TD Cowen Downgrades Tapestry: What Investors Should Know

Fintel reports that on October 29, 2024, TD Cowen downgraded their outlook for Tapestry (LSE:0LD5) from Buy to Hold.

Analyst Price Forecast Indicates Possible Decline

As of October 22, 2024, the average one-year price target for Tapestry stands at 49.50 GBX per share. Predictions vary, with estimates ranging from 40.27 GBX to 62.79 GBX. The average price target suggests a decline of 2.70% from its most recent closing price of 50.88 GBX per share.

Explore our leaderboard to see which companies have the largest price target upside.

Revenue and Earnings Outlook

The projected annual revenue for Tapestry is 7,417MM, reflecting an increase of 11.18%. Additionally, the anticipated annual non-GAAP earnings per share (EPS) is 4.86.

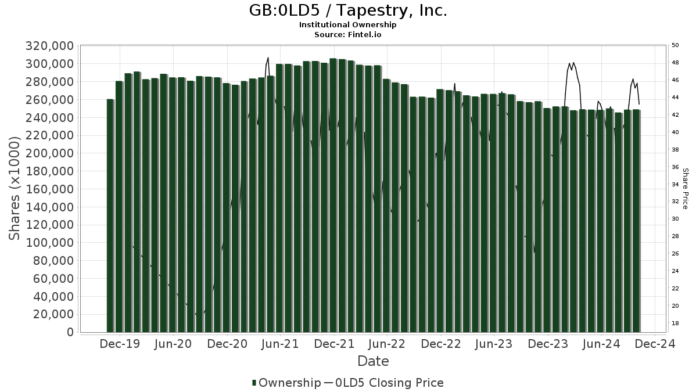

Current Fund Sentiment

There are currently 1,356 funds or institutions reporting positions in Tapestry, a decrease of 36 owners or 2.59% in the past quarter. The average portfolio weight of all funds allocated to 0LD5 is 0.20%, which has risen by 9.37%. Over the last three months, total shares held by institutions increased by 2.05%, reaching 249,639K shares.

Charles Schwab Investment Management owns 7,343K shares, representing 3.15% ownership of the company. In its previous filing, the firm reported owning 7,241K shares, which marks an increase of 1.39%. However, they reduced their portfolio allocation in 0LD5 by 37.10% last quarter.

Ameriprise Financial holds 7,301K shares, equating to 3.14% ownership. They increased their shares from 6,995K, showing a 4.20% rise, but cut their portfolio allocation in 0LD5 by 83.26% over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 7,269K shares or 3.12% of the company, up slightly from 7,256K shares, with a portfolio allocation decrease of 12.20% last quarter.

Capital Research Global Investors increased its holdings to 7,212K shares, now holding 3.10% of the company, up from 6,239K shares, indicating a 13.50% increase in ownership. They raised their portfolio allocation by 1.04% last quarter.

Pacer US Cash Cows 100 ETF (COWZ) has seen substantial growth, now holding 6,116K shares for 2.63% ownership. This is an increase from 4,154K shares, a growth of 32.08%, and they also raised their portfolio allocation in 0LD5 by 33.57% last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. It provides data on fundamentals, analyst reports, ownership trends, fund sentiment, and more.

Click to Learn More about Tapestry and its market outlook.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.