Dominion Energy Partners with Amazon to Pave the Way for Small Modular Reactors in Virginia

In a significant move, Dominion Energy (D) has partnered with Amazon.com (AMZN) to explore new methods for developing Small Modular Reactor (SMR) nuclear technology. This agreement aims to strengthen Dominion’s presence in Virginia’s growing energy market by leveraging innovative SMR solutions.

Understanding the Importance of SMR Technology

The demand for electricity is surging in Virginia and across the U.S., compelling utilities and government officials to consider SMRs as a reliable source of carbon-free energy. SMRs can generate consistent power while requiring less space and lower initial investment compared to traditional nuclear plants.

Predictions indicate that Virginia’s electricity demand could double in the next 15 years, with a growth rate exceeding 5%. In response, Dominion Energy is implementing an “all-of-the-above” strategy that includes investments in offshore wind, solar, battery storage, and natural gas, with SMRs playing a crucial role in this strategy for the 2030s.

This recent Memorandum of Understanding (MOU) reflects Dominion Energy’s proactive approach to reinforcing its position in the electric utility sector. Just last July 2024, the company issued a Request for Proposals to leading SMR technology firms to evaluate the possibility of constructing an SMR at its North Anna Power Station in Louisa County, VA.

Investment Opportunities with D Stock

The rising interest in SMR technology coincides with a global move toward incorporating nuclear energy into clean energy strategies, driven by its cost-saving potential and flexibility. A Wood Mackenzie report from March 2024 noted that the SMR project pipeline reached 22 gigawatts (GW) in the first quarter of 2024, demanding an investment of around $176 billion. Such trends highlight substantial growth opportunities for utilities like Dominion Energy that embrace SMR advancements.

America’s Growing Interest in SMR

Another player in the SMR landscape is Ameren Corporation (AEE). Its subsidiary, Ameren Missouri, is collaborating with Westinghouse Electric Company to secure funding from the U.S. Department of Energy for two SMR projects, including a Westinghouse SMR at the Callaway Energy Center.

AEE’s three-to-five-year earnings growth rate is projected at 6.58%, with the Zacks Consensus Estimate for 2024 earnings per share (EPS) showing a year-over-year increase of 5.5%.

Performance of Dominion Energy’s Stock

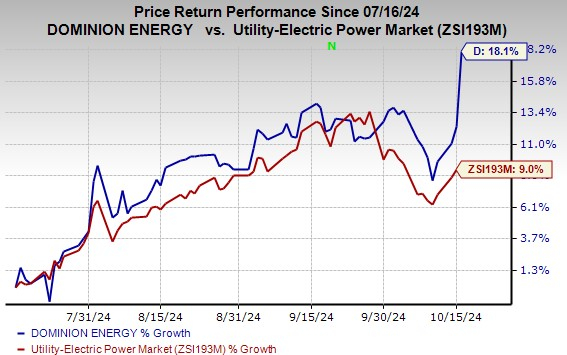

In recent months, shares of Dominion Energy have appreciated by 18.1%, outpacing the industry growth of 9%.

Current Zacks Ranking and Stock Comparisons

Presently, Dominion Energy holds a Zacks Rank of #3 (Hold). In contrast, NiSource (NI) boasts a higher Zacks Rank of #2 (Buy). NiSource’s long-term earnings growth rate is estimated at 6.95%, with a year-over-year EPS growth projection of 7.5% for 2024.

Unlock Zacks’ Insights for Just $1

We are serious about this offer.

For just $1, you can access 30 days of Zacks’ top stock picks without any further obligation. Many have taken advantage of this deal, while others have hesitated, wondering if there’s a catch.

This unique opportunity allows you to explore our portfolio services, which have successfully closed 228 positions with significant double- and triple-digit gains in 2023.

See Stocks Now >>

For the latest recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double” for free. Click to access:

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Ameren Corporation (AEE): Free Stock Analysis Report

NiSource, Inc (NI): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.