Dividend Details

Greif announced a regular quarterly dividend of $0.78 per share ($3.12 annually) on February 26, 2024, up from $0.77 per share previously. Shareholders must own shares before March 15, 2024, to receive the dividend, paid on April 1, 2024.

The current dividend yield stands at 4.95%. Over five years, the average yield was 5.61%, with a low of 3.61% and a high of 8.69%. The latest yield is 0.58 standard deviations below the historical average.

The company maintains a dividend payout ratio of 0.53, indicating how much of its income goes to dividends. Notably, Greif has held its dividend steady for the last three years.

Fund Ownership and Analyst Forecasts

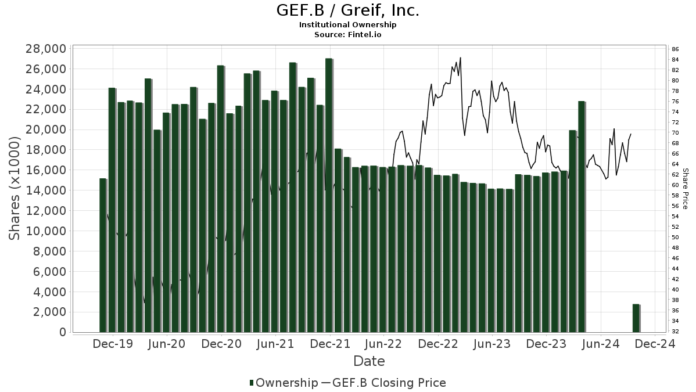

509 funds own Greif shares, with a 13.29% decrease in the last quarter. The average portfolio weight for GEF.B is 0.14%, down by 7.21%. Institutional ownership has increased by 26.46% to 19,933K shares in the last three months.

Analysts forecast a 25.18% upside for Greif, with a one-year price target averaging $78.96. The projected annual revenue is $5,867 million, up by 13.85%, with a projected non-GAAP EPS of 6.43.

Top shareholders like Fuller & Thaler Asset Management and Lsv Asset Management decreased their stake in GEF.B in the last quarter, while Vanguard Total Stock Market Index Fund increased its holding. Overall, these actions indicate shifting confidence among investors.

Company Background

Greif, based in Delaware, Ohio, initially manufactured barrels but now specializes in industrial packaging and containers.