The battleground of the cloud giants, Oracle Corp ORCL and Salesforce Inc CRM, is ablaze with competition as their stocks skyrocket on the back of the AI revolution.

But who is leading the charge to victory? Delving into the numbers, recent strategic maneuvers, and essential insights, it’s time to uncover the current state of play.

Oracle’s Bold Move: Malaysia’s Cloud Megalopolis

Oracle has been flexing its muscles in the cloud arena, experiencing a remarkable 20% surge in stock price over the past month and a jaw-dropping +61% year-to-date increase, fueled by impressive expansion in its cloud infrastructure offerings. The latest grand gesture comes in the form of a $6.5 billion investment to establish a public cloud region in Malaysia—outpacing Amazon.com Inc‘s $6.2 billion AWS venture. Oracle’s aggressive foray aims to capitalize on Malaysia’s soaring demand for AI, data, and analytics, potentially marking it as one of the most substantial tech investments in Southeast Asia.

Explore More: Oracle Sets Sights High with $6.5B Cloud Expansion Into Malaysia to Ignite AI Revolution

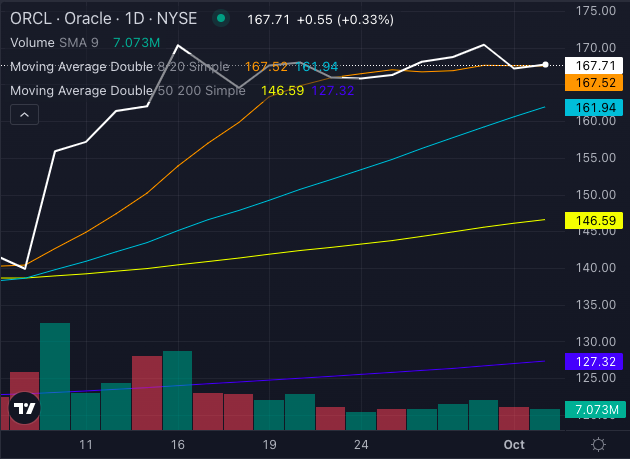

Chart crafted using Benzinga Pro

On the trading front, Oracle’s stock is displaying robust bullish signals all around, currently standing at $167.71, soaring above its eight-day, 20-day, and 50-day moving averages. Nevertheless, a hint of selling pressure looms, urging caution for those eyeing short-term gains. Yet, with ambitious revenue targets set at $104 billion by fiscal year 2029, Oracle is unmistakably playing the long game.

Salesforce: Unleashing GenAI Power

Meanwhile, Salesforce refuses to remain idle. With a commendable 12.67% surge in stock value over the last month, propelled by the introduction of its new AgentForce platform, which analysts acclaim as standing “on par” with Microsoft Corp‘s GenAI.

Piper Sandler even took the admirable step of upgrading Salesforce to Outperform, setting a price target of $400. AgentForce, tailored for sales, marketing, and service workflows, has the potential to expand Salesforce’s Total Addressable Market (TAM) by an astonishing $3.2 trillion.

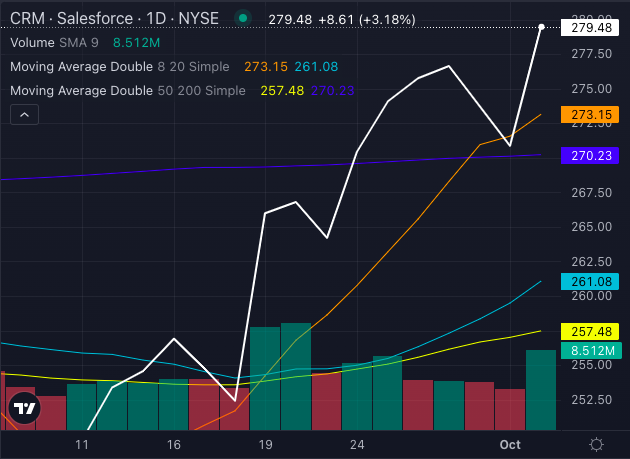

Chart created using Benzinga Pro

Signaling bullish technical trends, Salesforce’s stock is currently trading at $279.48, comfortably above its eight-day, 20-day, and 50-day moving averages, affirming robust buying pressure.

The Verdict Is In

Both Oracle and Salesforce, as AI-driven juggernauts with voracious appetites for cloud expansion, present abundant potential for growth. Oracle’s bold strides into Asian infrastructure provide it with a global presence, while Salesforce’s aspirations with GenAI position it favorably to dominate in enterprise software.

For investors with an eye on the cloud and AI realm, considering both entities is prudent. However, Oracle’s international endeavours and optimistic long-term projections might inch ahead of Salesforce’s innovative short-term victories.

The crucial question remains: Who will emerge as the reigning monarch of the cloud? Only time will tell as the AI saga continues to unfold.

Further Reading:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs