KeyBanc Begins Coverage of Zeta Global Holdings with Positive Outlook

Analyst Projects Significant Price Increase Ahead

On October 22, 2024, KeyBanc initiated coverage of Zeta Global Holdings (NYSE:ZETA), recommending an Overweight rating. The firm projects a promising price target for Zeta, forecasting an average one-year price of $31.62 per share. This estimate suggests a potential increase of 19.77% from Zeta’s recent closing price of $26.40 per share, with low and high projections at $28.28 and $36.75, respectively.

The anticipated annual revenue for Zeta Global Holdings stands at $828 million, reflecting a modest rise of 0.67%. Additionally, the expected non-GAAP earnings per share (EPS) is 0.50.

Investor Insights Reflect Growing Interest

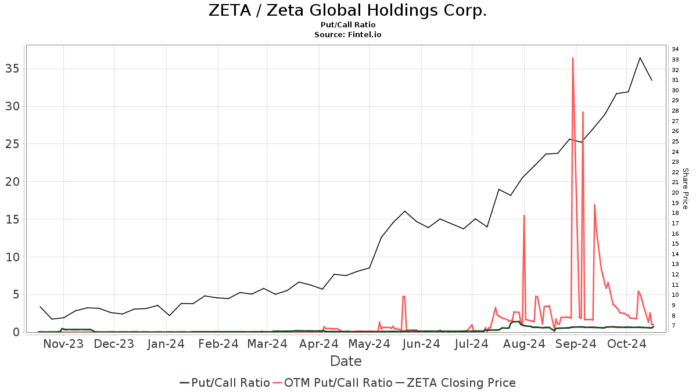

A total of 466 funds or institutions currently report holdings in Zeta Global Holdings, a notable increase of 93 owners, or 24.93%, in just the last quarter. On average, these funds dedicate 0.45% of their portfolios to ZETA, marking a 21.49% increase. Institutional ownership has risen by 16.19% over the past three months, reaching a total of 162,839K shares. The put/call ratio for ZETA is 0.99, indicating a bullish sentiment among investors.

Changes in Shareholder Positions

Gpi Capital holds 10,237K shares, which accounts for 4.90% of Zeta’s total ownership. This represents a substantial decrease from their previous holding of 16,237K shares, showing a drop of 58.61%. However, Gpi increased its portfolio allocation by 19.97% last quarter.

Granahan Investment Management, with 5,702K shares under its control (2.73% ownership), also reported a decrease from 8,228K shares, a decline of 44.31%. Yet, the firm’s portfolio allocation in ZETA grew by 27.50% since the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares now owns 5,116K shares, equating to 2.45% of the company. In its last filing, this fund reported an increase from 4,285K shares, a rise of 16.24%, with an impressive allocation boost of 87.47% last quarter.

Vanguard Small-Cap Index Fund Investor Shares own 4,056K shares, giving it 1.94% ownership. This is an increase from 3,533K shares previously, illustrating a gain of 12.88% and an allocation rise of 94.44% over the last quarter.

Geode Capital Management holds 3,592K shares for a 1.72% stake, up from 3,173K shares, a gain of 11.68%. Nevertheless, this firm decreased its portfolio allocation in ZETA by 9.40% recently.

Overview of Zeta Global Holdings

(This description is provided by the company.)

Zeta Global Holdings Corp. is a trailblazer in data-driven, cloud-based marketing technology, aimed at helping businesses acquire, grow, and retain their customers. The company’s flagship Zeta Marketing Platform (ZMP) is the largest omnichannel marketing platform, utilizing identity data to anticipate consumer behavior. By harnessing advanced artificial intelligence, the ZMP processes billions of data points to tailor experiences on a large scale. Founded in 2007 by David A. Steinberg and John Sculley, Zeta Global is based in New York City.

Fintel serves as a comprehensive research platform for individual investors, traders, financial advisors, and smaller hedge funds.

Their extensive data covers a wide range of topics, including fundamentals, analyst reports, ownership data, fund sentiment, and insider trading, among others, all supported by advanced quantitative models for better investment strategies.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.