Tesla’s Full Self-Driving Feature Faces Scrutiny Amid Mixed Market Signals

Despite concerns surrounding the effectiveness of Tesla’s (TSLA) Full Self-Driving feature, shares saw a slight uptick in Friday’s trading session. This comes as the National Highway Traffic Safety Administration (NHTSA) prepares to investigate recent incidents involving this controversial technology.

In a tragic event, a Tesla vehicle was involved in a fatal pedestrian collision while using the Full Self-Driving system. The conditions at the time, including fog, led the NHTSA to question the feature’s reliability in poor visibility scenarios.

Tesla has updated its marketing to label the Full Self-Driving feature as Full Self-Driving (Supervised). This change suggests that the technology’s limitations in difficult conditions were acknowledged. Although no vehicle performs optimally in low visibility, this clarification may placate some regulatory concerns, though future government responses remain uncertain.

Market Insights: Struggles and Triumphs

On a positive note, Tesla has successfully sold out its backlog of Cybertruck models, allowing new orders without reservations. This suggests that its production capabilities may be catching up to demand; however, the company has only moved around 30,000 Cybertrucks, leading to questions about the low conversion rate from the initial two million reservations.

The outlook is complicated further by the future of Tesla’s Robotaxi concept. Given the shaky performance of Full Self-Driving technology and some reluctance among investors, the company’s stock price is increasingly under scrutiny. Questions arise as to why it continues to maintain a premium valuation.

Analysts Weigh In: Buy, Hold, or Sell?

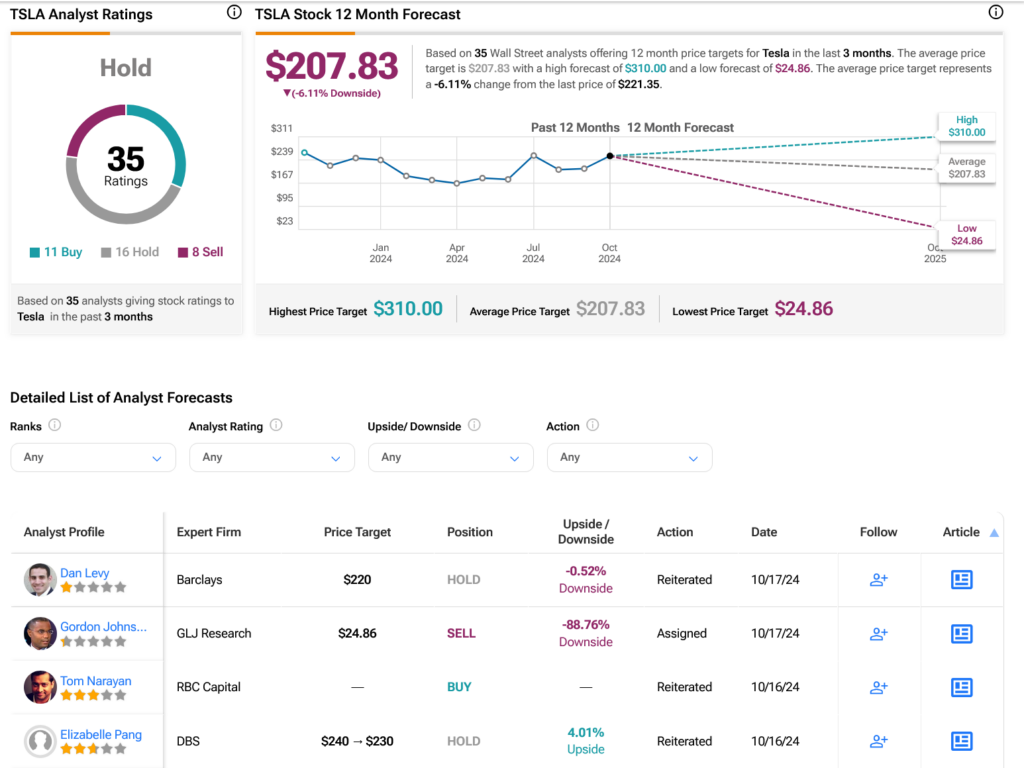

Looking at Wall Street sentiment, analysts currently give TSLA a consensus rating of Hold. This is based on 11 Buys, 16 Holds, and eight Sells in the past three months. After a modest 0.28% increase in share price over the past year, analysts have set an average price target of $207.83 per share, indicating a potential downside risk of 6.11%.

See more TSLA analyst ratings

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.