Alphabet Surpasses Earnings Expectations in Q3 2024

Alphabet’s GOOGL reported third-quarter 2024 earnings of $2.12 per share, exceeding the Zacks Consensus Estimate by 15.85% and up 37% from the previous year.

In fact, GOOGL has outperformed the Zacks Consensus Estimate in all four trailing quarters, achieving an average surprise of 11.84%.

Check the latest EPS estimates and surprises on Zacks Earnings Calendar.

The company’s revenue reached $88.3 billion, reflecting a 15% increase year over year (16% at constant currency).

When excluding total traffic acquisition costs (TAC)—which represent the share of revenue given to partners who drive traffic to Google—the net revenues totaled $74.549 billion, beating the consensus projection by 2.34% and growing by 16.4% year over year.

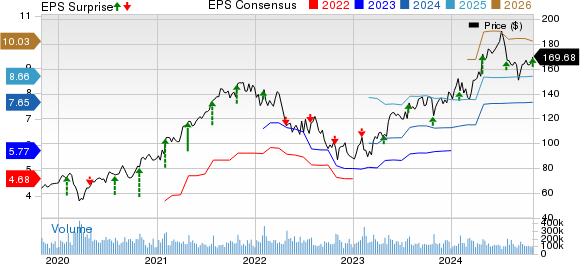

Alphabet Inc. Price, Consensus, and EPS Surprise

Alphabet Inc. price-consensus-eps-surprise-chart | Alphabet Inc. Quote

TAC reached $13.719 billion, marking an 8.5% year-over-year increase.

Following the earnings report, GOOGL shares climbed over 6% in pre-market trading on Wednesday. Year-to-date, Alphabet’s stock has risen by 21.5%, outperforming the Zacks Internet-Services industry (20%) but falling short of the Computer & Technology sector’s 27.6% gain.

Annual Performance Comparison

Image Source: Zacks Investment Research

Before exploring GOOGL’s investment potential, let’s examine its quarterly performance.

Growth Fueled by Search, YouTube, and Cloud Services

Revenues from Google Services grew by 12.5% year over year to $76.51 billion, making up 86.7% of total revenue. This figure also surpassed the Zacks Consensus Estimate by 2.1%.

Specifically, Search and other revenues increased by 12.2% year over year to $49.385 billion, exceeding estimates by 1.12%.

YouTube’s advertising revenue rose by 12% year over year to $8.921 billion, topping the consensus by 0.71%.

While Google Network revenues dipped by 1.6% year over year to $7.548 billion, they still beat estimates by 1.58%.

Overall, Google advertising revenues climbed by 10.4% year over year to $65.854 billion, comprising 74.6% of total revenues and beating estimates by 0.97%.

Revenues from Google subscriptions, platforms, and devices, formerly known as Google Other revenues, hit $10.656 billion in Q3, up 27.8% year over year, and surpassed consensus estimates by 9.4%.

Lastly, Google Cloud revenues surged 28.8% year over year to $11.35 billion, accounting for 12.9% of total revenues, and exceeded the Zacks Consensus Estimate by 4.02%.

Revenues from Other Bets were $388 million, up 30.6% year over year, but fell short of estimates by 1.82%.

Operating Margin Shows Significant Improvement

Total costs and operating expenses reached $59.747 billion, showing a 7.9% year-over-year increase. However, this still resulted in a decline of 450 basis points (bps) relative to revenues.

The operating margin improved to 32.3%, expanding by 450 bps year over year. Breaking it down further, Google Services reported an operating margin of 40.3%, up 510 bps year over year.

Google Cloud posted operating income of $1.947 billion, a significant increase from $266 million in the same quarter last year.

In contrast, Other Bets registered a loss of $1.116 billion, slightly improved from the $1.194 billion loss recorded in the previous year’s quarter.

Alphabet Maintains a Strong Financial Position

As of September 30, 2024, Alphabet held cash, cash equivalents, and marketable securities amounting to $93.23 billion, down from $100.7 billion as of June 30, 2024.

Long-term debt decreased to $12.297 billion as of September 30, from $13.24 billion at the end of June.

During Q3, Alphabet generated $30.698 billion from operations, up from $26.6 billion in Q2. Capital expenditures totaled $13.061 billion, leading to a free cash flow of $17.637 billion.

This strong liquidity allowed Alphabet to sustain its dividend payments. In Q3 2024, GOOGL distributed $2.5 billion in dividends and repurchased shares worth $15.3 billion. Over the past year, Alphabet has returned $70 billion to its shareholders.

Cloud Expansion: A Critical Growth Driver

Robust Q3 results for Google Cloud were driven by accelerated growth in AI infrastructure, the enterprise AI platform Vertex, generative AI (Gen AI) solutions, and key Google Cloud Platform offerings.

GOOGL’s strong AI capabilities are attracting new clients, securing larger contracts, and fostering deeper product usage among existing customers.

Notably, Gemini API calls have surged nearly 40 times in just six months. Companies like Snap SNAP are utilizing Gemini’s advanced features to boost user engagement within their AI chatbot in the U.S.

Businesses are also integrating Alphabet’s AI with BigQuery for real-time data-driven decision-making. BigQuery’s machine learning operations reported 80% growth in the last six months owing to steady demand.

The demand for cybersecurity solutions, such as Google Threat Intelligence and Security operations, has also risen sharply. Customer adoption of Mandiant-powered threat detection has quadrupled over the last six quarters.

In the competitive cloud landscape, Alphabet has positioned itself as the third-largest provider, following Amazon’s AMZN AWS and Microsoft’s MSFT Azure.

With continued investment in infrastructure, security, data management, analytics, and AI, Google Cloud is likely to see sustained revenue growth. Its innovative Gen AI-enhanced offerings are expected to resonate well with cloud customers.

The adoption of Google Workspace is rising swiftly, supported by an increase in the average revenue per seat.

GOOGL Shares Holding a Premium

Currently, Alphabet’s Value Score of C indicates that its valuation may be stretched.

GOOGL is presently trading at a premium, evidenced by a forward 12-month Price/Sales ratio of 6.43X compared to the industry average of 6.02X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Reliability of GOOGL Shares Post Q3 Earnings

The expanding Cloud business and advancing GenAI capabilities present promising prospects for Alphabet. Its leadership in the search engine sector remains a core growth catalyst.

While the company faces valuation challenges and fierce competition within the cloud market, these factors are expected to enhance GOOGL shares in the coming period.

Alphabet currently carries a Zacks Rank #2 (Buy), suggesting investors should consider accumulating the stock at this time. For a full list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Zacks Highlights Top Semiconductor Stock

Although it’s only 1/9,000th the size of NVIDIA, which has skyrocketed by more than +800% since our recommendation, this new top chip stock has significant growth potential.

With strong earnings growth and an expanding customer base, it is poised to fulfill the surging demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor market is anticipated to surge from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.