Top Oversold Stocks in Consumer Discretionary Sector Present Buying Opportunities

In today’s market, several stocks in the consumer discretionary sector appear to be undervalued, highlighted by their recent oversold conditions.

The Relative Strength Index (RSI) is a useful tool for traders; it measures momentum by comparing a stock’s performance on days when prices increase to days when they decrease. Typically, a stock is considered oversold if its RSI is below 30, according to Benzinga Pro. Below is a list of notable companies whose RSIs are around or below this threshold.

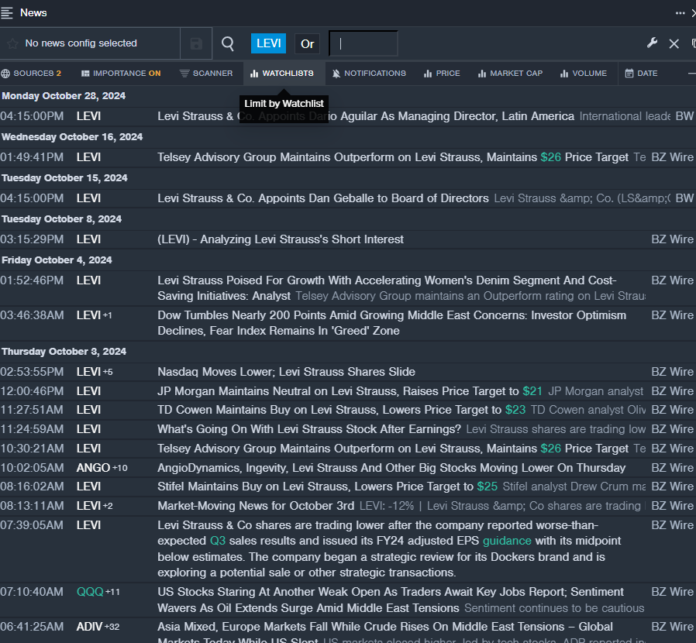

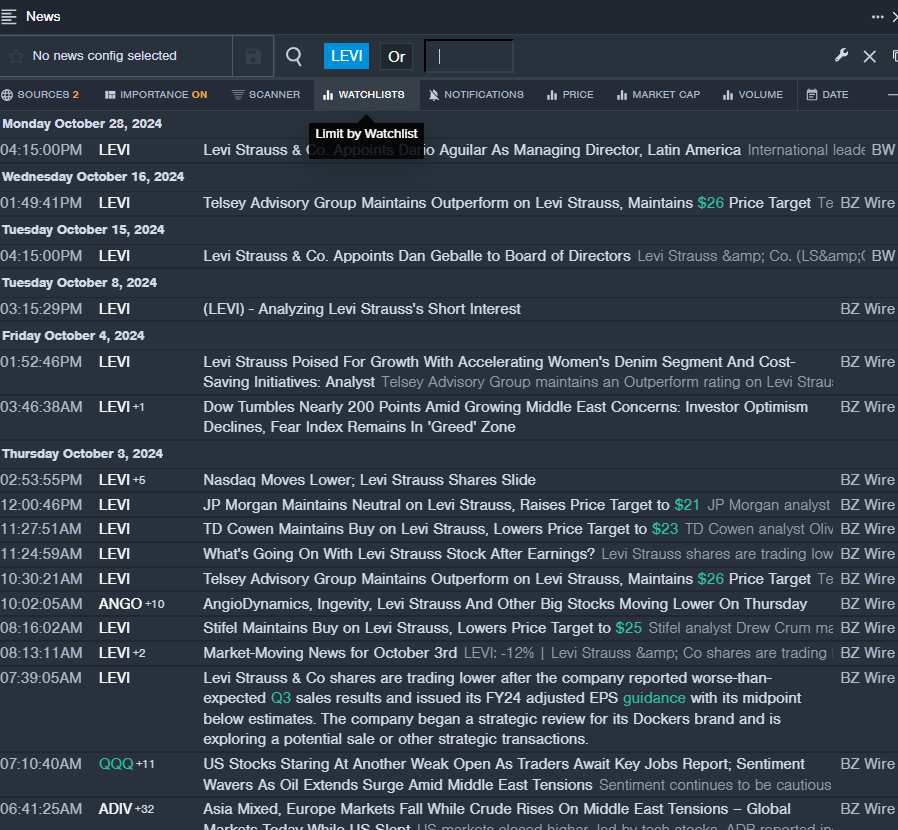

Levi Strauss & Co LEVI

- On Oct. 28, Levi Strauss & Co. appointed Dario Aguilar as Managing Director for Latin America. The stock has lost approximately 20% in value over the past month, reaching a 52-week low of $13.22.

- RSI Value: 29.15

- LEVI Price Action: Shares declined by 0.8% to close at $17.39 on Tuesday.

- Benzinga Pro’s real-time newsfeed provided updates on the latest LEVI announcements.

Mohawk Industries Inc MHK

- On Oct. 24, Mohawk Industries reported third-quarter earnings that exceeded expectations. The company earned $2.90 per share, slightly above the analyst estimate of $2.89. Additionally, they reported quarterly sales of $2.719 billion, topping the anticipated $2.700 billion. However, the stock has dropped about 13% in the last five days, with a 52-week low of $76.35.

- RSI Value: 29.10

- MHK Price Action: Shares increased by 0.5%, closing at $132.41 on Tuesday.

- The trend in MHK stock was identified using Benzinga Pro’s charting tools.

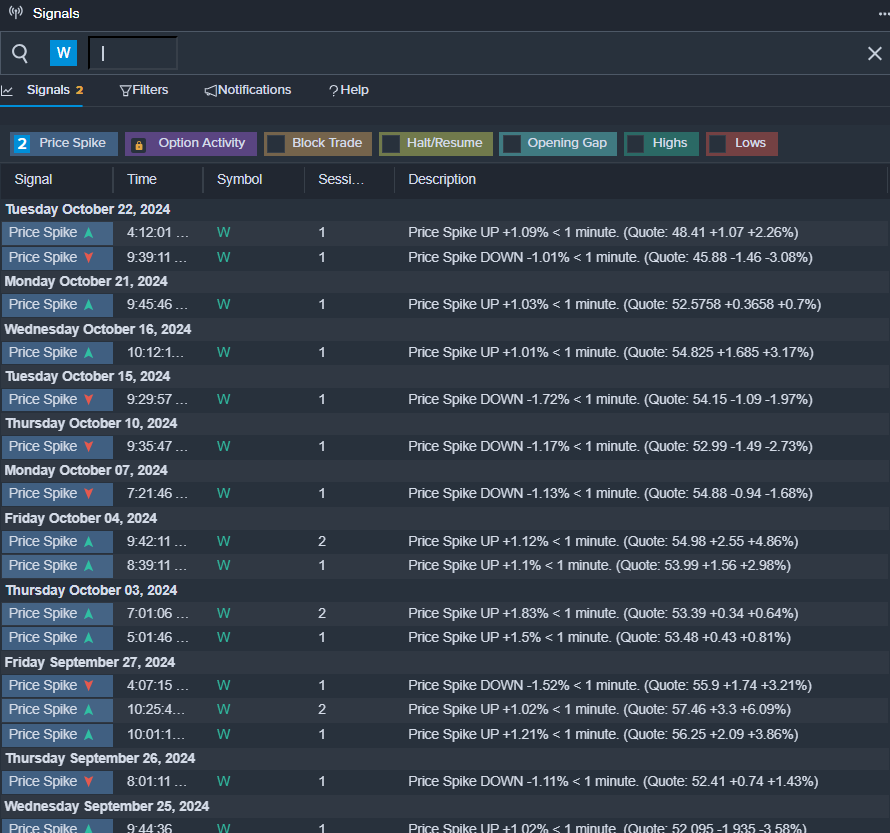

Wayfair Inc W

- On Oct. 28, Wedbush analyst Seth Basham reaffirmed an Outperform rating for Wayfair but lowered the price target from $60 to $50. The stock has plummeted approximately 24% in the past month, with a 52-week low recorded at $38.02.

- RSI Value: 29.10

- W Price Action: Shares dropped by 3.3%, closing at $42.96 on Tuesday.

- Benzinga Pro’s signals indicated a potential breakout for Wayfair shares.

Read More:

Market News and Data brought to you by Benzinga APIs