When nearing retirement, a crucial choice is when to start claiming Social Security benefits. This decision can have a lasting impact on your monthly income, especially for those relying significantly on Social Security during retirement.

Initially, I thought waiting until age 70 was the best option due to higher monthly payments. However, I’ve reconsidered and now believe that claiming as early as 62 can be beneficial for many. Let’s explore the reasoning behind this perspective.

Image source: Getty Images.

Understanding Your Social Security Benefits

There are three key ages to consider when claiming Social Security: your full retirement age, age 62, and age 70.

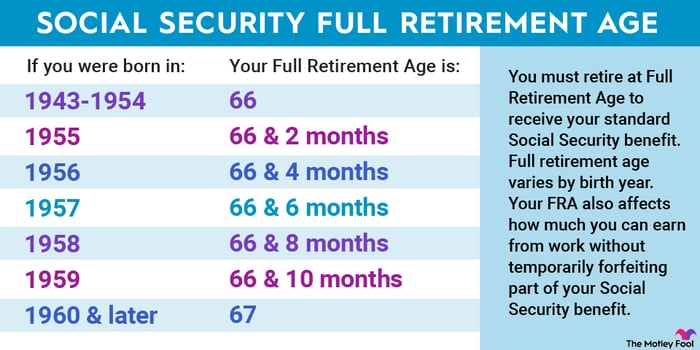

Your full retirement age (FRA) is when you can receive your Primary Insurance Amount (PIA), which is your baseline monthly benefit. Below is a chart that shows the full retirement ages based on your birth year:

Image source: The Motley Fool.

Age 62 is significant because it’s the earliest you can begin claiming Social Security benefits; however, doing so will permanently lower your monthly payments.

For those within 36 months of their full retirement age, benefits will be reduced by 5/9 of 1% monthly. After that, the reduction increases to 5/12 of 1% for each additional month. For example, assuming an FRA of 67, claiming at age 64 could reduce your monthly benefit by 20%, while claiming at 62 could decrease it by 30%.

Conversely, if you delay your benefits past your FRA, they will increase by 2/3 of 1% each month (equating to 8% per year). Claiming at age 70 means you will see a significant increase, roughly 24% more than your PIA, if your FRA is 67.

Smaller Payments Over Time vs. Larger Payments for a Shorter Duration

When choosing between two claiming ages, I recommend considering your breakeven age—the point at which cumulative benefits from different claiming ages become equal.

For a concrete example, let’s assume a monthly benefit of $2,000 at full retirement age. If you claim at 62, you will receive about $1,400 monthly, while delaying until 70 raises your benefit to approximately $2,480 monthly.

Here are the total expected benefits at various ages:

| Claiming Age | Total by 75 | Total by 80 | Total by 81 |

|---|---|---|---|

| 62 | $218,400 | $302,400 | $319,200 |

| 70 | $148,800 | $297,600 | $327,360 |

Table by author.

If someone has the option to claim at 62 or 70, the breakeven age is just over 80. Before reaching this age, total payouts will be higher with an earlier claim, while after age 80, the advantage shifts to those who waited until 70.

Assessing Your Breakeven Age

For those weighing the pros and cons of claiming between 62 and 70, the key question is: Is it worth giving up 96 monthly payments from 62 to 70 for a larger benefit? That’s a considerable amount of money that could enhance retirement lifestyles.

If it were guaranteed that you would live past your breakeven age, delaying might seem more appealing, but life expectancy varies. According to the Social Security Administration, here are the average life expectancies:

| Gender | Life Expectancy at 62 | Life Expectancy at 70 |

|---|---|---|

| Men | 81.00 | 83.69 |

| Women | 84.07 | 86.00 |

Source: Social Security Administration.

Additionally, there are lifestyle factors to evaluate. Generally, people tend to feel more energetic and capable in their 60s compared to their late 70s and 80s, which can influence retirement activities and vacations.

These observations are broad, and exceptions exist, but the key takeaway is to maximize your time enjoying the benefits you’ve earned through years of hard work and tax contributions, especially if you don’t immediately need the higher monthly benefits.

Even if your retirement vision involves relaxation, claiming your Social Security early can provide the financial flexibility to use your funds as you wish.

Ultimately, deciding when to claim Social Security is a personal choice with no right or wrong answer. The ideal time to claim should align with your unique financial situation and lifestyle choices.

The $22,924 Social Security Bonus Many Retirees Miss

If you’re like most Americans, you might be behind on retirement savings. However, several lesser-known “Social Security secrets” could help elevate your retirement income. For instance, one straightforward strategy might increase your benefits by as much as $22,924 each year! Understanding how to maximize your Social Security can empower you to retire with the confidence we all seek. Click here to explore these strategies in more detail.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.