ASML Faces Challenges Amid AI Chip Demand

Companies worldwide are investing heavily to meet the growing demand for semiconductors, particularly in the artificial intelligence (AI) sector. As a result, ASML (NASDAQ: ASML) experienced a remarkable 40% increase earlier this year. However, recent developments have reversed these gains, raising questions about the company’s future.

Mixed Signals from ASML’s Orders

ASML is a key provider of advanced lithography machines essential for semiconductor manufacturers. Its unique extreme ultraviolet lithography (EUV) technology is critical for producing high-performance AI chips, such as those made by Nvidia. Initially, investors anticipated a surge in orders due to AI investments; however, ASML reported a decline in orders in the third quarter.

In Q3, ASML received only 2.6 billion euros ($2.8 billion) worth of orders, a significant decrease from over 5 billion euros ($5.4 billion) a year earlier. Revenue did increase to around $8.1 billion during the same period, but a backlog of orders persists, meaning new orders won’t convert to revenue until well into the future. Notably, ASML forecasts $38.4 billion in revenue for 2024, down from previous estimates between $32.5 billion and $38 billion for 2025.

Long-Term Projections Remain Positive

The semiconductor equipment sector experiences cycles, and ASML is currently in a downturn outside of its AI segment. This dip is influencing order volumes and revenue projections. Despite this short-term challenge, the company remains confident about future growth, expecting an average annual sales increase of 9% until 2030. If this occurs, ASML could generate approximately $54.2 billion in sales by the end of the decade.

Maintaining a 30% operating margin would likely yield around $16.3 billion in operating earnings, presenting a favorable price-to-earnings ratio if these targets are met.

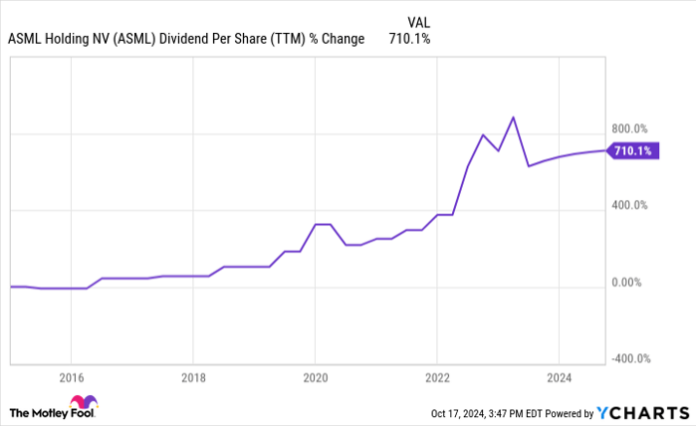

Exploring Dividend Growth Potential

ASML not only offers growth but also the potential for dividends, setting it apart from many other tech firms. Over the past decade, its dividend has skyrocketed by 710%, although the current yield is under 1%. ASML’s management aims to continue growing dividends while buying back shares, which may increase payouts. Their stock count has decreased approximately 10% in the last ten years.

The combination of dividend income and growth potential positions ASML as an attractive buy at current valuations. As the stock nears the $1,000 mark, a stock split may be on the horizon in the coming years.

Is ASML Worth Your Investment Now?

Before deciding to invest in ASML, it’s important to note that the Motley Fool Stock Advisor team recently identified their top 10 stock picks, and ASML is not among them. These selections are projected to offer significant returns in the near future.

Historically, such selections have proven rewarding. For example, if you invested $1,000 in Nvidia when it was recommended on April 15, 2005, you’d be looking at an impressive $845,679 today.*

The Stock Advisor service provides straightforward guidance for building a successful investment portfolio, including two new stock recommendations monthly, significantly outpacing the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.