ASML’s Early Earnings Slip Sends Shockwaves Through Tech Sector

NASDAQ Takes a Hit: A premature earnings announcement from ASML Holding N.V. ASML has negatively impacted the tech industry, leading to a 1% drop in the Nasdaq index on Tuesday. The concern arose when ASML accidentally published its third-quarter earnings report a day early, causing unease across the semiconductor landscape.

As noted by Benzinga Staff Writer Piero Cingari, this report included a significant reduction in 2025 net sales guidance, now expected to range from 30 billion euros to 35 billion euros ($32.7 billion to $38.2 billion), down from an earlier estimate of 30 billion euros to 40 billion euros.

Despite ongoing demand in the artificial intelligence sector, it wasn’t enough to revive other parts of the market. ASML’s president and CEO Christophe Fouquet remarked on the gradual pace of recovery, cautioning that this trend may persist into 2025, which could make customers hesitant.

Moreover, Fouquet indicated that the company’s 2025 net sales projection now falls into the lower half of the range suggested during its recent Investor Day conference.

The options market reacted swiftly, with institutional investors leaning toward bearish positions. A noticeable spike in put options emerged, with expiration dates set between this Friday and March 21 of the upcoming year.

Investment Opportunities with Direxion ETFs: In light of recent activity in the tech sector, investors may find potential in Direxion’s leveraged exchange-traded funds (ETFs). Notably, the Direxion Daily Semiconductor Bull 3X Shares SOXL is aimed at highly optimistic traders.

Additionally, the Direxion Daily Semiconductor Bear 3X Shares SOXS caters to those with bearish sentiments. Both ETFs aim for triple the daily returns (or losses) relative to the NYSE Semiconductor Index, emphasizing that these funds are best suited for one-day holding periods due to the 3X leverage involved.

Investors should exercise caution, as daily compounding, especially for the SOXS fund, can lead to significant volatility. Maintaining discipline in trading positions will be crucial as market conditions fluctuate.

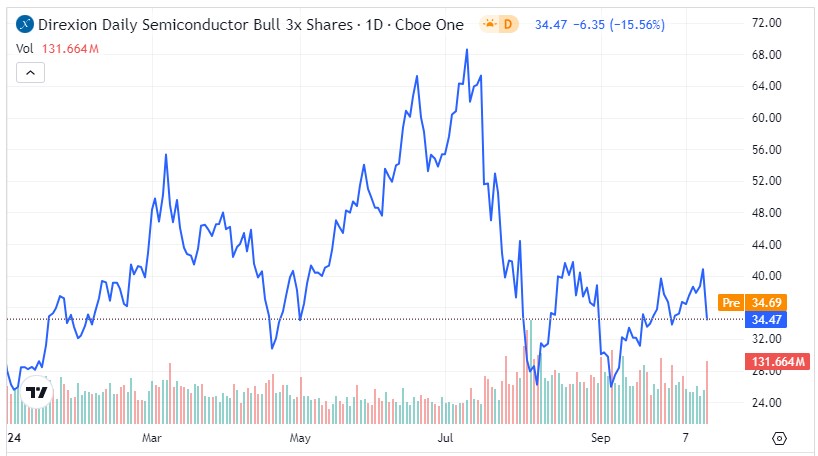

SOXL ETF Performance: Currently, the SOXL fund has shown positive traction this year, yet the extreme leverage has resulted in moderate performance outcomes.

- After a strong rise in early July, the 3X-leveraged ETF saw a steep decline in early August, followed by a period of uncertain trading.

- Presently, SOXL faces challenges as the disappointing ASML news has pushed its unit price below the 50-day moving average.

SOXS ETF Update: In contrast, the SOXS fund has struggled, recording over a 63% decline since the start of the year, reflecting the overall robust performance of the tech sector.

- The current trajectory of SOXS indicates persistent challenges, marked by a trend of lower lows.

- However, the recent ASML announcement triggered nearly an 18% surge in the 3X bear fund, injecting a dose of optimism.

Featured photo by Temel on Pixabay.

Market News and Data brought to you by Benzinga APIs