Apple’s Q4 Earnings: A Mixed Picture Amid PC Declines

Apple’s AAPL fourth-quarter fiscal 2024 results, set to be released on Oct. 31, may struggle due to a weakened PC market. However, growth in the Services sector could provide crucial support against this challenge.

PC Shipments Decline as Apple Faces Tough Competition

The PC market showed weakness in the third quarter of calendar 2024. According to IDC, only 68.8 million PCs were shipped, marking a decline of 2.4% compared to the same time last year. Gartner’s estimates also reflect this trend, noting a drop to 62.997 million units, a decrease of 1.3% year over year.

When it comes to PC vendors, Apple has faced significant challenges. IDC reports that Mac shipments plummeted by an alarming 24.2% from the previous year. In contrast, Gartner predicts a smaller decline of 3.5% in Mac shipments, positioning Apple just behind Acer Group.

PC Competitors Struggle with Weak Demand

Other traditional PC makers like Lenovo LNVGY, HP HPQ, and Dell Technologies DELL are also experiencing sluggish sales. IDC projects a possible increase of 3% in Lenovo’s shipments and a modest growth of 0.4% for HP, while Dell’s shipments may decline by 4%. In a twist, IDC lists ASUS as the leader with a shipment growth of 10%.

Meanwhile, Gartner sees Acer Group leading with a 4.4% growth. HP is forecasted to grow by 0.3%, while Dell may face a downturn of 3.9%.

The Zacks Consensus Estimate anticipates that Mac net sales for the fourth quarter will reach $7.43 billion, which translates to a year-over-year decline of 2.4%.

Services Sector Positioned for Strong Growth

Despite the challenges in hardware sales, Apple’s Services segment is expected to thrive. The increasing number of users on the App Store and a rise in viewership on Apple TV+ have played a significant role. Growth in Apple Music, Apple Arcade, Apple News+, and Apple Card also adds to this momentum.

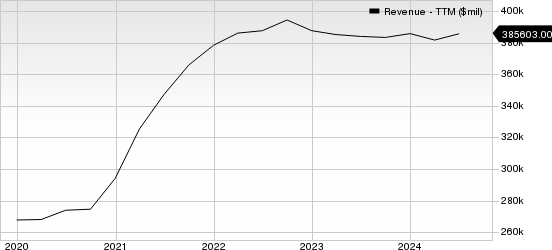

While the iPhone remains the cornerstone of Apple’s business, Services has emerged as a key revenue driver. It represented 28.2% of total sales in the third quarter of fiscal 2024.

By the end of the fiscal third quarter, Apple had over 1 billion paid subscribers across its Services offerings, and that number is likely to have increased in the upcoming report, boosted by the growing number of Apple devices and popular applications like Apple TV+.

The Zacks Consensus Estimate for Services net sales in the fiscal fourth quarter is projected at $25.759 billion, indicating an impressive year-over-year growth of 15.4%.

iPad Sales Expected to Rise Year Over Year

The iPad contributed approximately 8.3% to Apple’s total net sales in the fiscal third quarter. With strong interest in the iPad Pro and the introduction of new 11-inch and 13-inch iPad Air models, iPad sales soared by 23.7% from the previous year, reaching $7.16 billion. This positive trend is likely to continue in the upcoming quarter.

The Zacks Consensus Estimate for iPad net sales in the fiscal fourth quarter stands at $6.984 billion, suggesting a growth of 8.4% compared to last year.

A Look at Apple’s Current Market Position

Presently, Apple holds a Zacks Rank of #3 (Hold). For a comprehensive look at today’s top stocks, visit Zacks’ list of #1 Rank (Strong Buy) recommendations.

Zacks Identifies Promising Semiconductor Stock

One stock on the radar is significantly smaller than NVIDIA, which has soared over +800% since 2021. Our new semiconductor pick has substantial growth potential as it meets the burgeoning demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is projected to grow from $452 billion in 2021 to $803 billion by 2028.

For the latest stock recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double” for free. Click here for this report.

Apple Inc. (AAPL): Free Stock Analysis Report

HP Inc. (HPQ): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

Lenovo Group Ltd. (LNVGY): Free Stock Analysis Report

To access the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.