UBS Upgrades Datadog to Buy, Praising Growth Potential

On October 18, 2024, UBS announced it has upgraded its rating for Datadog (NasdaqGS:DDOG) from Neutral to Buy.

Analysts Predict a 16.69% Increase

As of September 24, 2024, the average one-year price target for Datadog stands at $149.51 per share. This forecast ranges from a low of $116.15 to a high of $241.50, suggesting a potential rise of 16.69% from the latest closing price of $128.12 per share.

Explore our leaderboard featuring companies with significant price target upsides.

Revenue Projections Signify Robust Growth

According to forecasts, Datadog is expected to generate annual revenue of $3,063 million, reflecting an impressive growth rate of 27.96%. The anticipated annual non-GAAP EPS is projected to be 1.68.

Understanding Fund Sentiment

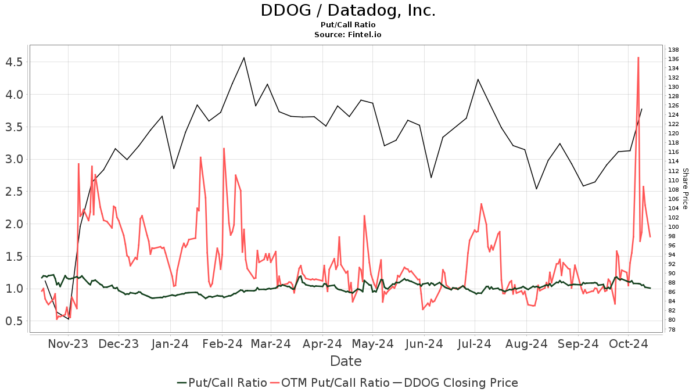

A total of 1,512 funds or institutions are currently reporting positions in Datadog, an increase of 11 owners, or 0.73%, from the previous quarter. The average portfolio weight of all funds dedicated to DDOG is now 0.45%, which is a rise of 1.56%. Over the last three months, total institutional shares owned increased by 5.47% to 280,395K shares.  Notably, the put/call ratio for DDOG is 0.99, indicating a bullish sentiment among investors.

Notably, the put/call ratio for DDOG is 0.99, indicating a bullish sentiment among investors.

Baillie Gifford holds 9,493K shares, accounting for 3.05% ownership in the company. Previously, the firm reported owning 9,624K shares, showing a decrease of 1.37%. Over the last quarter, they reduced their portfolio allocation in DDOG by 59.66%.

Meanwhile, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 8,777K shares, now representing 2.82% ownership. Their previous disclosure indicated they held 8,559K shares, marking an increase of 2.48%. They also increased their portfolio allocation in DDOG by 4.63% in the last quarter.

Jennison Associates has significantly increased its stake, holding 6,147K shares which represents 1.98% ownership—a remarkable rise from their prior holding of only 422K shares, an increase of 93.14%. Thus, their portfolio allocation in DDOG surged by 679.87% last quarter.

VIMSX – Vanguard Mid-Cap Index Fund Investor Shares holds 5,947K shares, signifying 1.91% ownership. Their earlier report showed 5,909K shares, resulting in a modest increase of 0.64% in portfolio allocation, up by 9.02% last quarter.

Invesco QQQ Trust, Series 1 reports ownership of 5,941K shares (1.91%). Their previous filing noted 5,741K shares, showcasing an increase of 3.36% but a slight decrease in portfolio allocation by 2.27% over the quarter.

About Datadog

(Information provided by the company)

Datadog serves as a comprehensive monitoring and security platform tailored for cloud applications. Its SaaS offering integrates infrastructure monitoring, application performance monitoring, and log management, enabling clients to gain complete, real-time visibility into their technology environment. Organizations of various sizes utilize Datadog to facilitate Digital Transformation, enhance collaboration across teams, expedite application release times, and track critical business metrics, among other objectives.

Fintel is a leading investing research platform available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers a global scope, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Additionally, our exclusive stock picks are driven by advanced, backtested quantitative models designed to enhance profitability.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the official stance of Nasdaq, Inc.