Exploring Smart Investment Alternatives to Nvidia in the AI Chip Market

Nvidia (NASDAQ: NVDA) is poised for another year of remarkable gains. The semiconductor leader has seen its stock climb over 150% in 2024, continuing its impressive trajectory from last year. With ongoing strong demand for its artificial intelligence (AI) chips, the company’s future growth looks promising as its upcoming Blackwell processors show greater demand than available supply going into 2025.

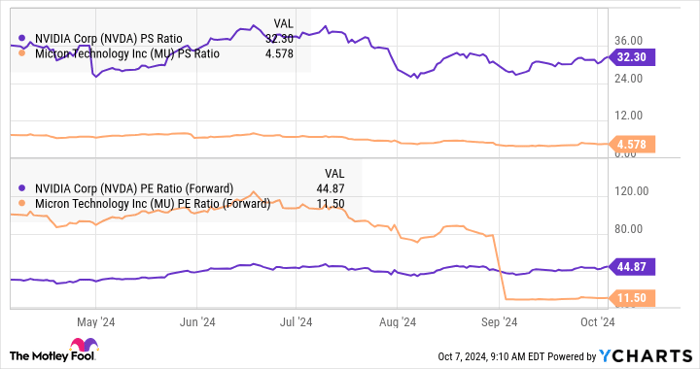

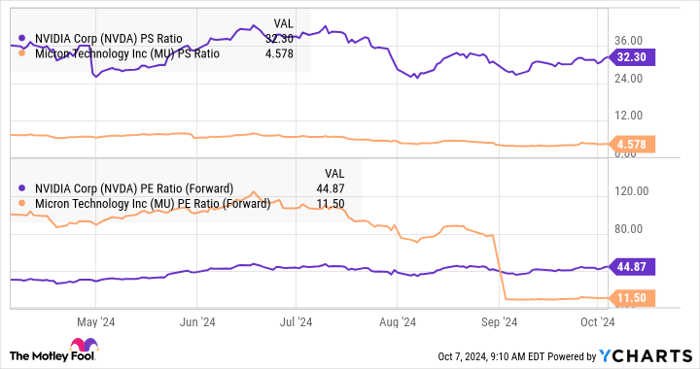

However, some investors are exploring alternatives due to Nvidia’s current valuation. The stock’s earnings multiple stands at 59, significantly above the Nasdaq-100 index’s multiple of 32. While Nvidia’s robust revenue and earnings growth help rationalize this valuation, those preferring a lower risk may consider more affordable options.

1. Micron Technology: A Growth Contender

Micron Technology (NASDAQ: MU) manufactures memory chips and serves clients including Nvidia. Thanks to the rising demand for Nvidia’s AI graphics processing units (GPUs), Micron has experienced substantial growth in sales of its high-bandwidth memory (HBM) chips, crucial components in these GPUs.

Micron’s revenue for the fourth quarter of fiscal 2024 (ending August 29) soared 93% year over year to $7.75 billion. Additionally, the company reported a non-GAAP profit of $1.18 per share, a stark contrast to the loss of $1.07 per share recorded in the same quarter last year.

Looking ahead, Micron anticipates revenue of $8.7 billion for the current quarter, representing an 84% increase from the previous year. In comparison, Nvidia expects 80% year-over-year revenue growth for this quarter. However, investors considering value may find Micron an appealing choice, especially given its lower valuation.

This concept is illustrated in the chart below:

NVDA PS Ratio data by YCharts

Furthermore, Micron is well-positioned to capitalize on the increasing integration of generative AI in smartphones and personal computers. During its latest earnings call, Micron noted that AI-enabled smartphones typically feature between 12 gigabytes (GB) and 16GB of dynamic random access memory (DRAM), compared to last year’s 8GB in flagship models.

Similarly, Micron CEO Sanjay Mehrotra highlighted advancements in the PC segment: “Leading PC [original equipment manufacturers] recently introduced AI-enabled PCs with at least 16GB of DRAM for value models and from 32GB to 64GB for mid to premium segments, up from an average of 12GB across all PCs last year.”

The market for both smartphones and AI PCs is set to grow significantly. IDC estimates that the annual growth rate for generative AI smartphones will be 78% through 2028, while Canalys projects that AI PC shipments will grow at 44% annually between 2024 and 2028.

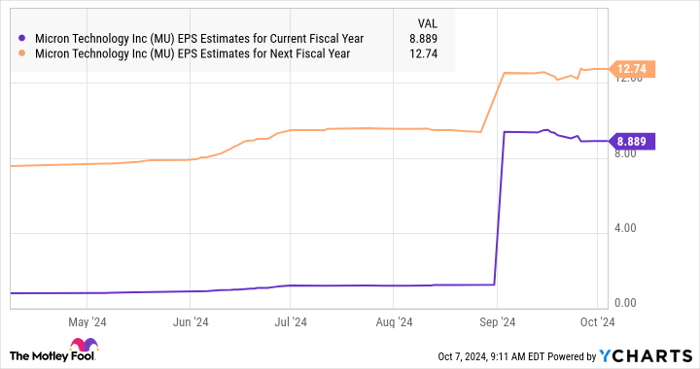

Finally, Micron forecasts that the HBM market will expand from $4 billion in 2023 to $25 billion by 2025. This posits Micron as a solid investment for capturing growth in the AI semiconductor market while avoiding the high valuation seen with Nvidia.

MU EPS Estimates for Current Fiscal Year data by YCharts

2. Taiwan Semiconductor Manufacturing: The Backbone of Chip Production

Taiwan Semiconductor Manufacturing (NYSE: TSM), commonly referred to as TSMC, occupies the top spot as the largest foundry in the world, producing chips for major companies like Nvidia. TSMC has been integral to Nvidia’s achievements in the AI chip sector, thanks to its advanced manufacturing processes that enable fast, energy-efficient chips.

Nvidia’s A100 GPU, used to train ChatGPT, was developed using TSMC’s 7-nanometer (nm) process, followed by the popular H100 processor produced using the more advanced 4nm process. Due to the high demand for TSMC’s processes, the factory’s capacity is fully booked for 2025, with notable commitments from Nvidia and AMD.

To meet this demand, TSMC plans to ramp up production. The company expects to end 2024 with a monthly advanced chip packaging capacity of 45,000 to 50,000 units, up from 15,000 units in 2023. This expansion is aimed at accommodating increasing orders from AI chip manufacturers and other clients like Apple.

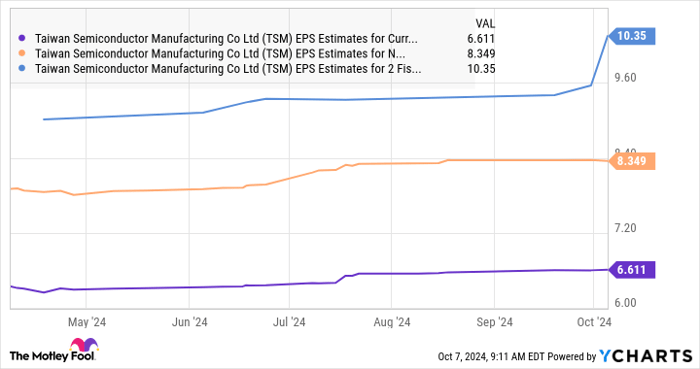

TSM EPS Estimates for Current Fiscal Year data by YCharts

The accompanying chart indicates that TSMC’s earnings are projected to rise over 20% in 2025 and 2026, building on an anticipated 27% surge this year compared to last year’s $5.19 per share. With TSMC currently trading at 22 times forward earnings, a noticeable discount relative to the tech sector’s average of 45, the stock presents an attractive opportunity for investors looking for growth in the AI space.

If TSMC’s earnings reach $10.35 per share by 2026 and trade at 30 times forward earnings, consistent with the Nasdaq-100 index, the company’s stock price could potentially rise to $310, reflecting a 72% increase from present levels.

Should you invest $1,000 in Micron Technology right now?

Before making any decisions regarding Micron Technology stock, consider this:

The Motley Fool Stock Advisor team has identified what they believe to be the 10 best stocks for investors to consider now… and Micron Technology is not among them. The chosen stocks are positioned for potentially massive returns in the years ahead.

Reflect on this: if you had invested $1,000 in Nvidia on April 15, 2005, you would now have $812,893!*

Stock Advisor offers a straightforward plan for success, providing insights on portfolio building, regular updates from analysts, and two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.