Sunrun Receives Upgraded Rating from GLJ Research, Signaling Potential Growth

Fintel reports that on October 28, 2024, GLJ Research upgraded their outlook for Sunrun (LSE:0A4S) from Sell to Hold.

Analyst Price Target Indicates Significant Upside Potential

As of October 22, 2024, analysts have set an average one-year price target for Sunrun at 22.90 GBX/share. Targets vary from a low of 7.84 GBX to a high of 39.79 GBX. This average reflects a possible increase of 57.92% from its most recent closing price of 14.50 GBX/share.

Projected Revenue Grows Amidst Market Reactions

For the coming year, Sunrun’s projected annual revenue stands at 2,691 MM, indicating a robust increase of 30.52%. Nevertheless, the projections suggest a non-GAAP EPS of -0.00.

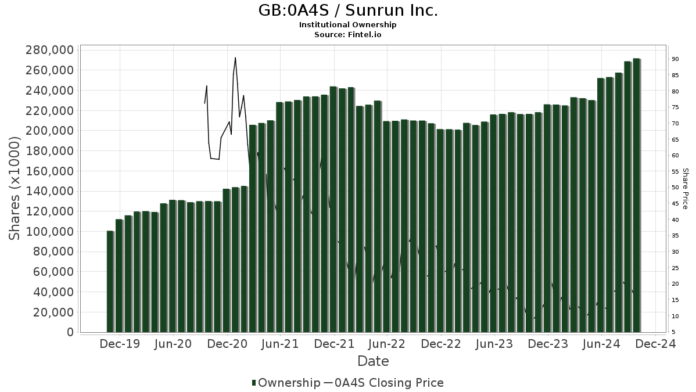

Fund Sentiment Reflects Growing Interest

Currently, 766 funds and institutions hold positions in Sunrun, marking an increase of 17 owners—or 2.27%—in the last quarter. The average portfolio weight dedicated to 0A4S has grown to 0.21%, a rise of 10.31%. Institutional ownership increased by 8.97% over the past three months, totaling 269,863K shares.

Grantham, Mayo, Van Otterloo & Co. commands 16,311K shares, reflecting 7.30% ownership of the company, which is an increase from 14,626K shares previously—an uptick of 10.33%. However, the firm reduced its portfolio allocation in 0A4S by 6.74% over the last quarter.

IJR – iShares Core S&P Small-Cap ETF now owns 14,335K shares, representing 6.41% ownership, an impressive increase from owning 0K shares before—indicating a 100.00% change.

Orbis Allan Gray holds 13,896K shares, showcasing 6.22% ownership; however, this is a slight decrease from the earlier reported 14,231K shares, reflecting a 2.42% drop in ownership. The firm also reduced its portfolio allocation in 0A4S by 32.49% over the last quarter.

Greenvale Capital LLP has increased its holdings to 11,750K shares, representing 5.26% ownership—up from 9,750K shares, or a 17.02% rise, though with a decreased portfolio allocation of 11.21%.

Alyeska Investment Group stands out with 7,614K shares, reflecting 3.41% ownership, up significantly from 1,400K shares, marking an increase of 81.62%. This equates to a whopping 354.71% rise in their portfolio allocation in 0A4S over the last quarter.

Fintel is recognized as one of the most thorough investing research platforms available to individual investors, traders, financial advisors, and small hedge funds. Our extensive data encompasses worldwide statistics, including fundamentals, analyst reports, ownership insights, fund sentiment, options sentiment, insider trading, unusual options trades, and much more. Our exclusive stock picks are driven by advanced, backtested quantitative models aimed at improving profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.