Jefferies Boosts NiSource with a Buy Rating: Key Insights on Market Sentiment

Fintel reports that on October 28, 2024, Jefferies initiated coverage of NiSource (LSE:0K87) with a Buy recommendation.

Analyst Forecast Indicates Modest Growth Opportunity

As of October 22, 2024, analysts set an average one-year price target for NiSource at 36.30 GBX/share. The targets vary, ranging from a low of 30.24 GBX to a high of 40.87 GBX. This average suggests a potential rise of 3.84% from its latest closing price of 34.96 GBX/share.

Check out our leaderboard of companies with the largest price target upsides.

Revenue Projections Show Promising Increase

NiSource’s projected annual revenue stands at 5,914MM, reflecting a notable increase of 12.85%. Additionally, the projected annual non-GAAP EPS is 1.74.

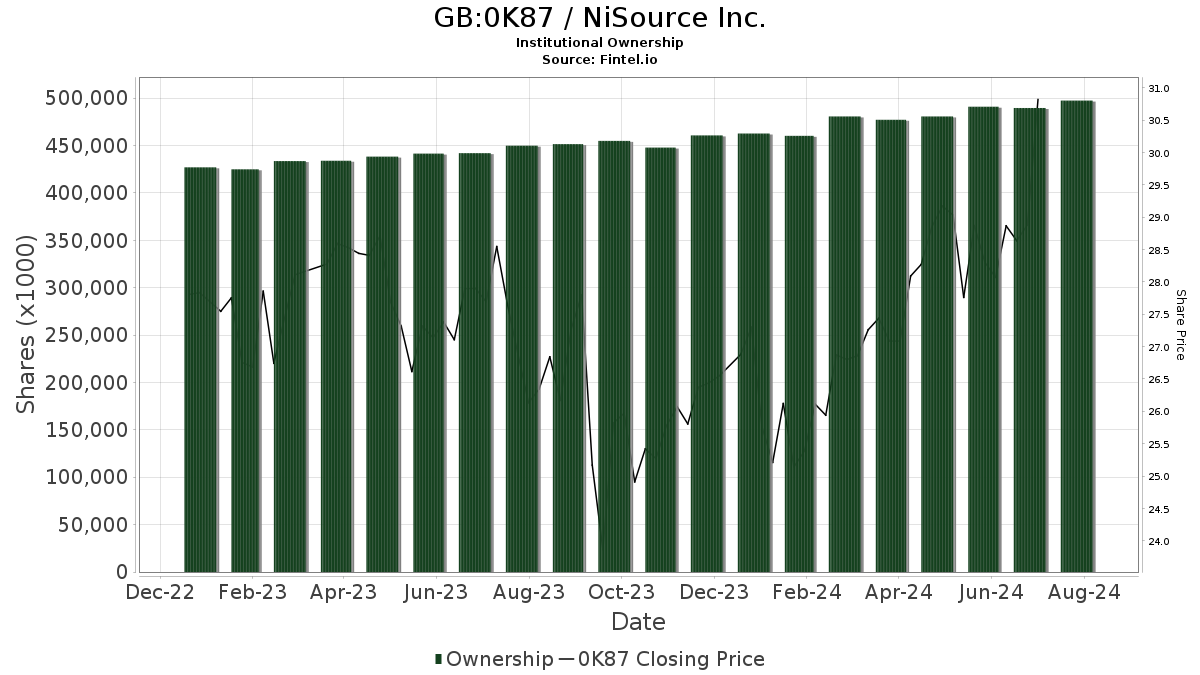

Institutional Investment Trends Highlight Growing Confidence

Currently, 1,353 funds or institutions have reported their positions in NiSource, marking an increase of 23 owners or 1.73% from the previous quarter. The average portfolio weight for all funds dedicated to 0K87 is 0.30%, up by 4.72%. Institutional ownership has also seen an increase of 6.87% over the last three months, totaling 519,262K shares.

Institutional Holdings Show Mixed Activity

Deutsche Bank AG holds 17,953K shares, accounting for 4.00% ownership of the company. However, in its previous filing, it reported owning 18,892K shares, indicating a decrease of 5.23% in its holdings. The firm has cut its portfolio allocation in 0K87 by 80.03% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 14,186K shares, representing 3.16% ownership. This reflects a slight increase of 0.43% from its prior filing, with a portfolio allocation increase of 1.72% over the last quarter.

T. Rowe Price Investment Management holds 13,751K shares, translating to 3.07% ownership. This is an increase of 15.03% from 11,685K shares reported earlier, with a portfolio allocation increase of 26.45% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 11,506K shares, or 2.57% ownership, up 9.50% from its earlier position of 10,413K shares, reflecting an 8.95% increase in portfolio allocation over the last quarter.

Geode Capital Management possesses 10,569K shares, representing 2.36% ownership. Previously, it reported 9,639K shares, showing an increase of 8.80%, but it decreased its portfolio allocation by 43.41% over the last quarter.

Fintel is recognized as a valuable investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Moreover, our exclusive stock picks are driven by advanced, backtested quantitative models designed to optimize profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.