The swift ascent of Skyward Specialty Insurance Group, Inc. SKWD to near its 52-week high has sent ripples through the financial realm, closing at $40.73 on Monday, just a stone’s throw away from its peak at $42.26. Over the past year, SKWD has soared by a staggering 48.8%, outshining not just its industry peers but also the broader Finance sector and the Zacks S&P 500 composite index.

The insurer unveiled a robust earnings performance over the last four quarters, divulging that each of its eight underwriting divisions is now a powerhouse individually, boasting over $100 million in gross written premiums. Scale has been reached across the board, promising sustained earnings contributions from each division.

Skyward Specialty’s Remarkable Year-to-Date Performance

Image Source: Zacks Investment Research

SKWD Riding High Above 50-Day Moving Average

Indicative of a bullish trend, SKWD shares have been cruising comfortably above the 50-day moving average for some time now, signaling continued upward momentum.

SKWD’s Stock Movement in Contrast to the 50-Day Moving Average

Image Source: Zacks Investment Research

Positive Analyst Sentiment Surrounding SKWD

Recent months have seen a surge in analyst estimates for 2024 and 2025, with four out of six analysts bumping up their projections. The Zacks Consensus Estimate for these years has followed suit, climbing 5.3% and 4.8% within the last 60 days, respectively.

Anticipated year-over-year increases of 40.3% for 2024 and 10.1% for 2025 paint a promising picture, with a long-term earnings growth rate pegged at 18%, surpassing the industry average of 11.6%.

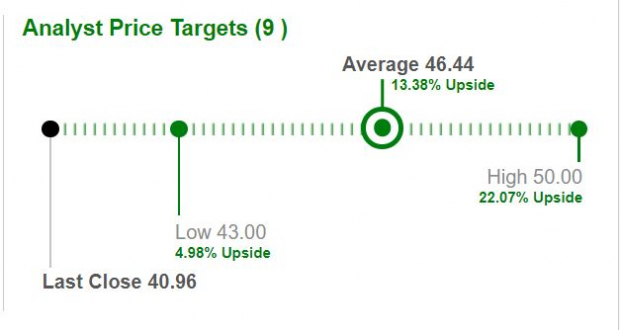

A Rosy Outlook for SKWD’s Average Target Price

With an average price target of $46.44 per share based on short-term forecasts from nine analysts, an enticing 13.4% potential upside from Monday’s closing price beckons.

Image Source: Zacks Investment Research

SKWD’s Growth Blueprint

Positioned in underpenetrated niche markets where standard insurance offerings fall short, Skyward Specialty’s growth strategy hinges on bespoke products, savvy underwriting, and technological prowess. This strategic edge enables SKWD to navigate a sea of opportunities with agility, bolstering its revenue streams, expanding margins, and curating a portfolio teeming with risk-adjusted returns on capital. The company’s focus on high-return areas insulated from P&C cycles, coupled with smart pricing strategies and an evolving business mix, augurs well for sustained growth. Notably, SKWD’s combined ratio, a critical measure of underwriting profitability, has shown steadfast improvement.

A shrewd investment approach has paid dividends for SKWD, with a recent Federal Reserve interest rate cut aligning favorably with insurers’ interests. By repositioning its investment portfolio and fortifying its cash reserves, SKWD stands to thrive in a potentially rising rate environment, insulating itself against investment headwinds. The company’s strengthened financial foundation, underscored by an improving debt profile and enhanced liquidity, further underscores its resilience in the face of market vicissitudes.

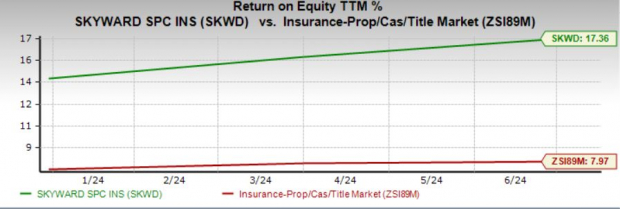

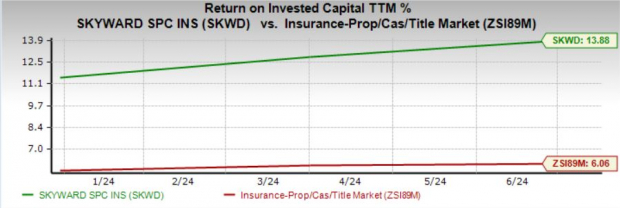

SKWD’s Capital Returns in Focus

With a trailing 12-month return on equity of 17.4%, outpacing the industry norm of 8%, SKWD demonstrates prudent capital utilization. A mounting return on invested capital (ROIC) in recent quarters, currently at 13.4% versus the industry average of 6.1%, underscores SKWD’s prowess in generating income efficaciously.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

SKWD Price Valuation

Despite its stellar performance, SKWD’s current valuation places it at a premium compared to industry peers, trading at a price-to-book multiple of 2.25, exceeding the industry average of 1.62. With a Value Score of A, SKWD is deemed overvalued, though historical data suggests that stocks with a high Value Score and favorable Zacks Rank often yield superior returns.

Image Source: Zacks Investment Research

Other industry counterparts like Aflac Inc AFL, The Progressive Corporation PGR, and The Travelers Companies TRV are similarly trading at elevated multiples versus the industry standard.

SKWD Strategy for Investors

Embracing the mantra of “Rule Our Niche,” SKWD is poised to propel growth, bolster margins, optimize earnings potential, enhance return on capital, and leverage its strengths to unlock further growth pathways. While the price tag may seem steep, buoyed by optimistic analyst sentiment, robust growth projections, and a VGM Score of B, SKWD emerges as an appealing prospect for prospective investors eyeing a stake in this Zacks Rank #2 (Buy) gem.

Explore the complete lineup of today’s Zacks #1 Rank (Strong Buy) selections here.

Unleashing an Infrastructure Stock Surge Across America

A transformative wave to revamp America’s ailing infrastructure looms large on the horizon. With bipartisan support, an air of urgency, and inevitability, this revitalization effort heralds a new dawn for the nation’s vital infrastructure backbone.

Skyward Specialty Soars: A Golden Opportunity Amidst Infrastructure Boom

Seizing the Moment: Finding Fortune in Infrastructure Investments

As trillions of dollars prepare to cascade into the infrastructure market, astute investors are sharpening their gaze on stocks expected to flourish in construction, repair, cargo hauling, and energy transformation. The path to financial prosperity hinges on identifying the right opportunities at the right time.

A Profound Revelation: Zacks Special Report Unveils Hidden Gems

Zacks, the heralded financial research firm, has unveiled a Special Report that could be your golden ticket to unearth the treasures hidden within the infrastructure sector. The report dissects 5 select companies poised to reap the rewards of the impending infrastructure boom, promising gains on a scale that might seem surreal.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

In the quest for lucrative investments, understanding the potential growth of companies involved in vast construction endeavors such as roads, bridges, and buildings is paramount. Additionally, the surge in cargo hauling and the monumental shifts in energy transformation are set to create ripples of prosperity in the stock market.

An Unmissable Opportunity: Companies Poised for Profits

Alongside this expansive growth narrative, companies like The Travelers Companies, Inc. (TRV), Aflac Incorporated (AFL), The Progressive Corporation (PGR), and Skyward Specialty Insurance Group, Inc. (SKWD) have positioned themselves strategically to ride the wave of infrastructure development to soaring success.

An analysis of these innovative companies reveals a bedrock of resilience and adaptability, characteristics that are likely to fuel sustained growth amidst the infrastructure investment revolution. Seizing the opportunity to invest in these forward-thinking entities could translate into substantial returns for proactive investors.

Upward Trajectory: Skyward Specialty’s Ascendancy

Noteworthy amongst these promising entities is Skyward Specialty Insurance Group, Inc., currently basking near its 52-week high. This signals a remarkable upswing in the company’s trajectory and prompts investors to ponder the significance of this momentous occasion. Is now the time to capitalize on Skyward Specialty’s upward surge?

To read this article on Zacks.com click here.

In the ever-evolving landscape of infrastructure investments, Skyward Specialty stands as a beacon of potential, offering investors an enticing prospect for lucrative returns in the burgeoning market of insurance and risk management. The question remains – will you seize the opportunity at hand?

As the dawn of unparalleled infrastructure spending approaches, investors must tread carefully but decisively on the path to prosperity. By aligning investment strategies with the transformative potential of companies like Skyward Specialty, individuals can position themselves to reap the rewards of this transformative period in the financial markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.