“`html

Optimism Amidst Uncertainty: Navigating the Market in 2024

Investors often see the glass as half full. Investing typically reflects a belief that stock values will rise over time. However, with the upcoming presidential election looming, maintaining that optimism can be challenging.

The Election’s Impact on Markets

The atmosphere surrounding the upcoming election appears more contentious than ever. As November 5 approaches, many yearn for resolution, but it’s important to acknowledge that counting every vote can stretch for days. The outcome may remain unclear for up to a week.

Regardless of who claims victory, the public will face persistent price hikes on essential items such as groceries, healthcare, and housing. Additional factors, including longstanding geopolitical tensions in Europe and the Middle East, further complicate the landscape. Coupled with these challenges is the rapid advancement of Artificial Intelligence (AI), reshaping industries almost overnight. Every time a new AI tool emerges, another may falter.

There’s growing concern surrounding the energy demands of AI technologies. Remarkably, while ChatGPT showcases impressive capabilities, it consumes ten times the energy of a typical Google search. This raises important questions about future energy sources as the reliance on AI expands.

Despite these overwhelming issues, there are still grounds for optimism.

Market Performance in 2024: A Silver Lining

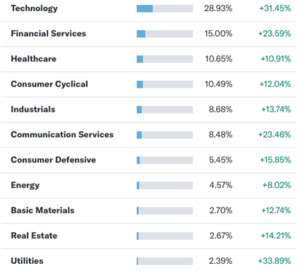

Focusing on positive trends can help shift one’s perspective. The S&P 500 has seen gains exceeding 20% in 2024, showcasing robust performance across the board. Notably, every sector within the S&P 500—aside from energy—has recorded double-digit growth this year.

As displayed in a recent chart from Yahoo Finance (as of Friday morning), this indicates a broad-based bull market despite what skeptics may claim.

Future Growth Drivers

Just as rivers converge in nature, two key market forces are coming together, setting the stage for accelerated stock growth beyond the large-cap companies that dominated the last two years.

Previous discussions highlighted the significance of the AI wave. My colleague Jeff Remsburg and I note that this trend is so substantial that it merits ongoing attention. Now, an additional tailwind is set to complement the AI megatrend. As these two forces merge, attention will shift to a new set of stocks poised for rapid growth.

We’ve mentioned Louis Navellier’s insights on AI before. Another influential figure in this space is Jason Bodner, editor of Quantum Edge Pro in partnership with TradeSmith. A veteran analyst, Bodner brings experience from leading firms, including Cantor Fitzgerald and Jefferies & Company, where he executed multi-billion-dollar stock transactions.

With both artificial intelligence and institutional investments on the rise, the market landscape may soon unveil exciting opportunities.

“`

Investors Eye Big Gains Amid Market Changes

Parsons Corp. Performance and Insights

Last April, Jason advised his Quantum Edge Pro subscribers to invest in Parsons Corp. (PSX). This company excels in technology-driven solutions across defense, intelligence, and critical infrastructure. Parsons offers a range of products and services, including software, hardware, cybersecurity, and missile defense systems.

At the time of his recommendation, the stock showed strong potential, highlighted by impressive one- and three-year earnings growth rates of 64.8% and 25.9%. Furthermore, sales increased by 29.7% last year and 12.6% over the last three years.

What stood out was the substantial institutional ownership of the stock. As Jason pointed out,

Institutions own 98.8% of shares, so you would expect Big Money to be active, and that is indeed the case. My system shows 13 Big Money buy signals already in 2024, as shares ran from $62 to nearly $85.

PSN has also appeared on my institutional research’s Top 20 list four times already this year. These are the best of the best – highly rated stocks with Big Money flowing in. Just what we look for.

Significant Market Convergence

Jason has observed a notable shift in the markets. He believes that during this period, investors might achieve substantial returns in a short timeframe. His subscribers may have the chance to reach their financial goals, reminiscent of similar opportunities that have only arisen four times in the last 35 years.

A key influence in this shift is the Federal Reserve’s decision to cut interest rates. Smaller companies, which often rely on borrowing for growth, will find it easier to secure funding in a low-interest environment. This change could significantly benefit small-cap stocks.

The combination of affordable borrowing costs and the explosive growth of the AI sector is attracting investor attention. Jason has closely monitored these developments. In his January analysis, he noted the increasing integration of AI into various businesses:

Companies of every size and stripe are falling all over themselves to highlight how they are incorporating AI into their businesses and technologies. It’s finding its way into more and more products and becoming a bigger part of our daily lives.

Amid all of this, a massive volume of money is about to pour into this sector in waves.

Wall Street is going to be first in line to the big gains, and the American people are going to be last in line.

We can be there near the front of the line. I set my computers to work every day retrieving the most important data and designing sophisticated algorithms to analyze the data – including Big Money inflows – in a way that identifies the best opportunities in the market with the highest probability of making us money.

New Investment Opportunities

Now, Jason’s data indicates that capital is moving, creating what he terms a “retirement accelerator window.” This opportunity allows individuals to fast-track their financial ambitions in a bullish market, where ten out of eleven sectors have risen by double digits this year.

The intersection of the AI megatrend and declining interest rates has opened new doors for investors. Jason recently prepared a presentation explaining this retirement accelerator window and its potential. You can access the presentation by clicking here.

Market optimists have reaped rewards in 2023, but as conditions evolve, Jason’s system can help investors stay ahead of future market movements.

Wishing you a pleasant weekend,

Luis Hernandez

Editor in Chief, InvestorPlace