Bank of America Gets a Boost with New Upgrade from Phillip Securities

On October 18, 2024, Phillip Securities raised its outlook for Bank of America (SNSE:BACCL) from Neutral to Accumulate.

Strong Fund Sentiment Surrounds Bank of America

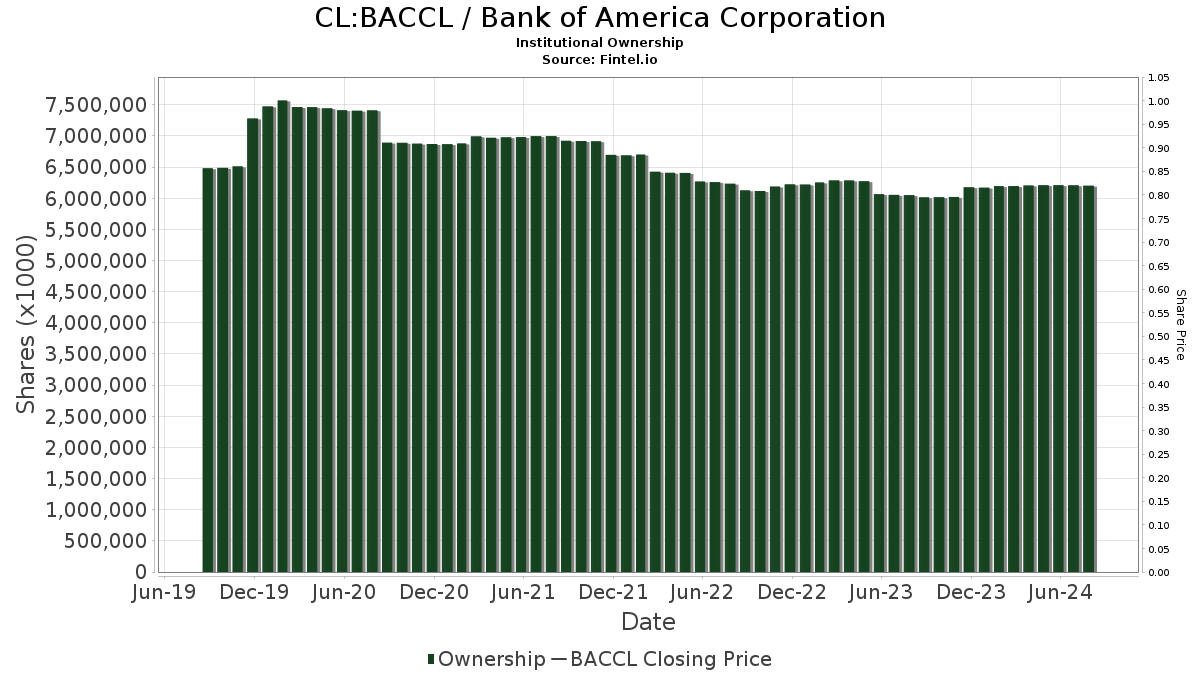

Currently, 4,235 funds or institutions have reported stakes in Bank of America. This marks an increase of 45 holders, equivalent to 1.07%, over the last quarter. The average portfolio weight allocated to BACCL among these funds is 0.67%, up by 2.51%. Over the past three months, institutional ownership of Bank of America has grown by 2.94% to a total of 6,280,126K shares.

Actions of Major Shareholders

Berkshire Hathaway remains a significant player, holding 1,032,852K shares, which accounts for 13.43% ownership with no changes in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) reports 209,897K shares, representing 2.73% of the company. This reflects a decrease of 0.17% from its previous total of 210,263K shares. Meanwhile, the fund has increased its allocation to BACCL by 1.81% over the recent quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 174,622K shares, which is 2.27% ownership. This shows a slight increase of 0.64% from 173,507K shares but a decrease in portfolio weight by 0.08% over the last quarter.

JPMorgan Chase has also grown its stake, holding 147,816K shares, or 1.92% ownership, up from 146,885K shares—a rise of 0.63%. Their portfolio allocation in BACCL increased by 2.49% recently.

Geode Capital Management rounds out the list with 138,556K shares, accounting for 1.80% ownership. This is an increase of 1.10% from its previous holding of 137,026K shares, and the firm has upped its portfolio allocation in BACCL by 0.63% this quarter.

Fintel provides extensive research tools for investors, traders, financial advisors, and small hedge funds. Our platform includes vital data such as fundamentals, analyst reports, and ownership details, among other insights.

This article was initially published by Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.