Shares of electric vehicle maker Tesla (TSLA) are down 8% after the company’s Cybercab event failed to impress Wall Street analysts.

Cybercab Unveiling Meets Wall Street’s Disappointment

During the launch, previously called the Robotaxi, Tesla CEO Elon Musk showcased a self-driving concept car that features two seats and lacks a steering wheel or pedals. Tesla plans for the vehicle to be fully autonomous, aiming for a launch by 2027, with a starting price below $30,000.

Elon Musk is betting heavily on the future of self-driving vehicles. He announced that Tesla will have full self-driving capabilities in its Model 3 and Model Y in Texas and California by the end of 2025. However, there remain uncertainties about when regulators will give the green light for broader use of self-driving technology.

Analysts Call Out the Event

The Cybercab presentation was met with sharp criticism from analysts on Wall Street, many labeling it a mere publicity stunt. Barclays (BCS) noted that the event did not showcase any immediate sales opportunities for Tesla.

Piper Sandler (PIPR) expressed disappointment with the Robotaxi unveiling and anticipates the stock will continue to decline through the rest of 2024. Morgan Stanley (MS) analysts remarked that Musk did not convincingly position Tesla as an artificial intelligence (AI) leader, leading to “overall disappointed expectations.”

Over the past year, TSLA stock has now dropped 15%.

TSLA Stock Assessment: Buy or Hold?

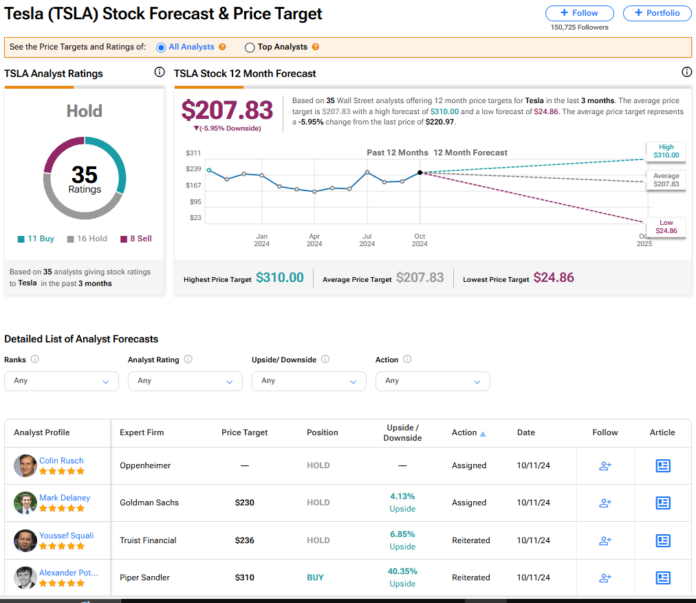

Tesla stock holds a consensus Hold rating among 35 Wall Street analysts. This rating consists of 11 Buy, 16 Hold, and 8 Sell recommendations made in the last three months. The average price target for TSLA stands at $207.83, suggesting a potential downside of 5.95% based on current prices.

Read more analyst ratings on TSLA stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.