BXP, Inc. Prepares for Q3 2024 Earnings Release

BXP is set to announce its third-quarter 2024 results on October 29, after the market closes. Investors anticipate a year-over-year decline in revenues and funds from operations (FFO) per share.

Stay informed on all quarterly releases with Zacks Earnings Calendar.

Last Quarter Performance

In the previous quarter, this office real estate investment trust (REIT) surpassed the Zacks Consensus Estimate for FFO per share, which stood at $1.77. Strong leasing activity helped drive revenues higher, although increased interest expenses tempered the overall results.

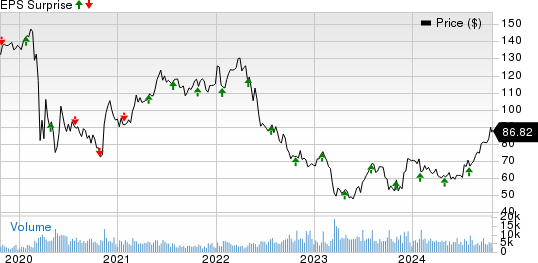

For the past four quarters, BXP’s FFO per share exceeded the Zacks Consensus Estimate three times, with one quarter meeting expectations. On average, it has beaten estimates by 1.00%, as shown in the graph below:

BXP, Inc. Price and EPS Surprise | BXP, Inc. Quote

Current Trends in the U.S. Office Market

A recent Cushman & Wakefield CWK report shows that overall net absorption in the U.S. office market was negative in the third quarter. The office vacancy rate rose for the 10th consecutive quarter, indicating a sustained trend.

Overall net absorption dropped to negative 18.5 million square feet (msf) in the third quarter, a decrease from the negative 13.9 msf in the second quarter. Since the pandemic began, total net absorption has reached negative 293.7 msf.

Despite national trends, some markets showed improved demand for office spaces. Over half of U.S. office markets reported better absorption figures year-over-year, and many saw quarter-over-quarter growth. In total, 27 markets experienced positive absorption in the third quarter of 2024.

Occupiers increasingly prefer high-quality office buildings, which has led to positive net absorption rates in promising areas. In six key markets, occupancy was about 800 basis points (bps) higher than the overall office average.

However, the national vacancy rate hit a record high of 20.9%, rising 55 bps since last quarter and 190 bps year over year. Meanwhile, the national asking rent climbed to $38.15, up from $37.68 in the previous quarter.

BXP’s Outlook

BXP’s portfolio consists of class-A office buildings in high-demand locations such as Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC. Given the increased demand for premium assets, BXP likely enjoyed strong leasing activity last quarter.

We expect the occupancy rate for BXP’s in-service properties to rise by 20 bps sequentially to 87.3% in the upcoming earnings report.

Demand for life-science assets has remained robust, suggesting that BXP’s life-science properties performed well in the latest quarter. Additionally, a stable balance sheet likely supported its development projects.

However, an overabundance of office spaces in some of its markets could diminish performance. This excess may hinder BXP’s ability to retain tenants at higher rent levels or fill vacancies.

The Zacks Consensus Estimate anticipates third-quarter revenues at $803.8 million, reflecting a 2.5% decrease from the previous year.

High interest expenses are also expected to negatively impact BXP’s performance for the quarter.

Analyst Insights

Analysts remain cautious about BXP’s performance this quarter. The Zacks Consensus Estimate for FFO per share has not changed, remaining steady at $1.81, which represents a decrease of 2.7% compared to last year.

Stock Predictions

According to our model, predicting a surprise for BXP’s FFO per share proves inconclusive this quarter. A positive Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) can increase the likelihood of a surprise, but BXP does not currently meet those criteria.

BXP’s Earnings ESP stands at 0.00%, and it holds a Zacks Rank of 3. To find top stocks to buy or sell before earnings reports, utilize our Earnings ESP Filter.

Other Stocks of Interest

Consider two stocks from the REIT sector — Cousins Properties CUZ and Digital Realty Trust DLR — which our model indicates could exceed expectations this quarter.

Cousins Properties, expected to release quarterly figures on October 24, has an Earnings ESP of +0.75% and carries a Zacks Rank of 3. Explore today’s top Zacks #1 Rank stocks here.

Digital Realty Trust is also set to report on October 24, showcasing an Earnings ESP of +1.36% with a Zacks Rank of 3.

Note: All earnings related to this report refer to funds from operations (FFO), a key metric for assessing REIT performance.

Insights from Zacks’ Research Chief

Our experts have identified five stocks with the highest potential for over 100% gains in the coming months. Among them, Director of Research Sheraz Mian emphasizes a standout stock expected to show remarkable growth.

This top stock belongs to an innovative financial firm with a rapidly expanding customer base of over 50 million, boasting a diverse array of advanced solutions. While not all recommendations prove successful, this one has the potential to exceed previous standout stocks like Nano-X Imaging, which rose by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up

BXP, Inc. (BXP) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Cushman & Wakefield PLC (CWK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.