Stock Market Outlook: Goldman Sachs Predicts Lower Returns Ahead

Recent predictions from Goldman Sachs indicate a significant slowdown in the stock market’s growth. The investment bank warns that the S&P 500 (SNPINDEX: ^GSPC) will only average about 3% annual returns over the next decade, a stark decline from the 13% seen in the past 10 years. Understanding this outlook can help investors navigate the market effectively.

Anticipating Headwinds

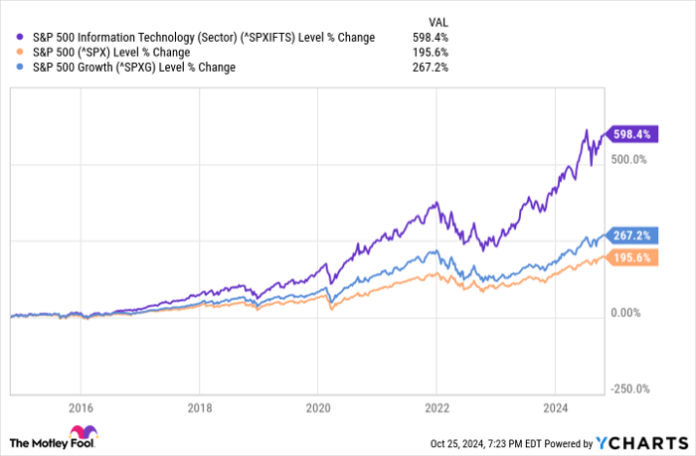

Goldman’s Chief U.S. Equity Strategist, David Kostin, shares that due to its heavy reliance on a few high-growth technology stocks, the S&P 500 may struggle. Recent stars like Nvidia and Microsoft comprise a large portion of the index’s value, making it vulnerable if their growth falters. Currently, the largest 10 companies account for around 30% of the S&P 500’s total value, and with a forward price-to-earnings ratio of 24, risks are heightened.

The thoughts from JPMorgan Chase align with Goldman Sachs, predicting a slightly better annualized gain of 6%. However, both firms share concerns about the sustainability of growth in major tech companies.

Strategies for Investors

The market’s situation is a reminder that diversification is key. The S&P 500 is often viewed as a balanced representation of the U.S. economy, but a focused strategy can be beneficial. Goldman Sachs suggests that the S&P 500 equal-weight index may perform better ahead, as it doesn’t depend so heavily on large-cap stocks. The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) could be a straightforward investment option.

Additionally, consider investing in the Vanguard S&P 500 Value ETF (NYSEMKT: VOOV) or Berkshire Hathaway. These investments would likely avoid the struggles predicted for growth stocks. As interest rates rise, value stocks may start to perform better.

Small and mid-cap stocks also present opportunities as they seem undervalued compared to their large-cap counterparts. The iShares S&P 600 Small-Cap ETF (NYSEMKT: IJR) currently trades at a trailing price-to-earnings ratio of less than 17, while the iShares S&P 400 Mid-Cap ETF (NYSEMKT: IJH) sits at over 19. Both may outperform the S&P 500 moving forward.

^SPX data by YCharts.

Perspective is Key

Long-term investors should maintain their focus on stock selection. Both sentiment and market conditions can shift unexpectedly. Goldman Sachs’ predictions should be viewed critically, as there’s no guarantee that high-growth tech stocks will lead the market for the next decade. It’s possible that new companies will emerge to drive the S&P 500 forward, so keeping a stake in an index fund is advisable.

Ultimately, diversification remains vital. However, exploring different forms of diversification beyond just an S&P 500 fund can enhance your investment strategy.

A New Investment Opportunity Awaits

If you ever felt like you missed significant investment opportunities in the past, you may want to pay attention now.

Our analysts occasionally provide a “Double Down” stock recommendation, pointing to companies poised for substantial growth. If you believe you’ve missed your chance, now may be the time to act. Historical returns support this strategy:

- Amazon: A $1,000 investment in 2010 could yield $21,217!*

- Apple: A $1,000 investment in 2008 might grow to $44,153!*

- Netflix: An investment of $1,000 in 2004 could soar to $403,994!*

Currently, we have “Double Down” alerts for three promising companies that you won’t want to miss.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Goldman Sachs Group, JPMorgan Chase, Microsoft, Nvidia, and iShares Trust-iShares Core S&P Small-Cap ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.