Investors Eye High-Yield Dividend Stocks Amid Market Uncertainty

In turbulent financial times, dividend-yielding stocks become an appealing choice for many investors. Companies with robust cash flow often offer substantial payouts to shareholders.

Benzinga allows readers to explore the latest analyst evaluations on their preferred stocks. Users can navigate through a comprehensive database of ratings, including insights on analyst performance.

Here are the ratings from top analysts for three high-yield stocks within the financial sector.

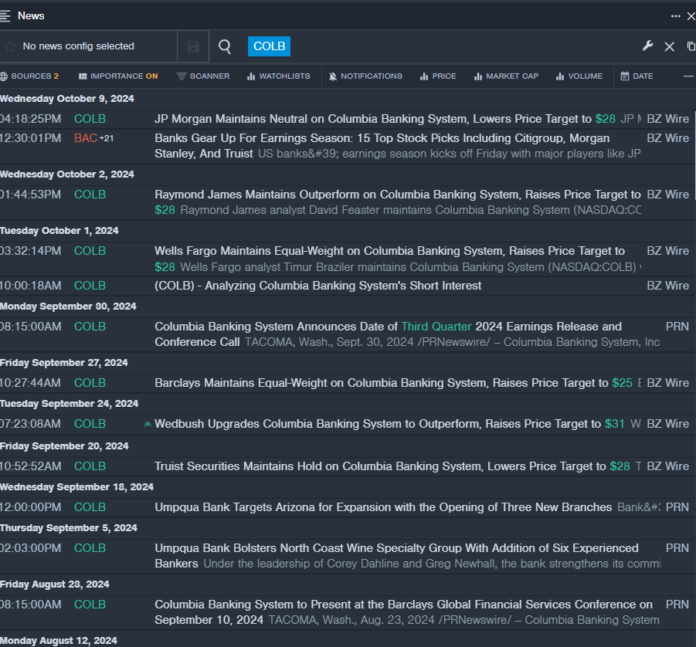

Columbia Banking System, Inc. COLB

- Dividend Yield: 5.19%

- JP Morgan analyst Steven Alexopoulos held a Neutral rating, lowering the price target from $29 to $28 on October 9. His accuracy rate stands at 71%.

- Raymond James analyst David Feaster maintained an Outperform rating, increasing the price target from $26 to $28 on October 2. His accuracy rate is 68%.

- Recent News: Columbia Banking System will announce its third-quarter financial results on Thursday, October 24, before the market opens.

- Benzinga Pro’s newsfeed provides real-time updates on COLB.

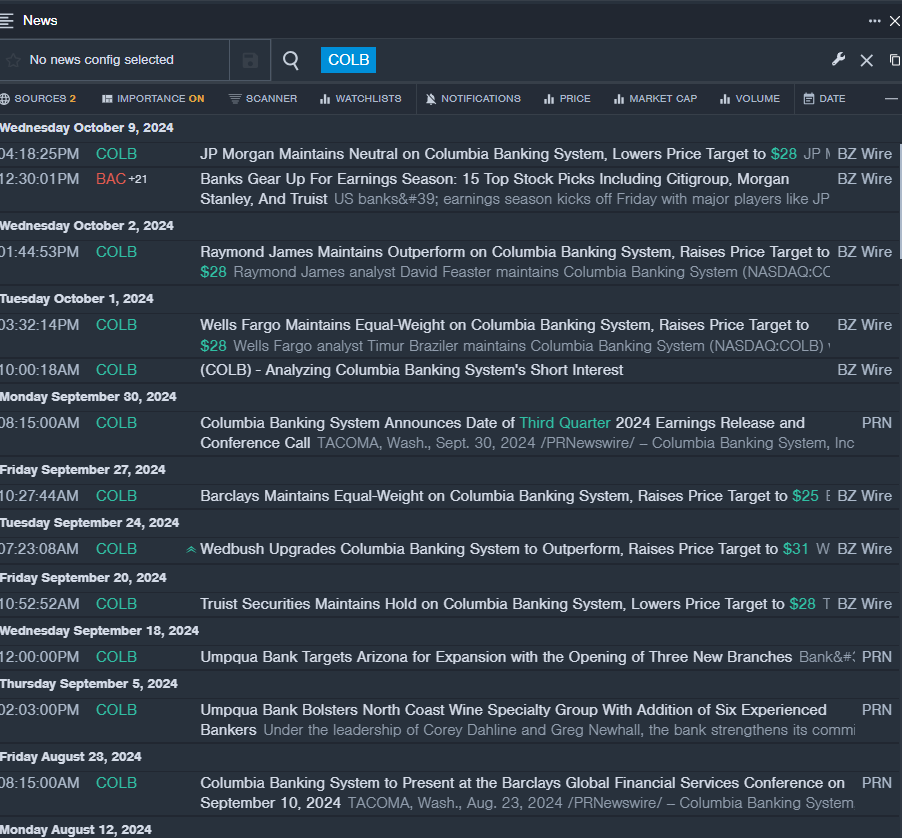

Lincoln National Corporation LNC

- Dividend Yield: 5.35%

- Wells Fargo analyst Elyse Greenspan maintained an Equal-Weight rating, raising the price target from $28 to $29 on October 10. This analyst has an accuracy rate of 68%.

- TD Cowen analyst Daniel Bergman began coverage with a Hold rating and a price target of $34 on October 9, with an accuracy rate of 66%.

- Recent News: Lincoln Financial will report its third-quarter results on October 31.

- Benzinga Pro’s newsfeed provides real-time updates on LNC.

Main Street Capital Corporation MAIN

- Dividend Yield: 7.86%

- Morgan Stanley analyst Devin McDermott upgraded the stock from Underweight to Equal-Weight, setting the price target at $24 on September 16. This analyst reports an accuracy rate of 80%.

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and raised the price target from $21 to $22 on September 13, with an accuracy rate of 78%.

- Recent News: On October 15, Main Street disclosed a preliminary estimate of third-quarter net investment income between $0.99 and $1.01 per share.

- Benzinga Pro’s charting tool assisted in identifying trends in MAIN stock.

https://www.youtube.com/watch?v=pVF0O2lsEH4[/embed>

Read More:

Market News and Data brought to you by Benzinga APIs