Bank of America Preferred Stock Sees Positive Outlook Boost

Phillip Securities Raises Rating to Accumulate

Fintel reports that on October 18, 2024, Phillip Securities upgraded their outlook for Bank of America Corporation – Preferred Stock (NYSE:BAC.PRL) from Neutral to Accumulate.

Fund Sentiment Indicates Growing Interest

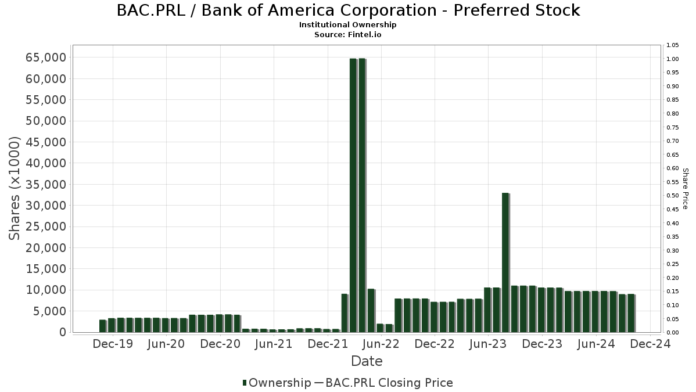

Currently, 337 funds or institutions have reported positions in Bank of America Corporation – Preferred Stock. This marks an increase of 16 investors, or 4.98%, compared to the previous quarter. The average portfolio weight of all funds in BAC.PRL is 0.57%, reflecting a rise of 0.63%. However, total shares owned by institutions fell 7.34% over the last three months, now totaling 9,037,000 shares.

Russell Investments Group holds 6,495,000 shares, up from 6,295,000 shares, indicating an increase of 3.08%. However, this firm decreased its portfolio allocation in BAC.PRL by 85.68% in the last quarter.

Loomis Sayles & Co L P now holds 608,000 shares, down considerably from 1,445,000 shares, showing a decrease of 137.56%. The firm’s allocation in BAC.PRL also dropped by 76.64% over the same period.

Advent Capital Management maintained its 182,000 shares, reflecting a minimal increase of 0.08%, although its portfolio allocation in BAC.PRL was reduced by 4.20% last quarter.

PFF – iShares Preferred and Income Securities ETF now holds 152,000 shares, down from 156,000 shares, showing a decrease of 2.35%. Interestingly, this firm increased its portfolio allocation in BAC.PRL by 2.23% over the previous quarter.

Valeo Financial Advisors retained 93,000 shares, marking a small increase of 0.39% from the last filing. This firm significantly boosted its portfolio allocation in BAC.PRL by an impressive 82.78% in the last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses a global scope, including fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, and much more. Our exclusive stock picks utilize advanced, backtested quantitative models aimed at optimizing profits.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.