MGM Resorts Set to Report Q2 Earnings Amid Mixed Stock Performance

Market Expectations for Fiscal Q2 2024 Earnings from MGM Resorts

MGM Resorts International (MGM), based in Las Vegas, Nevada, operates a range of casino, hotel, and entertainment venues. With a market cap of $12.7 billion, the company provides services including accommodation, dining, and hospitality management for both casino and non-casino properties. MGM is anticipated to release its fiscal second-quarter earnings for 2024 after the market closes on Wednesday, Oct. 30.

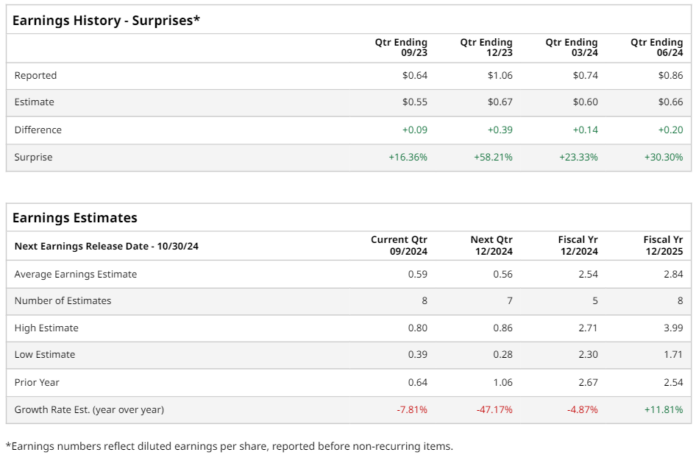

Before the earnings announcement, analysts predict MGM will report a profit of $0.59 per share on a diluted basis, which reflects a decrease of 7.8% from $0.64 per share reported in the same quarter last year. Historically, MGM has exceeded Wall Street’s EPS estimates in its last four quarterly reports.

Annual Projections Show Slight Decrease in EPS for MGM

For the upcoming fiscal year, projections indicate MGM will report an EPS of $2.54, a reduction of 4.9% compared to $2.67 in fiscal 2023. Looking ahead to fiscal 2025, an increase of 11.8% in EPS to $2.84 is expected.

Stock Performance Compared to Broader Markets

MGM stock has lagged behind the S&P 500’s ($SPX) 38.5% growth over the past 52 weeks, with its shares increasing by just 15%. It also trailed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 30% gains during the same period.

Recent Performance Highlights and Analyst Sentiment

On Jul. 31, MGM shares saw a slight uptick after the company reported its Q2 results. The adjusted EPS was $0.86, surpassing Wall Street’s expectations which were set at $0.66. MGM’s revenue reached $4.3 billion, also exceeding analysts’ forecasts of $4.2 billion.

Positive Analyst Ratings for MGM Stock

Overall, analysts maintain a positive outlook on MGM stock, granting it a “Strong Buy” rating. Out of 18 analysts covering the stock, 15 have assigned a “Strong Buy” rating while three recommend a “Hold.” The average price target among analysts is $52.74, pointing to a potential upside of 30.2% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.