Alphabet Appoints New Leader for Search and Ads Amid AI Race

Google’s parent company, Alphabet (GOOGL), has made a significant change in its leadership by appointing Nick Fox as the new head of its online search and advertisement unit.

Fox, a longtime employee of Alphabet, will replace Prabhakar Raghavan, who held the position for 12 years. Raghavan will now take on the role of chief technologist at Alphabet. Since joining the company in 2003, Fox has played a vital part in developing Google’s digital assistant.

This executive shift was announced by Alphabet CEO Sundar Pichai in a blog post. Both Fox and Raghavan will continue to report directly to Pichai. These changes come at a critical time as Google strives to maintain its competitive edge in the fast-evolving field of artificial intelligence (AI) and faces numerous antitrust lawsuits concerning its leadership in online search and advertising.

The Significance of Online Search for Alphabet

Online search and advertising is crucial for Alphabet’s overall performance. Google’s search engine, celebrating its 25th anniversary in 2023, processes an astounding 5.4 billion queries each day—equating to roughly 70,000 searches every second.

As a primary revenue source for the company, Google’s search engine brought in over $200 billion in advertising revenue last year. Despite some competition from alternatives like Microsoft (MSFT) Bing, Google’s influence in the search engine market remains overwhelming, controlling approximately 90% of the global market. Such dominance has sparked multiple antitrust lawsuits against the company.

Nevertheless, Alphabet’s stock has appreciated by 17% year to date.

Should You Buy GOOGL Stock?

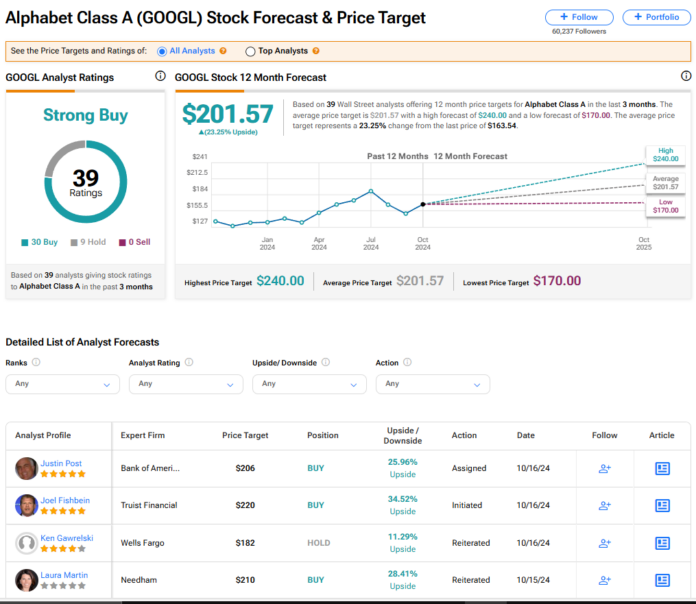

Currently, Alphabet’s stock holds a consensus Strong Buy rating from 39 Wall Street analysts, comprised of 30 Buy and nine Hold recommendations issued in the last three months. Notably, there are no Sell ratings. The average price target for GOOGL stock stands at $201.57, suggesting a potential upside of 23.25% from its current levels.

Read more analyst ratings of GOOGL stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.