Updated Outlook: CF Industries Holdings Rated ‘Neutral’ by Redburn Atlantic

On October 18, 2024, Redburn Atlantic began coverage of CF Industries Holdings (NYSE:CF) with a Neutral recommendation.

Analyst Price Forecast Indicates Limited Upside

As of September 24, 2024, analysts set the average one-year price target for CF Industries Holdings at $86.06 per share. Predictions range from a low of $69.69 to a high of $105.00. This average suggests a modest increase of 2.47% from its most recent closing price of $83.99 per share.

For an overview of companies with the highest price target upside, check out our leaderboard.

Strong Revenue Growth Anticipated

The projected annual revenue for CF Industries Holdings stands at $7.71 billion, showing a significant increase of 30.99%. Analysts expect a non-GAAP earnings per share (EPS) of $8.65.

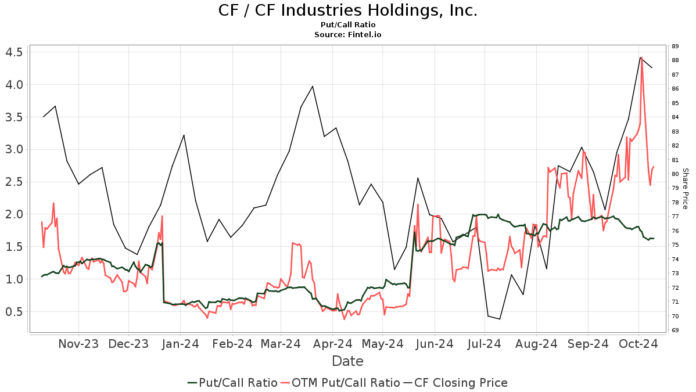

Current Fund Sentiment for CF Industries

A total of 1,529 funds or institutions have reported their positions in CF Industries Holdings, reflecting a decrease of 21 (or 1.35%) compared to the previous quarter. The average portfolio weight dedicated to CF among these funds is 0.25%, up by 9.67%. Over the last three months, total institutional shares owned dropped by 1.46% to 199.42 million shares. The put/call ratio for CF is currently at 1.59, signaling a bearish outlook.

Price T Rowe Associates holds 13.31 million shares, which accounts for 7.38% of the company. This represents a decrease from 13.49 million shares previously, marking a decline of 1.37%. The firm has also cut its portfolio allocation in CF by 14.21% over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 5.78 million shares, reflecting 3.21% ownership, down from 5.93 million shares, a decrease of 2.47%. Their portfolio allocation in CF diminished by 15.46% during the same period.

Invesco owns 5.78 million shares (3.20% ownership), also down from 6.10 million shares, a drop of 5.49%. Their allocation reduced substantially, by 92.68%, in the last quarter.

Charles Schwab Investment Management holds 5.55 million shares, or 3.07% of the company. This shows a slight increase from 5.49 million shares previously, an uptick of 0.91%, but they decreased their portfolio allocation by 38.13% recently.

The Vanguard 500 Index Fund (VFINX) possesses 4.69 million shares (2.60% ownership), down from 4.82 million shares, a decrease of 2.64%. Their portfolio allocation in CF has also fallen by 17.84% over the last quarter.

Overview of CF Industries Holdings

(Company description provided by CF Industries)

CF Industries Holdings Inc. is a major global producer of hydrogen and nitrogen products used in clean energy, emissions reduction, fertilizers, and various industrial applications. Its manufacturing facilities located in the United States, Canada, and the United Kingdom are known for being cost-effective and efficient. The company boasts an extensive storage, transportation, and distribution network in North America. With 3,000 employees, CF Industries focuses on safety, environmental sustainability, and effective management to support its goal of growing the hydrogen and nitrogen market while delivering value to shareholders.

Fintel serves as a leading investment research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

Our platform offers comprehensive data covering fundamentals, analyst reports, ownership details, and fund sentiment, among other information. We provide exclusive stock picks backed by advanced quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.