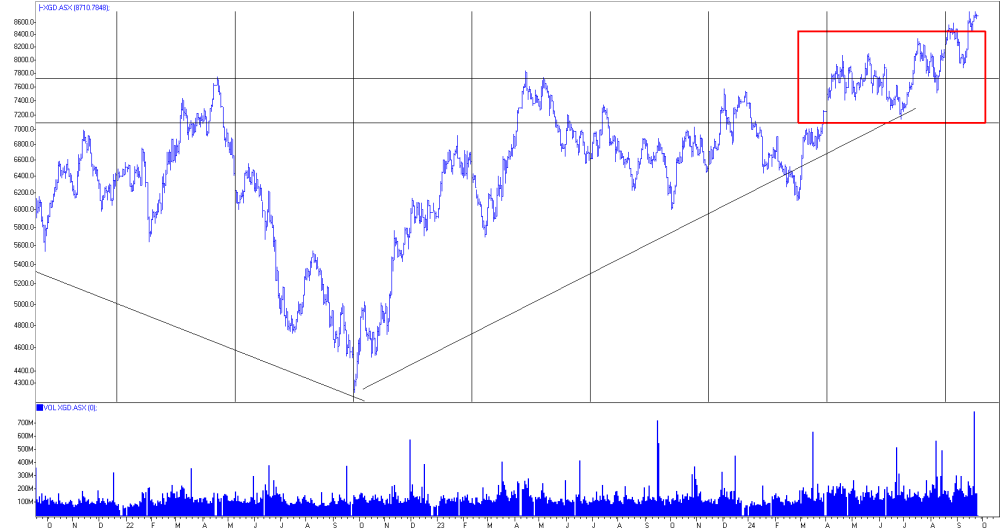

ASX Gold Index on the Rise

Breaking free from the confines at 8700, the ASX Gold Index is embarking on a journey towards the coveted milestone of 10,000.

Witness the trajectory of XGD from 2022 to 2024 in the visual representation below.

Silver’s Momentous Leap

A monumental shift is underway as silver prepares to make a triumphant march towards US$50.

The stage is set for silver to outshine its lustrous counterpart, gold, in the glittering spectacle that lies ahead.

The Radiance of Copper

With copper surging past US$4.40 per pound, a shimmering beacon of hope emerges amidst the market tumult.

In navigating the market terrain, heed the movements of the markets themselves rather than the whirlwind of commentators circling above.

Important Disclosures:

-

Opinions expressed herein are solely those of the author and do not reflect Streetwise Reports, Street Smart, or their officers. The author bears full responsibility for the accuracy of the statements provided. Streetwise Reports did not receive any compensation from the author for the publication or syndication of this article. Contributing authors are obligated to disclose any financial holdings or relationships with companies under discussion. Any such disclosures from the author can be found below. Streetwise Reports relies on authors to furnish accurate details, with no means of independent verification.

- This content should not be construed as investment advice or a solicitation for investment. Streetwise Reports does not furnish general or specific investment counsel, and the information presented here should not be viewed as a recommendation to trade any securities. Readers are encouraged to consult with their personal financial advisor and conduct thorough due diligence before making investment decisions. By accessing this page, readers agree to the terms of service and full legal disclaimer outlined by Streetwise Reports. Streetwise Reports does not endorse or promote the products, services, securities, or businesses of any particular company.

Market News and Data brought to you by Benzinga APIs