TSMC Joins the $1 Trillion Club Amid AI Boom

Nvidia (NASDAQ: NVDA) reached the $1 trillion market capitalization in May 2023, fueled by its involvement in the burgeoning artificial intelligence sector. Since that milestone, Nvidia’s value has surged more than three-fold, making it the second most valuable company globally, trailing only Apple.

This elite group of companies includes many of Nvidia’s largest clients—hyperscalers investing heavily in expansive data centers for generative AI. However, the latest addition to this prestigious club also plays a critical role in Nvidia’s supply chain. Notably, this semiconductor giant collaborates with many tech firms in the $1 trillion club and has now joined their ranks.

Meet TSMC: The Newest Star in the $1 Trillion Club

The Taiwan Semiconductor Manufacturing Company, or TSMC (NYSE: TSM), is now an esteemed member of this elite group. With its position firmly established, TSMC is poised for further growth in the stock market.

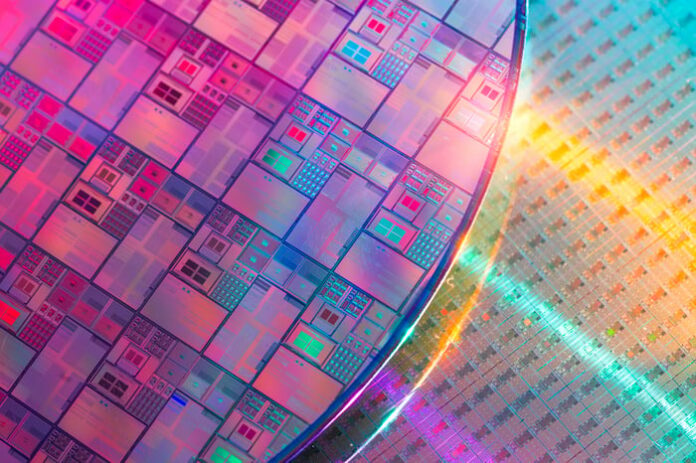

![]()

Image source: Getty Images.

Leading the Pack in Chip Manufacturing

TSMC is a leading chip foundry, capturing over 60% of the industry’s spending. This significant market share is a testament to TSMC’s advanced technology, which stands leaps and bounds ahead of most competitors.

During a recent investor conference, Nvidia CEO Jensen Huang emphasized TSMC’s industry dominance: “We’re fabbing out of TSMC because it’s the world’s best. And it’s the world’s best not by a small margin, it’s the world’s best by an incredible margin.”

Recent financial results underline this claim. TSMC reported a remarkable 39% increase in year-over-year revenue for the third quarter. Its gross margin rose to 57.8% from 54.3% last year, with a net income boost of 54.2%. TSMC’s technological edge has solidified its position as a key partner for firms looking to produce advanced chips for AI applications, like Nvidia’s GPUs, and for smartphones, including Apple’s iPhone.

A Growing Demand for AI Technologies

Management anticipates that revenue from AI-related chips could more than triple in 2024, although it would only represent a mid-teen percentage of TSMC’s overall revenue. This signals a considerable growth opportunity for TSMC in the AI sector, as the company invests to capitalize on these developments.

While Nvidia utilizes TSMC for its chip production, other major players, including Microsoft, Alphabet, Meta, Broadcom, and Advanced Micro Devices, also engage TSMC for their AI accelerator chips. Apple has relied on TSMC for developing its iPhone, iPad, and Mac chips for several years.

This means that regardless of how AI technology evolves in data centers or in training large language models, TSMC is positioned to benefit significantly.

Future Investments Signal Ongoing Growth

TSMC has raised its capital expenditure forecast for 2024 to more than $30 billion and expects to continue this trend into 2025. They also increased research and development spending by 11.4% year-over-year last quarter.

This spending is crucial as TSMC maintains its status as the world’s largest foundry. It can outpace competitors in machinery investments and technological advancements, ensuring it remains the industry leader and a preferred partner for top-tier clients. This positive cycle creates a robust competitive advantage for TSMC.

Room for Growth Beyond $1 Trillion

TSMC’s shares have more than doubled this year, yet there’s potential for further appreciation. The stock currently trades at a little over 25 times analysts’ earnings estimates for 2025, prior to any adjustments following the latest results and guidance.

With projections for TSMC’s earnings to grow around 20% annually over the next five years, and ongoing strong demand for AI investments, the company maintains its high gross margins even as it introduces next-generation technologies. This growth rate justifies the current earnings multiple.

One of TSMC’s most appealing attributes is its resilience to changes in the tech landscape. Regardless of which companies design chips for data centers or smartphones, TSMC is likely to secure the majority of that business due to its established advantages. Given TSMC’s successful management approach during the AI boom, its future appears bright as the latest $1 trillion club member.

A Unique Investment Opportunity

Have you ever felt like you missed out on investing in top-performing stocks? You might want to pay attention now.

Occasionally, our team of analysts flags a “Double Down” stock—a recommendation for companies they believe are on the brink of substantial growth. If you think you’ve missed your chance, now might be the perfect time to invest:

- Amazon: Investing $1,000 when we recommended it in 2010 would have grown to about $21,285!*

- Apple: A $1,000 investment from 2008 is now worth $44,456!*

- Netflix: A $1,000 investment in 2004 would have soared to $411,959!*

Currently, we’re sharing “Double Down” alerts for three exceptional companies, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also a member of The Motley Fool’s board of directors. Adam Levy has positions in Alphabet, Apple, Meta Platforms, Microsoft, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Advanced Micro Devices, Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom and discloses positions in long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool operates under a disclosure policy.

The views and opinions expressed herein are those of the author and do not reflect the opinions of Nasdaq, Inc.