“`html

Note: The following is an excerpt from this week’s Earnings Trends report. For a full report containing historical data and estimates for the current and upcoming periods, please click here>>>

Key Earnings Highlights

- As of Wednesday, October 30th, total Q3 earnings for 258 S&P 500 members that have reported are up +8.9%, with +5.0% higher revenues. Additionally, 74.4% exceeded EPS estimates while 59.3% surpassed revenue estimates.

- For the entirety of Q3, when combining actual results from the index members with estimates from those yet to report, S&P 500 earnings are projected to rise +4.4% compared to last year, alongside +5.2% higher revenues.

- The Tech sector is seeing its 5th successive quarter of double-digit growth, expected to rise by +14.6%. Without Tech’s influence, Q3 earnings for the rest of the index would only increase +0.4%.

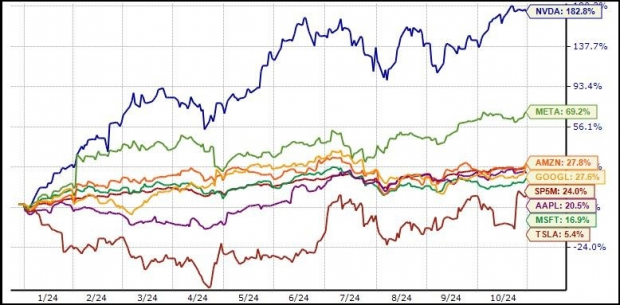

- Earnings for the ‘Magnificent 7’ companies are expected to grow +20.1% year-over-year, with revenues increasing by +14.0%. In contrast, Q3 earnings growth for the remainder of the index would be only +0.7% after excluding the ‘Mag 7’.

Strong Earnings from the Magnificent 7

Last week, Tesla’s TSLA report sparked interest among investors, marking the start of Q3 results for the Magnificent 7 group. Although Tesla slightly missed revenue expectations, it exceeded earnings estimates with a +16.9% increase compared to last year, driven by a +7.8% revenue gain.

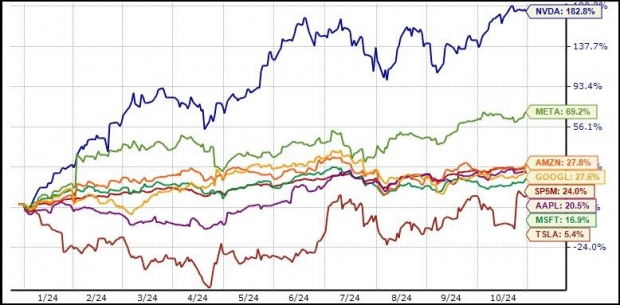

Despite being laggards in 2023, Tesla shares have shown a +5.4% rise following this news, including a significant bounce after the report. An increase in profit margins has encouraged investors, although specifics behind the margin improvements remain unclear. There is speculation that a greater portion of deliveries came from the more profitable Shanghai factory.

Unlike Tesla’s report, Alphabet GOOGL provided insights that pleased the market. Following some initial skepticism over spending on AI, management showed that efficiencies gained from AI are beginning to boost growth. In Q3, Alphabet’s cloud revenue surged +35%, up from +29% in Q2 and +28% in Q1, significantly aided by AI technologies.

Investors are hoping that the remaining reports from the Magnificent 7 showcase similar enthusiasm and potentially restore their leading position in the market.

A year-to-date performance summary shows that, except for Nvidia and Meta, the other five companies are trailing behind the market.

Image Source: Zacks Investment Research

The upcoming Q3 earnings reports will be crucial for companies like Alphabet, Microsoft, and Amazon, all grappling with AI developments.

Despite recent market challenges, the Magnificent 7 firms are enjoying commendable profitability. Collectively, they are anticipated to generate $116.1 billion in Q3 earnings on $488.7 billion in revenues, reflecting +20.1% earnings growth alongside +14.0% revenue growth.

Image Source: Zacks Investment Research

These companies are projected to contribute 21.7% of total S&P 500 earnings for Q3. Their strong performance has kept overall earnings growth from dipping into negative territory for the remaining S&P 500 members.

The Overall Earnings Landscape

As a whole, S&P 500 earnings for Q3 are now expected to rise +4.4% from last year, based on +5.2% higher revenues. Excluding the Energy sector’s decline of -26.6%, earnings growth would improve to +6.8%. When removing the Tech sector’s substantial contribution, overall index earnings would only grow +0.4%.

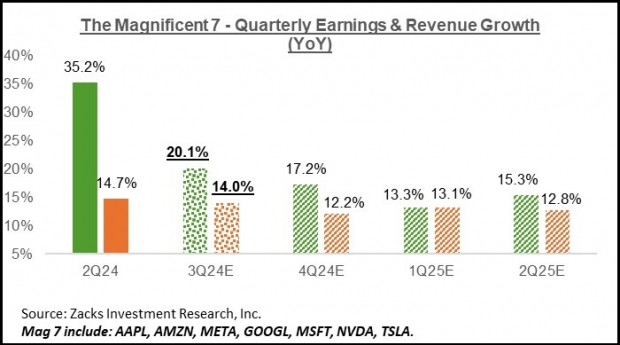

Looking ahead, quarterly earnings growth is anticipated to pick up in the next quarter. The chart below depicts this earnings outlook over time.

Image Source: Zacks Investment Research

For Q4 2024, total S&P 500 earnings are projected to increase by +8.7% with +5.2% revenue growth. Without the Energy sector’s influence, expected earnings would rise by +10.5%.

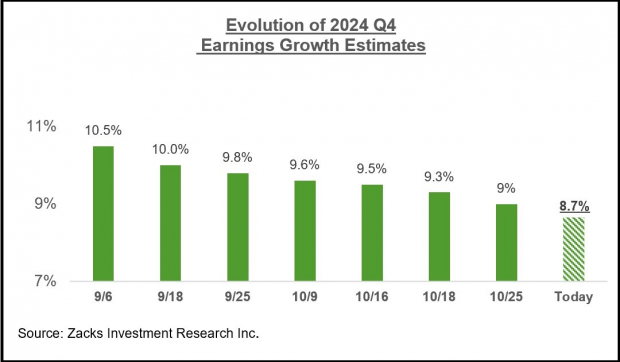

Recent estimates for this quarter have decreased, although the declines are less drastic than those seen in Q3. This trend is illustrated in the chart below depicting the evolution of Q4 estimates.

Image Source: Zacks Investment Research

This year has seen a +7.3% increase in earnings, attributed to only +1.9% growth in revenue. This indicates challenges in the Finance sector. However, if excluded, earnings growth changes to +6.3%, with a revenue growth of +4.2%. Thus, nearly half of this year’s earnings growth is linked to revenue improvements.

Zacks Recommends a Top Semiconductor Stock

This stock, while only 1/9,000th the size of NVIDIA, which has seen growth of more than +800% since our recommendation, has significant growth potential. Driven by strong earnings and an expanding customer base, it aims to meet the increasing demands for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to soar from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double. Click to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`