Nu Holdings: A Fintech Giant on the Cusp of Greater Things

If you’ve never heard of Nu Holdings (NYSE: NU), now may be an opportune moment to consider investing in this high-growth company. Although Nu faces some challenges in the next three years, it has ample potential to overcome them. For investors willing to hold their shares long-term, this could be a promising opportunity.

The Unique Blend of Technology and Finance

Nu Holdings is a prime example of a fintech company, operating in the financial sector by offering services like credit and debit cards, insurance, and even cryptocurrency trading. However, it also functions as a technology company, delivering these services directly to customers through a digital platform.

Similar to many financial firms, Nu’s potential market is vast, targeting anyone who uses money. As a tech-driven entity, Nu can expand its reach much faster than traditional financial institutions. For instance, when it launched its cryptocurrency trading platform, the company gained over 1 million new users within the first month. This rapid growth is facilitated by its existing base of more than 100 million users, for whom a new financial product can be promoted with just a smartphone notification.

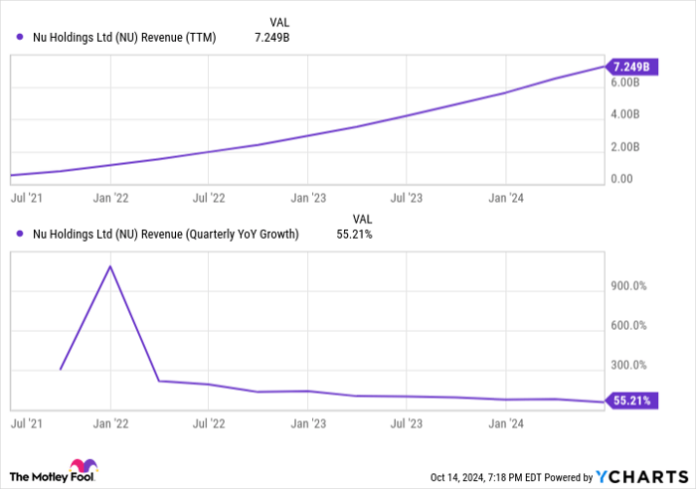

Since its market debut in 2021, Nu has experienced significant sales growth. Although the year-over-year growth rate remains above 50%, expect these numbers to moderate in the future. Operating solely in Latin America, Nu has already ventured into the three most populous and economically robust nations: Brazil, Colombia, and Mexico. In Brazil specifically, more than half of adults are now Nu customers, indicating its strong market presence.

While sales growth may not always match past performance, there’s a silver lining: Nu can still be a strong investment right now without needing to replicate its historical success.

NU Revenue (TTM) data by YCharts.

Today’s Valuation Appears Attractive

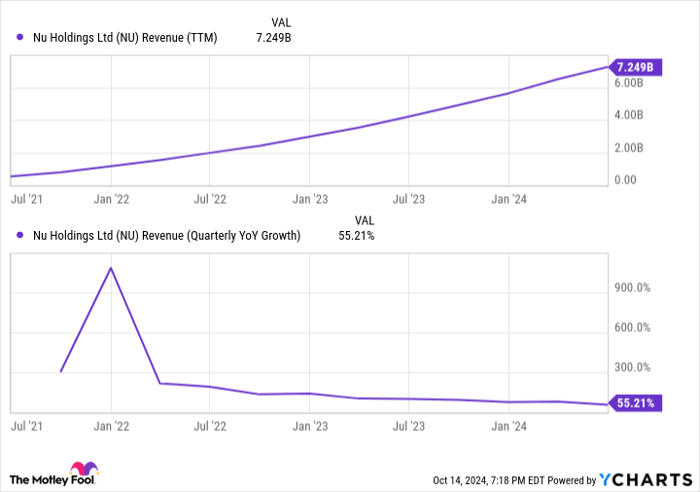

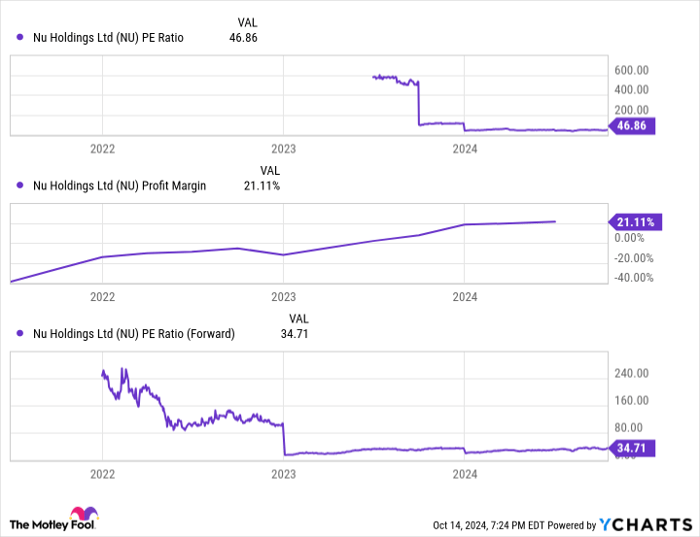

Last year marked Nu’s first profitable period, paving the way for continued profit expansion. Analysts on Wall Street expect profits to grow by more than 50% annually over the next five years. If these projections hold true, the company’s current 47 times earnings valuation could decrease significantly. For example, based on projections for next year, shares are trading at about 35 times forward earnings. In a few years, today’s valuation might seem remarkably low.

NU PE Ratio data by YCharts.

Nu has both the technology and reputation necessary for sustained growth over the next few years. Even if its sales growth falls short of past highs, earnings growth will become the key driver of the company’s trajectory. Last quarter, it recorded a return on invested capital exceeding 20%, a noteworthy achievement for a recently profitable business.

In the upcoming years, expect Nu to capture more market share in its existing countries, with the possibility of exploring new regions if management sees fit. Ultimately, the focus for Nu will be on increasing profits. By investing today, you are betting that the current 47 times earnings valuation will soon appear inexpensive—a wager that requires patience to materialize.

Is Now the Right Time to Invest $1,000 in Nu Holdings?

Before purchasing shares in Nu Holdings, take a moment to consider the following:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks for investors at this moment, and Nu Holdings was not among them. The stocks that made the list are anticipated to deliver substantial returns in the coming years.

Remember when Nvidia was recommended on April 15, 2005? A $1,000 investment would now be worth $845,679!*

Stock Advisor provides investors with a straightforward path to success, offering guidance on portfolio building, regular analyst updates, and two new stock recommendations every month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.