Netflix Directors Plan Significant Stock Sales as Shares Soar

Two long-time board members of Netflix (NFLX) are poised to sell approximately $9 million each in company stock, capitalizing on a recent surge in share prices following strong financial performance in the third quarter.

Price Surge Follows Strong Quarterly Results

On October 21, NFLX shares were hovering around $770, close to an all-time intraday high of $773. The increase in stock value comes after Netflix reported robust quarterly results that exceeded many analysts’ expectations, driving investor confidence.

Richard Barton and Timothy Haley, both board members, are in the process of selling their combined $18 million worth of stock. These transactions are conducted under Rule 10b5-1 plans filed with the U.S. Securities and Exchange Commission (SEC), which enables them to sell shares without the appearance of impropriety.

Understanding Rule 10b5-1 Plans

These pre-arranged trading plans activate automatically when specific conditions are met, such as reaching a certain stock price or trading volume. This system helps to minimize conflicts of interest and prevents insiders from trading based on non-public information.

Barton has been on Netflix’s board since 2002, the year the company went public, and is also a co-founder of Zillow Group (Z). Haley has been a member of the Netflix board since 1998 and currently serves as a managing director at Redpoint Ventures and Institutional Venture Partners, both of which are private venture-capital firms.

Analysts Weigh in on NFLX Stock

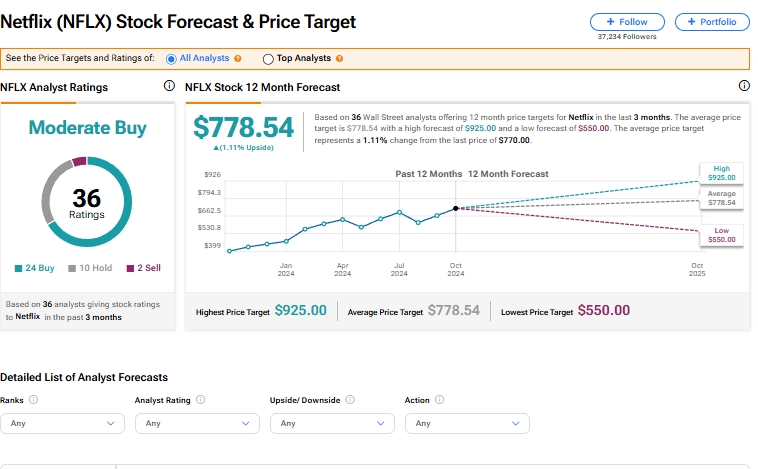

As for investment recommendations, Netflix stock carries a consensus rating of Moderate Buy among 36 Wall Street analysts. This rating reflects 24 Buy, 10 Hold, and two Sell opinions issued in the past three months. The average price target for NFLX is $778.54, suggesting a potential upside of 1.16% from current prices.

Explore more analyst ratings for NFLX stock

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.