Moderna Prepares for Key Q3 Earnings Report Amid Stock Struggles

Cambridge, Massachusetts-based Moderna, Inc. (MRNA) stands out in the biotechnology sector for its development of messenger RNA (mRNA) therapeutics and vaccines. Notably, its mRNA technology played a crucial role in the fast-tracked creation and distribution of its COVID-19 vaccine. With a current market cap of $20.7 billion, the company has gained recognition for its research initiatives aimed at tackling global health issues and expanding its portfolio of mRNA-based therapies. Moderna is set to disclose its fiscal Q3 earnings results before the market opens on Thursday, Nov. 7.

Analysts Predict Larger Losses This Quarter

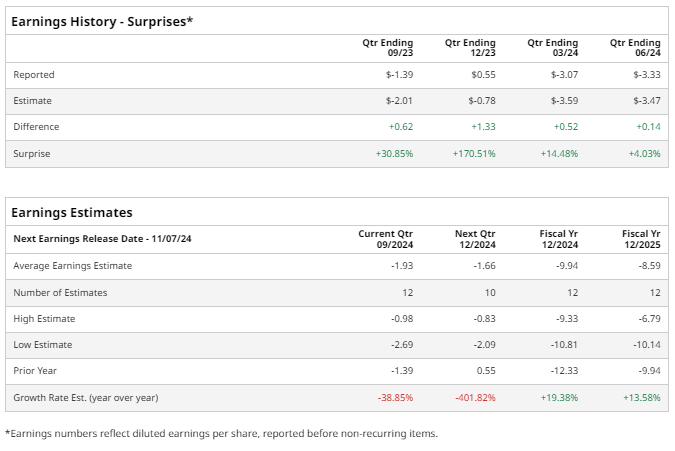

Ahead of the earnings announcement, experts predict that MRNA will report a loss of $1.93 per share, an increase of 38.9% from the loss of $1.39 per share recorded in the same quarter last year. However, Moderna has a track record of surpassing Wall Street’s earnings per share (EPS) estimates in its last four quarterly reports.

Looking Ahead: Fiscal 2024 Expectations

For fiscal 2024, analysts anticipate a loss of $9.94 per share for MRNA, a decrease of 19.4% compared to the loss of $12.33 per share seen in fiscal 2023.

Stock Performance Compared to Indices

MRNA stock has declined by 45.9% year-to-date, lagging behind the broader S&P 500 Index, which has seen gains of 22.7%, and the Healthcare Select Sector SPDR Fund, which is up by 11% over the same period.

Challenges Following Vaccine Demand Declines

Despite being a trailblazer in the COVID-19 vaccine space, Moderna has faced significant stock declines over the past two years due to decreasing demand for its vaccine. Recently, MRNA shares fell by over 20% in the last month after management provided an updated business outlook for the next four years. In addition, shares tumbled by 13% on Sept. 12 when the company announced potential cuts to its research and development (R&D) budget.

Analyst Recommendations and Price Targets

Currently, the consensus opinion on MRNA stock is neutral, with an overall “Hold” rating. Among 23 analysts monitoring the stock, six recommend a “Strong Buy,” 15 advise a “Hold,” and two suggest a “Strong Sell.”

The average analyst price target for Moderna stands at $100.85, indicating a notable potential upside of 87.5% from current price levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.