The announcement of a future spin-off of Honeywell’s (NASDAQ: HON) advanced materials business caused a spike in the share price and some rare excitement for a stock that hasn’t gone anywhere over the last three years.

But is it a temporary break in the slumber or the start of a significant move upward in the price? Here’s what you need to know about Honeywell’s latest news.

Honeywell’s Spin-Off Sparks Investor Excitement

Stock Performance: A Steady Course

The industrial company’s stock price has been flat over the last three years compared to a 32% increase in the S&P 500. Investors are searching for possible opportunities to boost the share price, and the idea of a breakup to release value has emerged as a leading candidate.

Historically, former industrial giants like United Technologies (now RTX), Otis, and Carrier Global; General Electric (GE Aerospace, GE Healthcare, GE Vernova); and Danaher (including Fortive, Veralto, Envista, and Vontier) have gone down similar paths.

The notion is that breaking up conglomerates allows management to concentrate on core business capabilities and better align the capital structure of the resulting companies. Consequently, Honeywell’s breakup could theoretically yield a combined value higher than its current standing.

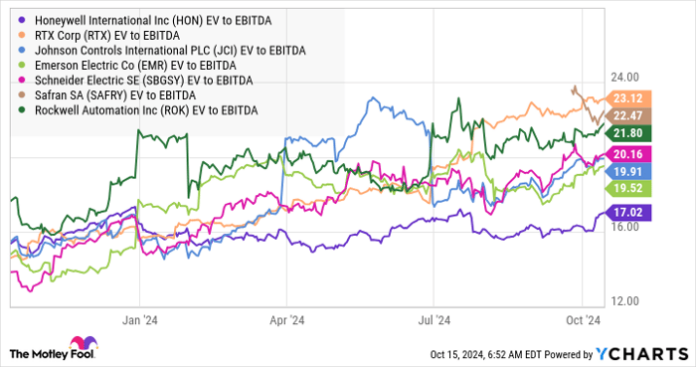

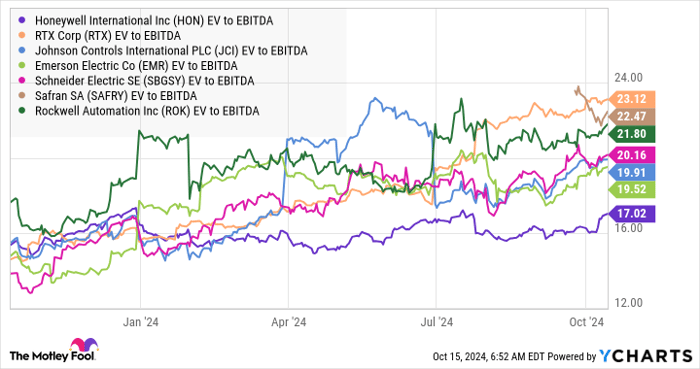

Investors seem to favor this idea. Looking at Honeywell’s enterprise value to earnings before interest, taxation, depreciation, and amortization (EV-to-EBITDA) ratio in comparison to competitors in aerospace (RTX and Safran), industrial automation (Rockwell, Emerson Electric, and Schneider), and building automation (Johnson Controls and Schneider), reveals a notable discount.

HON EV to EBITDA, data by YCharts.

This explains the market’s enthusiasm regarding Honeywell’s plan to spin off its advanced materials business by the end of 2025 or early 2026.

Restructuring Under Honeywell’s Leadership

However, it appears that this move aligns more with CEO Vimal Kapur’s broader strategy of portfolio restructuring rather than a definitive breakup. Management has indeed considered separating the company, focusing on three key megatrends: the future of aviation, automation, and energy transition. This framing positions the company for potential separation.

Moreover, Kapur’s approach has been more assertive in pursuing mergers and acquisitions compared to his predecessor, Darius Adamczyk. Since 2023, he has led over $10 billion in acquisitions across the mentioned trends.

Image source: Getty Images.

Additionally, Bloomberg reports that Honeywell is nearing a sale of its personal protective equipment (PPE) business for $1.5 billion and is considering an initial public offering for its quantum computing business, Quantinuum, valued around $10 billion.

These developments suggest an ongoing effort at portfolio restructuring focusing on megatrends rather than indications of an impending breakup.

Challenges Now, Opportunities Ahead

While Honeywell’s portfolio adjustments might pose some short-term challenges, they aim to support long-term growth. Such adjustments might make immediate separation less appealing as the market often considers current earnings in its pricing models.

For instance, during the second-quarter earnings call in July, CFO Greg Lewis informed investors that the profit margin for the aerospace technologies sector would “decline modestly” in 2024 due to the integration of defense-focused CAES Systems. Similarly, margins for industrial automation are expected to drop in the upcoming third quarter.

It’s noteworthy that by spinning off its advanced materials business, Honeywell is separating one of its strongest non-aerospace segments. Lewis indicated that “energy and sustainability solutions and building automation will lead the group in margin expansion.” In fact, this advanced materials business operates within the energy and sustainability solutions (ESS) segment, which is set to have robust growth this year, aside from aerospace and building solutions.

Implications for Investors

Honeywell’s stakeholders should not anticipate a breakup in the immediate future, nor should they expect the restructuring efforts to significantly enhance earnings anytime soon. However, this restructuring aligns with what many investors have been advocating for.

Realizing the full benefits of these changes may take time, but once they materialize, management may contemplate a more substantial separation.

Overall, Honeywell remains a quality company that will appeal to patient investors ready to hold their positions long-term and observe how management unlocks value within its portfolio, rather than those in search of an instant dramatic breakup.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.