Vanguard S&P Mid-Cap 400 Growth ETF: Analysts Predict Potential for Gains

Recent evaluations show promising upside for the Vanguard S&P Mid-Cap 400 Growth ETF (Symbol: IVOG), with analysts suggesting an average target that could lead to significant gains for investors.

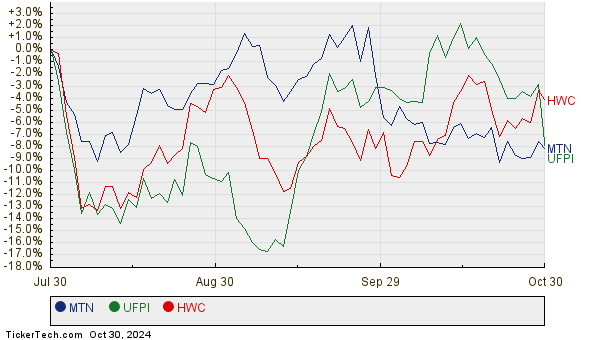

By analyzing the underlying assets of IVOG, we found the implied target price is $128.35 per unit based on analyst expectations. Currently, IVOG trades around $115.01, indicating that analysts foresee an 11.60% increase in value over the next 12 months. Among the notable holdings contributing to this projection are Vail Resorts Inc (Symbol: MTN), UFP Industries Inc (Symbol: UFPI), and Hancock Whitney Corp (Symbol: HWC). For instance, while MTN recently traded at $169.21 per share, the average target stands at $194.20, representing a potential upside of 14.77%. Additionally, UFPI shows a target of $140.00—a 13.78% gain from its recent price of $123.04. Lastly, analysts expect HWC to increase to $59.64, which is 13.60% above its current trading price of $52.50. Below is a chart illustrating the performance of these three stocks over the past year:

Here’s a summary of the analysts’ target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 Growth ETF | IVOG | $115.01 | $128.35 | 11.60% |

| Vail Resorts Inc | MTN | $169.21 | $194.20 | 14.77% |

| UFP Industries Inc | UFPI | $123.04 | $140.00 | 13.78% |

| Hancock Whitney Corp | HWC | $52.50 | $59.64 | 13.60% |

Whether these price targets are realistic or overly optimistic is a question worth exploring. Investors will need to research further to understand if analysts’ projections align with recent industry trends and developments. Historical price targets can sometimes reflect outdated expectations, so careful evaluation is essential.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Carl Icahn Stock Picks

• AXON shares outstanding history

• ITUS Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.