Understanding Costco’s Stock: Why It Might Still Be a Smart Investment

Costco Wholesale (NASDAQ: COST) has become a standout performer in the investment world. The company has shown impressive earnings growth, with revenue and net income rising even through tough times like the early pandemic. This success is mirrored in its stock performance, which has soared nearly 200% over the last five years and has increased by more than 30% so far in 2024.

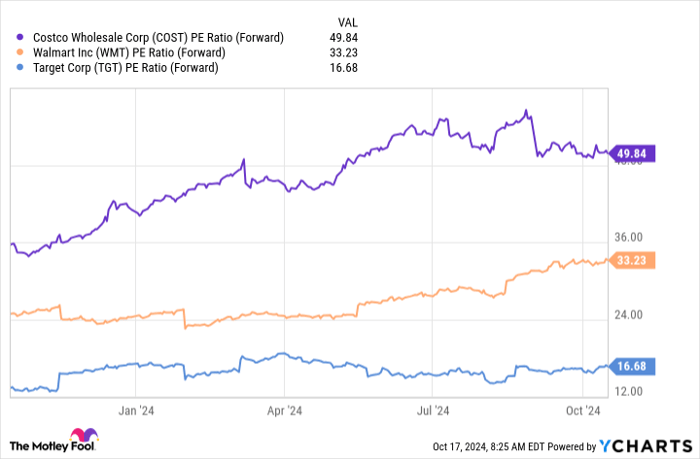

Currently, Costco’s share price exceeds $800, with a valuation of about 49 times its forward earnings estimates — a high figure for a retail stock. This may make prospective buyers hesitant. However, the company’s strong performance could still be appealing. Here are three key points to consider before investing.

Image source: Getty Images.

1. Costco’s High Valuation May Be Justified

On the surface, Costco might seem pricey. Its forward price-to-earnings (P/E) ratio is considerably higher than competitors like Walmart and Target.

COST PE Ratio (Forward) data by YCharts.

However, Costco’s warehouse model distinguishes it from competitors. The majority of Costco’s profits come from membership fees, allowing the company to secure income before any purchases are made. This, combined with bulk selling, enables Costco to offer low prices. Members are incentivized to shop frequently to make the most of their membership, and the affordability of products keeps them returning, especially during economic downturns.

Moreover, Costco maintains a remarkable membership renewal rate of over 90%, suggesting steady profitability in the future.

2. A Potential Stock Split

The high cost of Costco’s shares can be a barrier for some small investors, unless brokers offer fractional shares. This situation could lead Costco to consider a stock split, which involves issuing more shares while lowering the price of each share proportionally. Notable companies like Walmart and Chipotle Mexican Grill recently executed stock splits after significant share price increases.

While a stock split doesn’t change anyone’s fundamental stake in the company nor its market cap, it can attract more investors by making the shares more accessible and potentially boosting demand—and prices. Costco hasn’t split its stock in 24 years, but with its price rising from around $500 to over $800 in two years, a split may be timely.

3. Costco’s Attractive Dividend Payments

Although Costco’s regular dividend yield is relatively modest at about 0.5%, lower than the S&P 500 average of 1.3%, the stock remains appealing for long-term dividend investors. Current payouts stand at $4.64 per share, with a consistent history of increasing dividends.

Additionally, Costco has a track record of distributing substantial special dividends, having done so five times previously, with payouts ranging from $5 to $15 per share. The latest special dividend paid out $6.7 billion, announced in December and distributed in January. While future special dividends are uncertain, Costco has shown a willingness to provide them, adding to the optimism surrounding its dividends.

Should You Invest $1,000 in Costco Wholesale Right Now?

Before making a decision to invest in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for today’s investors, and Costco Wholesale isn’t among them. Those selected stocks could yield substantial returns in the coming years.

For example, consider when Nvidia made this list on April 15, 2005 — if you had invested $1,000 at that time, you’d now have $845,679!

Stock Advisor offers investors a clear path to success, featuring guidance on building a portfolio, analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has delivered returns that have more than quadrupled the S&P 500’s performance.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Adria Cimino has positions in Target. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Costco Wholesale, Target, and Walmart. The Motley Fool recommends the following options: short December 2024 $54 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.